Why have US long-term rates trended up? Hypothesis 2: Tight policy

Genevieve Signoret & Delia Paredes

(Hay una versión en español de este artículo aquí.)

What follows is an excerpt from Quarterly Outlook 2023–2025: It All Hinges on Rates.

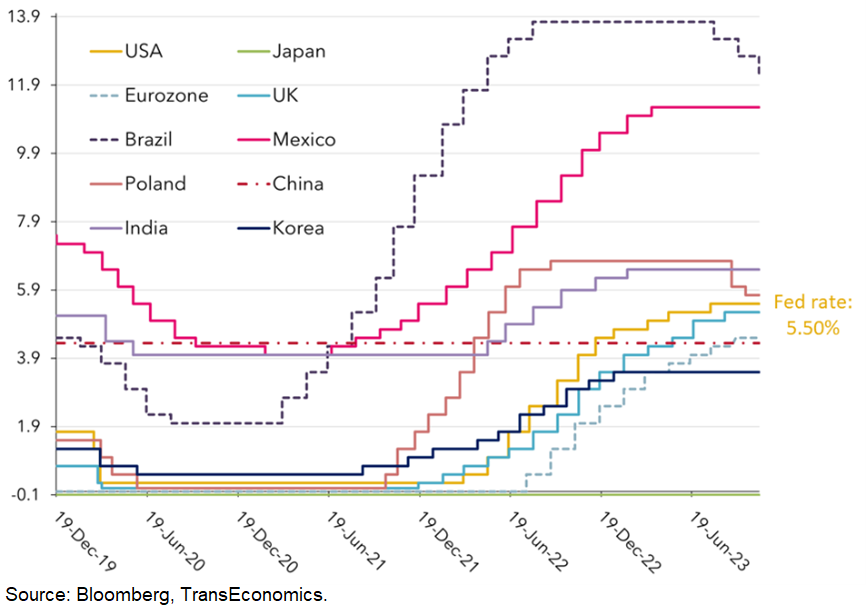

A second factor pushing up on long rates, we think, is that, in spite of the downward trend in inflation, the Fed has held to its tight policy stance, as have other central banks. The phenomenon is worldwide.

Policy is tight worldwide. The Fed rate remains at 5.50%.

Selected countries: Monetary policy rates since December 2019

% per annum

We focus here on the Fed.

Fed tightness can be seen in three ways. First, in the short-term policy rate, which remains at 5.50%.

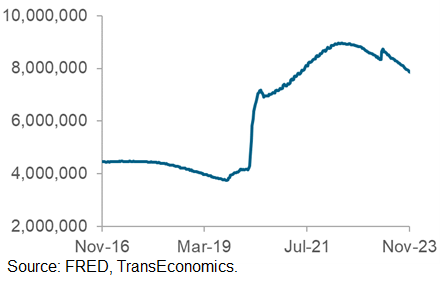

Second, in the fact that the Fed has persisted in its quantitative tightening (QT) program, whereby it allows the long-term debt securities held in its investment portfolio to mature without replacement. Theoretically at least, this shrinking of the Fed’s balance sheet exerts upward pressure on long rates.

The Fed, through QT, is shrinking its balance sheet. This should push up on long-term rates.

USA: Value of total Federal Reserve assets

Millions of dollars

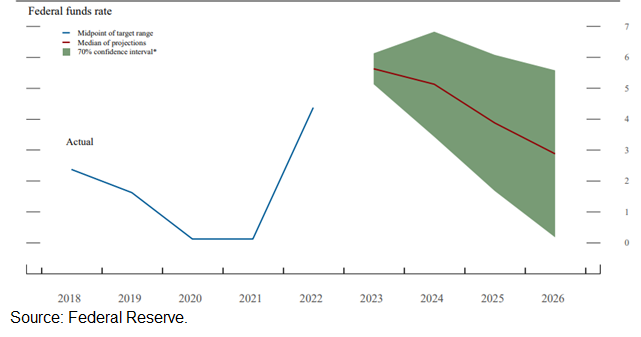

Third is “tight” Fed communication. The Fed “talks” to markets through speeches, pressers, communiqués, statements of guidance, and releases of not only the macro and rate outlooks held by Fed officials but also visuals (at times, alarming!) depicting the risks they see and the magnitudes of their uncertainty.

The Fed barrages the market with its rate outlooks and (sometimes scary!) perceptions of risk

USA: Actual and projected monetary policy rates 2018

% per annum

Since 2008, for example, Fed officials have told the public repeatedly that Fed asset purchases push down long-term yields, implying that to stop these purchases will push them up. While we’re unsure as to whether that claim is true in a direct or mechanical sense, we do suspect that strong and incessant Fed narratives (“guidance”) can sway market outlooks. So, we believe that, at least through the communication channel, quantitative tightening is contributing to keeping Fed policy tight and thus pushing up on long-term rates.

Through all this communication, the central message reaching the market is that Fed officials see an uncomfortably large risk that inflation will remain stubbornly high or even start to climb again.

Previous excerpts from Quarterly Outlook 2023–2025: It All Hinges

on Rates: