Why have US long-term rates trended up? Hypothesis 1: Debt issuance

Genevieve Signoret & Delia Paredes

(Hay una versión en español de este artículo aquí.)

What follows is an excerpt from Quarterly Outlook 2023–2025: It All Hinges on Rates.

If long rates are driving asset valuations, then the question is, why are rates so high? After all, aren’t the financial media reporting signs of an incipient slowdown, and isn’t inflation in decline?

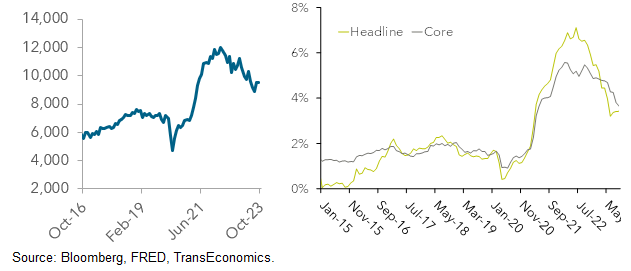

What is pushing long time rates up, if the data show signs of a slowdown, and inflation is trending down?

USA: Job openings (left, thousands) and PCE headline and core inflation rates (right, year-on-year % change)

Factor 1: Debt issuance

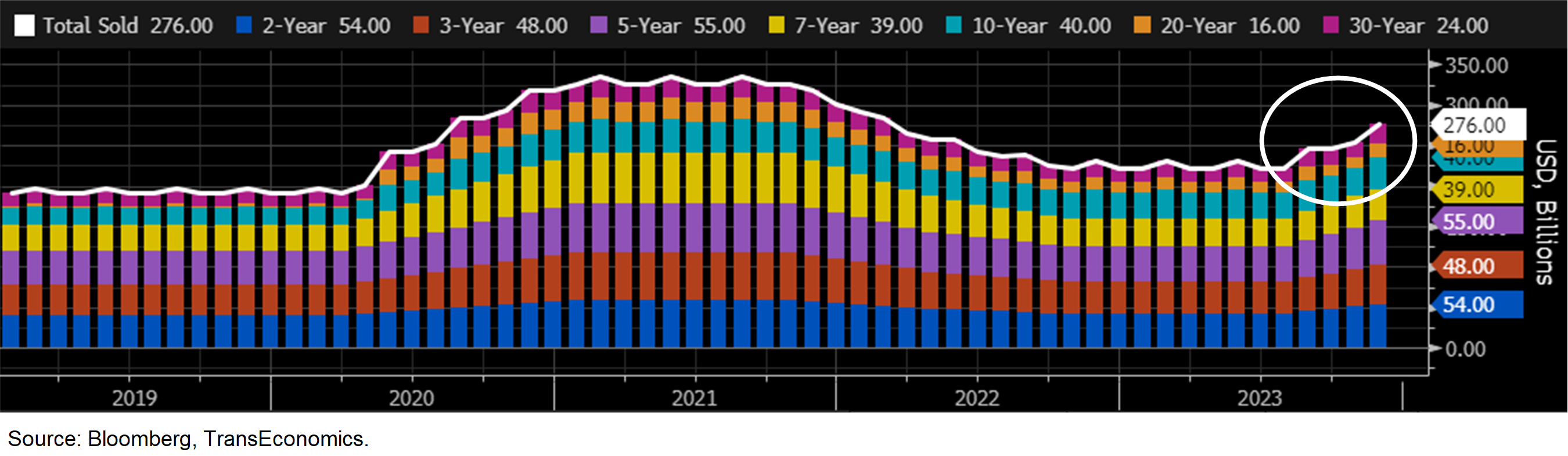

One factor explaining why rates are so high, we think, is the recent swell in Treasury debt security issuance—fiscal payback for the massive stimulus Americans enjoyed during Covid. For the Treasury to auction off all the debt it needs to raise, it has no choice but to pay ever more attractive rates.

Rising debt issuance is one factor keeping long-term interest rates high

USA: US Treasury monthly note and bond issuance since 2019

Total sold

Previous excerpts from Quarterly Outlook 2023–2025: It All Hinges

on Rates: