Still soft: Three Scenarios

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

We continue with our excerpts from the latest edition of Quarterly Outlook. Click here to read the full report.

Three Scenarios

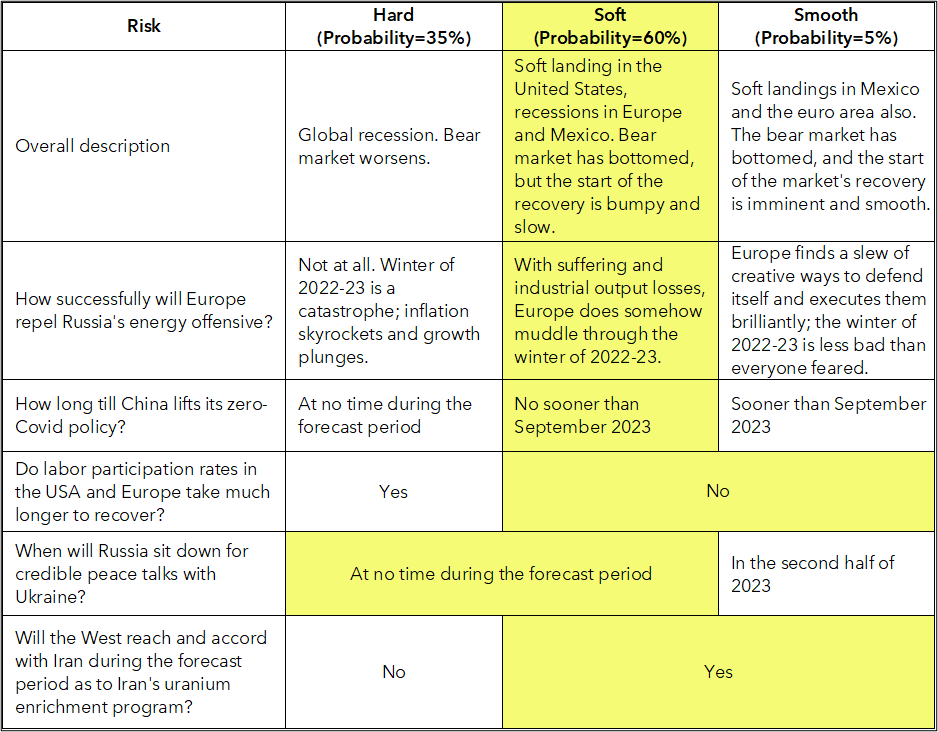

In our central scenario, called Soft (subjective probability = 60%), we assume we’re correct in our current reading of the data: which is that negative supply shocks already are easing; so the Fed need not tighten much more. In this scenario, alone among major world economies, the U.S. economy enjoys a soft landing—meaning either no recession or just a mild one. In Soft, in public markets, the bear market is already bottoming, though the take-off will be prolonged and bumpy.

In our downside risk scenario (35%), called Hard, the negative supply shocks and aftershocks do persist so long that the Fed feels compelled to tighten so far that the United States ends up joining the rest of the world in a hard landing—that is, a severe recession. In this scenario, the stock market has still not bottomed. Hard is a higher-inflation, lower-growth scenario than Soft.

In our highly unlikely (5%) upside risk scenario, called Smooth, supply shocks ease up so quickly that the whole world can enjoy a soft landing. As is the case in Soft, in Smooth, the stock market has already bottomed. Smooth is a lower-inflation, higher-growth scenario than Soft.

We build our scenarios on top of assumptions of two types, those that distinguish across scenarios, which we sometimes call “pivotal assumptions”, and those common to all assumptions and rule out tail risks.

Assumptions that distinguish across scenarios

How successfully can Europe repel Russia’s energy offensive?

In our central scenario, Soft, while it is true that this coming winter brings to Europe hardships, governments protect the private sector and go into deep deficit to limit the damage from Russia’s energy war on Europe. The economy goes into a moderate recession.

In Hard, on the other hand, governments are less generous and willing to go into debt. Inflation skyrockets, and the economy goes into a deep and severe recession.

In Smooth, European leaders are especially creative, lucky, and willing to take on debt, such that the continent manages to defend itself brilliantly from Russia’s energy war. Next year´s recession is surprisingly mild.

How long till China lifts its zero-Covid policy?

In Soft, China does not lift its zero-Covid policy before September 2023.

In Hard, it doesn’t lift the policy ever over the next eight quarters.

In Smooth, China surprises the world by lifting its zero-Covid policy before September 2023.

Do labor participation rates in the USA and Europe take much longer to recover?

No, in Soft and Smooth, yes, in Hard.

When will Russia and Ukraine sit down to credible peace talks?

Not before September 2023 in our central scenario, Soft; sooner than that in the upbeat Smooth scenario; at no time during the forecast horizon in our downbeat Hard scenario.

Will the West reach an accord with Iran as to Iran’s uranium enrichment program?

We assume that it will in our central scenario, Soft, and upside risk scenario, Smooth, but we assume the opposite in our downside risk scenario, Hard.

These scenarios are summarized as follows.

Assumptions common to all scenarios (how we rule out tail risks)

To build our forecast model, we rule out tail risks with the following list of assumptions common to all three scenarios:

- All central banks, regardless of their official mandates, prioritize credibility over recession avoidance.

- New variants of Covid prove no more lethal than Omicron.

- A new pandemic does not break out.

- War over the Taiwan Strait does not break out.

- A cyber terror attack does not paralyze the world economy for an extended period of time.

- Israel does not attack Iran.

- Europe never caves to Russia.

- Long-term consumer inflation expectations remain well anchored.

- The Mexico–U.S. trade dispute does not reach crisis levels.

- Trump is either not convicted, or, if he is, the subsequent rioting is contained.

- Putin stays in power.