What about growth in Mexico?

Delia Paredes & Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

What follows is a slightly edited excerpt from Quarterly Outlook 2023–2025: It All Hinges on Rates.

In Mexico, growth remains strong; we see the GDP growth rate for all of 2023 reaching 3.4%.

As in the United States, growth here has been supported by strong demand for consumer services and for construction. These two sectors explain more than three quarters of the economic expansion seen so far this year.

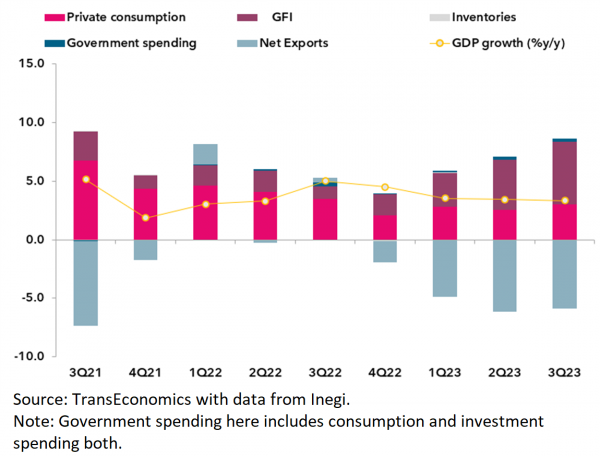

The following chart shows the breakdown of aggregate demand. Notice how household consumption and government expenditure (which includes government investment) stand out.

Although growth in private consumption has moderated, it is still the main driver of GDP growth in 2023

Aggregate demand in Mexico

%-pts contribution

We begin with household consumption. We believe that three tailwinds explain its impetus.

Three tailwinds driving household consumption

The first of these tailwinds is that, as is true in the United States, the demand for services that was pent up during the Covid shutdown has subsequently exploded.

Second is a fiscal impulse working through two channels: the first and stronger of the two, government transfers; and the second, still in the early stages, pre-electoral spending.

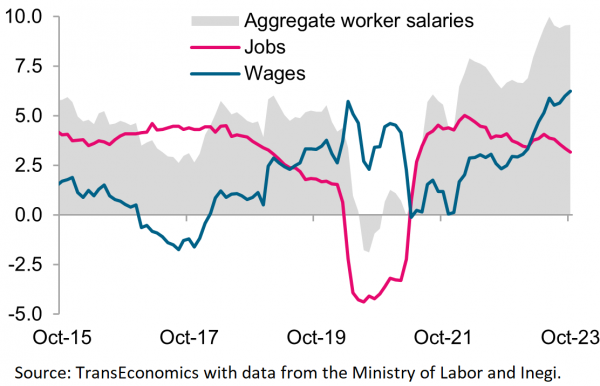

A third tailwind is the boost to purchasing power households are enjoying thanks to rising nominal salaries and disinflation.

These tailwinds have compounded to produce exponential growth in aggregate payrolls.

Aggregate payrolls in Mexico have grown exponentially

Aggregate salaries (formal workers)

Year-on-year % rate in real terms

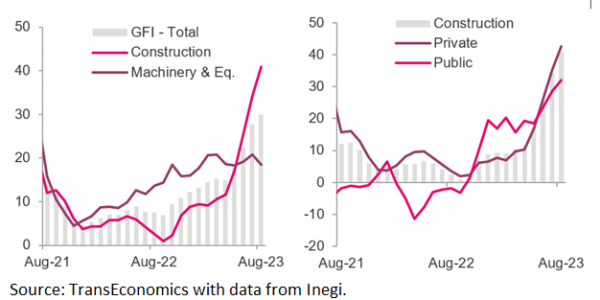

Gross fixed investment is accelerating thanks to surging investment in construction both in the public and private sectors both, and, to a lesser extent, in machinery and equipment.

The surge in public-sector construction stems chiefly from the government’s flagship public-works project, Tren Maya.

The surge in private-sector construction seems to be coming from projects related to nearshoring: in some cases the laying of groundwork, in others their full-on launch.

Gross fixed investment is surging thanks to the government’s flagship project and nearshoring

Mexico: Gross fixed investment (GFI, left, % y/y 3 month moving average) and GFI in construction (right, % y/y 3 month moving average)

Previous excerpts from Quarterly Outlook 2023–2025: It All Hinges

on Rates:

- Summary

- Long-term rates and equity valuations

- Rates, Covid and real estate valuations

- Why have US long-term rates trended up? Hypothesis 1: Debt issuance

- Why have US long-term rates trended up? Hypothesis 2: Tight policy

- Why have US long-term rates trended up? Hypothesis 3: Investor inflation worries

- Why is US nominal income unexpectedly high?

- Momentum: Recap