A tad cheerier

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

Markets and analysts remain unsure as to whether the United States is headed into a recession or a soft landing. At TransEconomics, we’re feeling a tad cheerier than before as to the prospects of a U.S. soft landing. Warily, we’re watching corporate earnings and Fed policy.

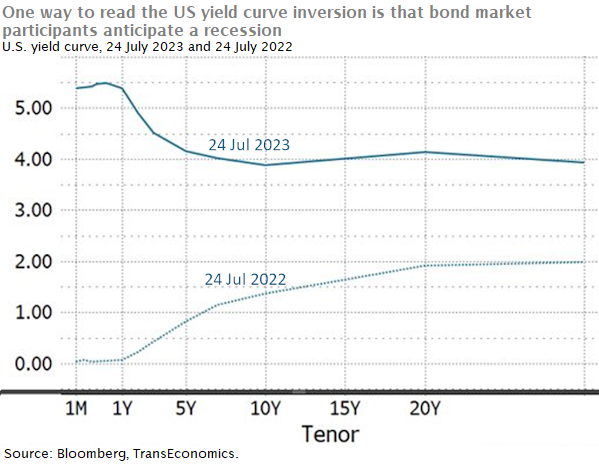

The U.S. Treasury yield curve is inverted. One plausible[1] interpretation is that, collectively, bond market participants anticipate a recession in the near future.

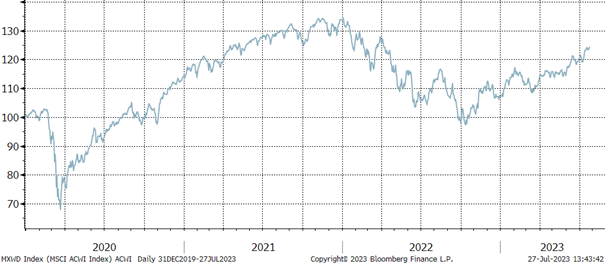

The stock market, by contrast, is surging. This can be interpreted as saying that stock market participants anticipate a soft landing.

The stock market surge could mean that shareholders anticipate a soft landing

Global stock markets (daily close prices for MSCI ACWI Index ETF, 100= 31 December 2019)

This apparent schizophrenia—simultaneous pessimism in the bond market and optimism in the stock market—stems from the still-high uncertainty prevailing as to whether the current slowdown in the United States signals the start of a recession or that of a soft landing (a slowdown to a near standstill but never contraction, followed by recovery).

The research team at TransEconomics has revised up to 60% from 55% the subjective probability it assigns to the soft-landing scenario. At its June meeting, the Fed took a pause. We interpret this as Fed eagerness to stop raising interest rates. Moreover, while it is true that the labor market is coming into balance—the gap between vacancies and jobseekers is narrowing, and labor force participation rate is slowly rising—unemployment remains low. This is the best of all imaginable labor market outcomes.

TransEconomics is closely watching quarter two corporate earnings. Should a recession lie ahead, we’ll see profits take a dive first, with businesses reacting subsequently by laying off workers. So, as long as profits are holding up, we’ll view a soft landing as the likelier scenario.

Of course, the risk that the Fed will go too far hasn’t gone away. Fed Chair Jerome Powell can sometimes sound as if he thought unemployment had to go up for core inflation to keep on falling. This distorts the idea behind the Phillips curve. If the FOMC buys this myth, they could push rates too high, triggering a recession.

[1] Alternative readings of inverted yield curves, too, are plausible. Stay tuned.