Fed obsession plus labor shortage pose recession risk

Genevieve Signoret & Delia Paredes

(Hay una versión en español de este artículo aquí.)

In last September’s Quarterly Outlook, we laid out a central scenario called Soft Landing in which the U.S. economy slows all the way down to a standstill before taking off again but never contracts and a downside risk scenario called Hard Landing in which the economy does go into recession. Our rosier scenario assumed that labor supply in the United States would recover to its pre-Covid state quickly. Our gloomier scenario assumed the opposite. Which assumption has proved true?

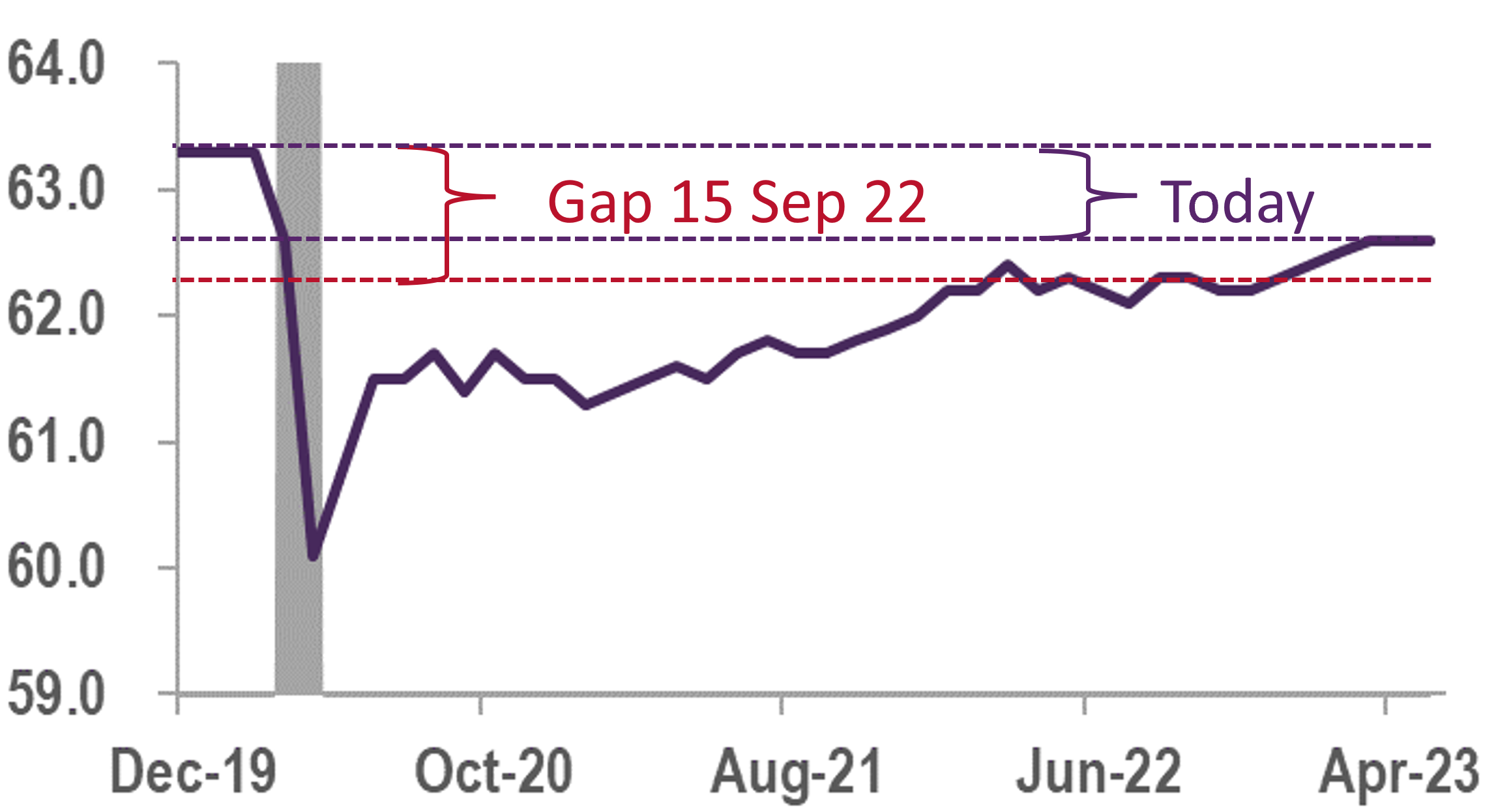

One way to measure [1] the labor supply is to compute the size of the labor force as a share in the entire population of working age. Has it returned quickly to its pre-Covid size?

No, it has not, we see in the chart below. Nearly nine months after publishing those scenarios, we observe that the gap has closed some but still has far to go.

US labor participation still has not recovered from Covid

USA: Labor force participation rate (%)

Source: FRED.

Why has this gap not been closed?

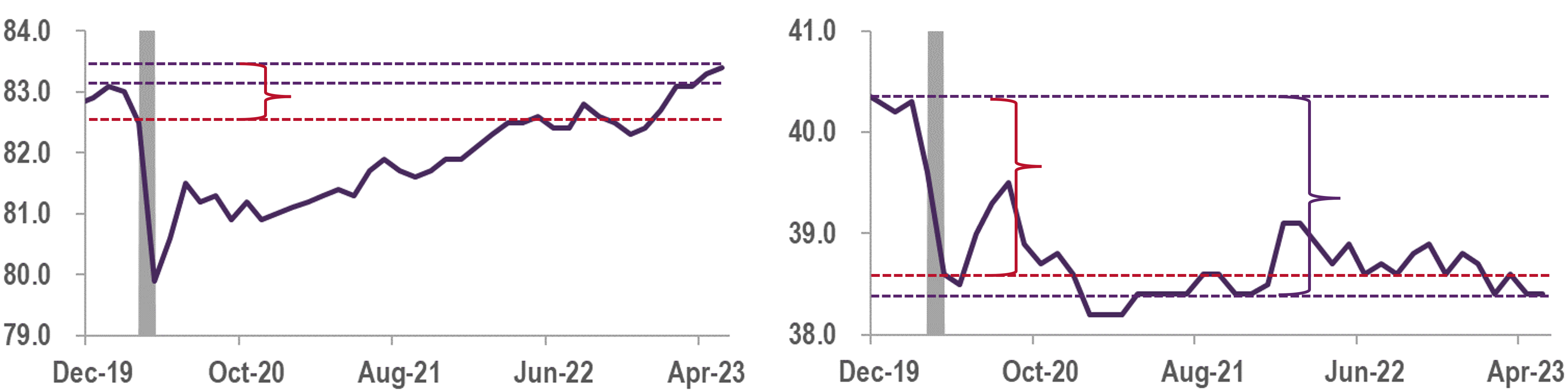

Covid seems to have driven baby boomers prematurely out of the labor force. Below on the left, we see that, whereas the labor participation rate for workers younger than 55 has now fully recovered from Covid, for older workers, the gap has opened wider still.

| Younger workers have come back, but older ones continue to desert | |

| USA: Labor force participation rate (%) | |

| For workers 24-54 years | For workers >54 years |

Source: FRED.

What does this mean for the economy? We think it raises the risk of a Fed error—that the Fed will induce a recession needlessly.

The Fed seems obsessed with the low unemployment rate. It wants financial conditions to become tight enough to bring unemployment up.

Of course, left to its own devices, the labor market would balance itself. The participation gap would produce enough upward pressure on real wages for workers to be lured back into the labor force and for firms to make labor-saving productivity investments. However, if the Fed persists in intervening, it will end up tightening conditions so much that people are needlessly thrown out of work.

In other words, spark a recession.

Research assistance by Estefanía Villeda.

Update (13 June 2023): We added titles to the graphs.

1. Technically, the labor supply is a function and is unobservable. So we rely on proxies. In this post, we choose the participation rate as our proxy.