We Revise our 2023–2024 Growth Outlook for Mexico

Delia Paredes & Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

We hold to our view that the boost from a gush of fiscal spending ahead of 2024 presidential elections will keep growth robust in what remains of 2023 and in 2024. Moreover, we’re now seeing what may be incipient signs in the data that growth rates are receiving added oomph from fixed investment motivated by the fact or anticipation of nearshoring. Recent data on economic activity, however, suggest slightly greater dynamism than we had expected for the second half of 2023.

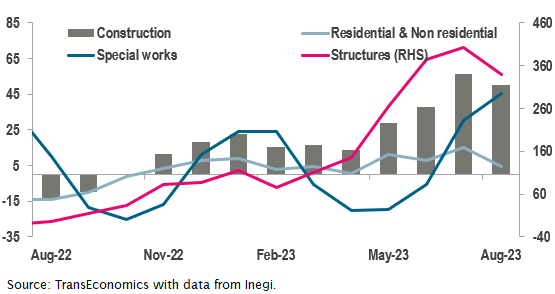

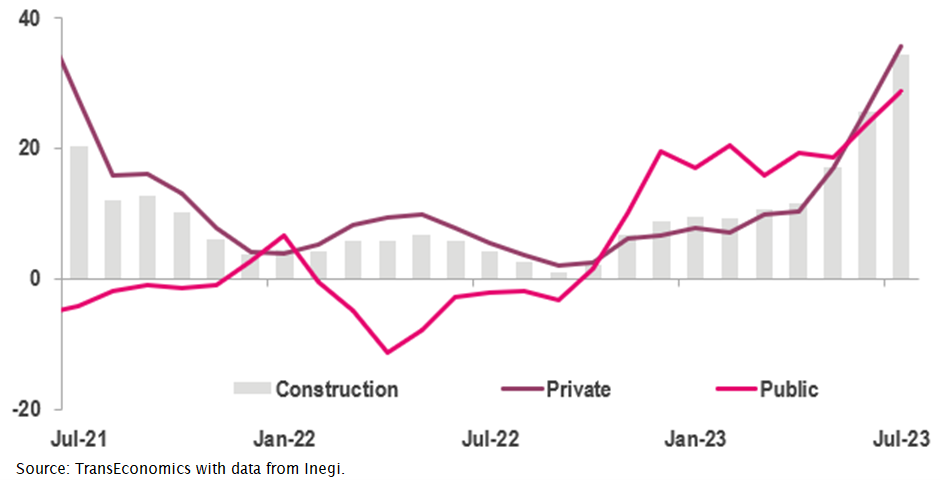

Stronger-than-expected growth numbers are showing up in the construction sector which, because of its intense use of budget-constrained workers, is known for its capacity for strong spillover effects on consumption and activity overall. Driving construction are stimulus from government investment in public works—Tren Maya especially—and, possibly, actual or expected nearshoring.

Construction both in private and public works is proving stronger than expected

Construction output

3m/3m % change, seasonally adjusted annual rate

Mexico, gross fixed investment: Construction

Year-on-year % change, 3-month moving average

Growth has surprised to the upside also in household discretionary spending on services such as recreation.[1] This is consistent with our hypothesis that strong construction and pre-electoral spending generally are generating abundant spillovers. Unsure as to whether this unexpected burst will persist, we’ll be watching discretionary consumer spending numbers closely.

Because of these data surprises, we revise up our growth projection for Mexico to 3.4% from 3.2% for 2023, and revise down our growth outlook for 2024 to 2.4% from 2.6%.

[1] In August, recreation surged at a 13.8% seasonally adjusted annual rate.