Two reasons for Fed reluctance to cut

Genevieve Signoret & Delia Paredes

(Hay una versión en español de este artículo aquí.)

Fed Chair Jerome Powell has signaled that the Fed will probably not cut rates in March. Two reasons (among many) for the Fed’s reluctance to cut are that:

- Demand for goods has recovered with no counteracting collapse in service demand;

- The unemployment rate remains low.

Demand for goods has recovered, while service demand remains resilient

You’ll recall that, during Covid, U.S. consumer demand for goods went crazy, while spending on services collapsed. Once consumers got vaccinated, however, demand for services exploded, while spending on goods collapsed.

Today, goods consumption is recovering, but its recovery is not coming at the expense of services. In January, household consumption of goods excluding food, energy, and housing grew at an annualized rate of 6.0%, while that of services grew at a still-galloping pace of 7.9%.

Strong spending on goods and service both are contributing to healthy GDP growth. In fact, the Atlanta Fed GDPNow model projects that growth for quarter one will come in at an annualized 3.0%—a pace not far behind that of the revised 3.3% observed last quarter.

Hence, unemployment has remained low

Needless to say, with growth so strong, the unemployment rate remains low.

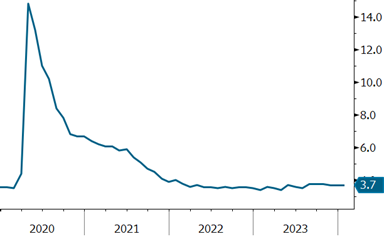

US unemployment remains at a low 3.7%

USA: Unemployment rate (%)

Source: Bloomberg.

Strong growth and low unemployment together cause the Fed to worry that inflation will resurge and thus be loath to cut rates.