Why have US long-term rates trended up? Hypothesis 3: Investor inflation worries

Genevieve Signoret & Delia Paredes

(Hay una versión en español de este artículo aquí.)

What follows is a slightly edited excerpt from Quarterly Outlook 2023–2025: It All Hinges on Rates.

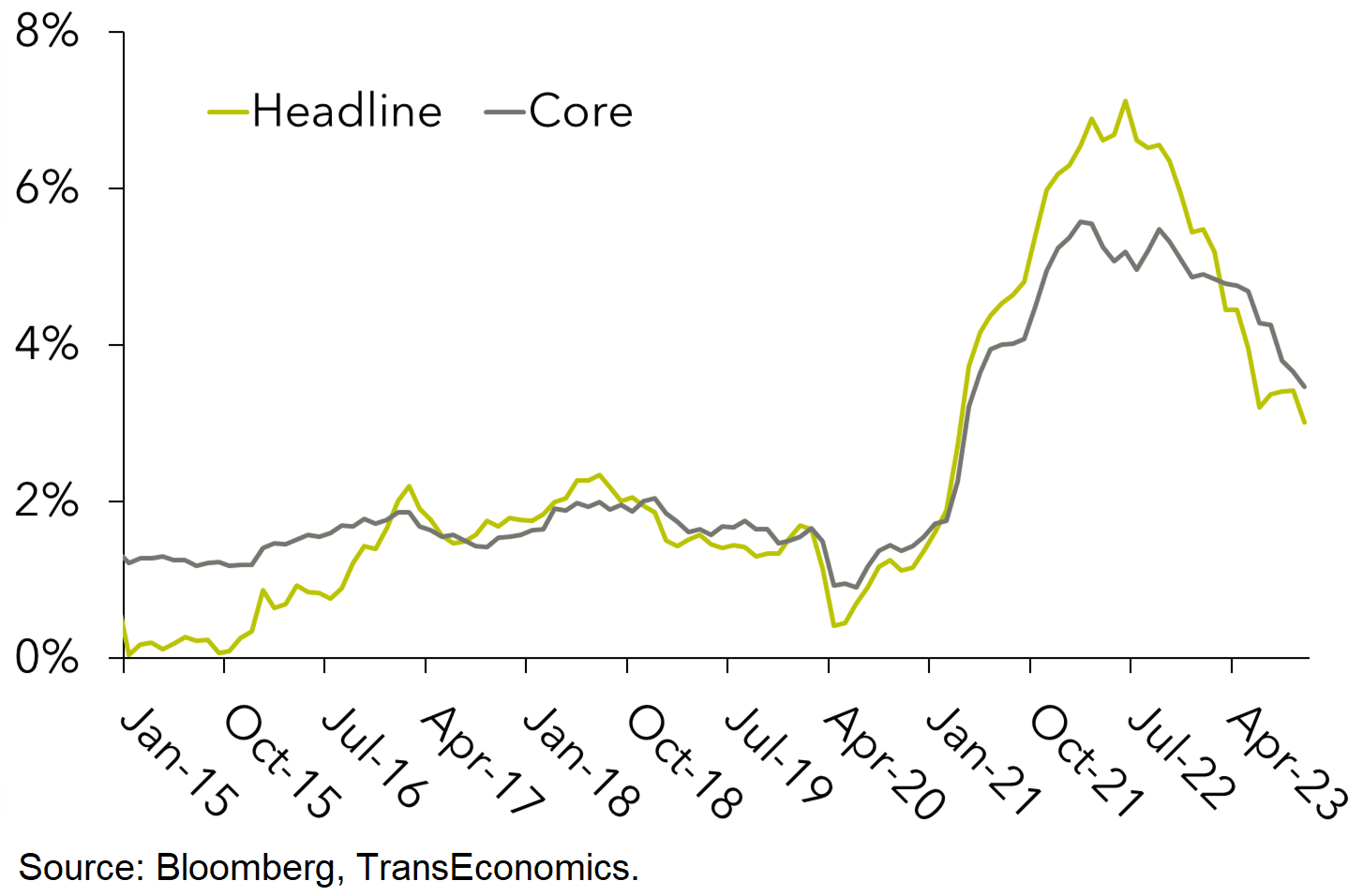

A third factor that we think is keeping long-term rates high is that not only the Fed but also investors worry that core inflation may fail to quickly converge to the Fed’s 2% target, forcing the Fed to keep policy tight for months or even years to come.

While a scenario of persistently high inflation and rates is not our base case, we do see foundation for that concern.

Core inflation has proved harder to bring down than headline inflation.

Core inflation stickiness is a worry for investors

USA: PCE headline and core inflation rates

Year-on-year % changes

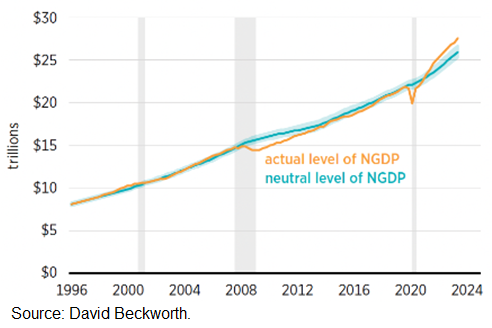

Also, nominal GDP, which is the sum of all income produced by the economy, is sky-high. It’s above its “neutral” or long-term expected path in the sense that incomes are growing faster than anyone over the past five years had forecast. In fact, it’s diverging from that path.

Firms and households make long-term commitments based on their expected incomes. When their actual incomes exceed expectations, the result can be inflation.

US nominal GDP is diverging from its neutral path, which is potentially inflationary

USA: Actual and estimated “neutral” levels of nominal GDP

US$ trillion

Investors notice aggregate income divergence from the long-term path. They see the inflation risk inherent in this divergence, and worry. Their worries, we think, are pushing up on long-term rates.

Previous excerpts from Quarterly Outlook 2023–2025: It All Hinges

on Rates:

- Summary

- Long-term rates and equity valuations

- Rates, Covid and real estate valuations

- Why have US long-term rates trended up? Hypothesis 1: Debt issuance

- Why have US long-term rates trended up? Hypothesis 2: Tight policy