Why is US nominal income unexpectedly high?

Genevieve Signoret & Delia Paredes

(Hay una versión en español de este artículo aquí.)

What follows is a slightly edited excerpt from Quarterly Outlook 2023–2025: It All Hinges on Rates.

Last time we told you that unexpectedly high nominal income in the U.S. was a probable source of concern over inflation, and thus one likely driver of long-term rates (on trend). This leads to the question, where is all this unexpected nominal income coming from?

We see three sources of unexpectedly high nominal income: the lagged effects of pandemic-era fiscal stimulus; fast-rising nominal payrolls; and still-strong demand for construction.

We think the growth in nominal payrolls stems first of all from Covid-era labor shortages and their resulting boost in worker bargaining power. In our view, these severe shortages, though now resolved, left a psychological scar on employers, resulting in their hoarding labor still today.

A second source of income, also related to payrolls, is the sudden switch that we documented in these pages last September from strong Covid-era consumer demand for goods, which are capital-intensive, to strong post-reopening consumer demand for services, which are labor intensive.

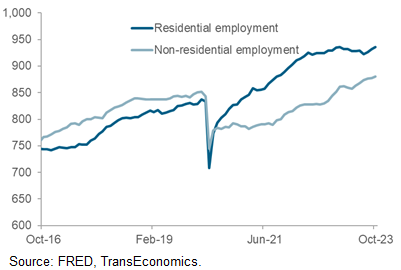

A third answer to the question of why incomes are so high is that, despite high interest rates, demand for construction workers has held up. Bidenomics may well be playing a part. Demand for newly built homes for sure is playing one.

As we explained earlier, with natural demographics sending first-time home buyers hunting for homes, the shortage of existing homes for sale has sparked a mini boom in the labor-intensive new home construction sector.

Jobs and therefore incomes in the residential construction sector are picking up

USA: Total employment in residential and non-residential construction

Thousands

Previous excerpts from Quarterly Outlook 2023–2025: It All Hinges

on Rates:

- Summary

- Long-term rates and equity valuations

- Rates, Covid and real estate valuations

- Why have US long-term rates trended up? Hypothesis 1: Debt issuance

- Why have US long-term rates trended up? Hypothesis 2: Tight policy

- Why have US long-term rates trended up? Hypothesis 3: Investor inflation worries