Home affordability has plunged. Could this be what’s hurting Biden?

Genevieve Signoret & Delia Paredes

(Hay una versión en español de este artículo aquí.)

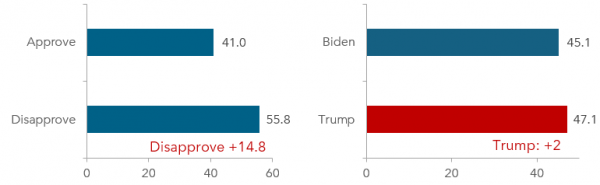

Economists have been puzzling over why Joe Biden has such low approval ratings and is slightly behind Donald Trump in the polls when inflation is slowing down, household income and consumption are so strong, and unemployment is at a low 3.7%.

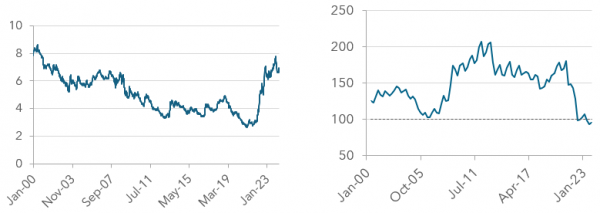

One hypothesis we’re toying with is that home unaffordability is hurting Biden’s popularity. With mortgage rates having risen so much, affordability is at its lowest since the National Association of Realtors began publishing its Home Affordability Index.

Economists find it puzzling that strong growth, falling inflation and low unemployment aren’t helping Biden more

|

President Biden job approval per Real Clear Politics poll averages |

Voter preferences for 2024 US presidential elections per Real Clear Politics poll averages |

|

|

||

|

Source: www.realclearpolitics.com, retrieved 1 March 2024. |

Source: www.realclearpolitics.com, retrieved 1 March 2024. |

|

Perhaps one factor hurting Biden is that, with mortgage rates so high (left-hand chart), homes are less affordable now than any time this century (right-hand chart)

|

US: Average 30-year fixed mortgage rate (%) |

US: Housing Affordability Index [1] |

|

|

||

|

Source: Bloomberg. |

Source: Bloomberg. |

|

[1] When the index measures 100, a family earning the median income has exactly the amount needed to purchase a median-price resale home using conventional financing. An increase in the home affordability index means that a family is more likely to be able to afford the median priced house.