Still soft: Momentum – Financial conditions

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

The following is an excerpt from Quarterly Outlook. Click here to read the full report.

Financial conditions

Milton Friedman once famously said that monetary policy transmission to the economy with long and variable lags, but I adhere to the Scott Sumner view that, at least to asset markets, monetary policy transmission is coincident or leading. In the United States, for example, high-yield corporate bonds began paying steeper risk premia over comparable U.S. Treasury securities the summer preceding the Fed’s March start of the rate hiking cycle.

Junk bond spreads led Fed tightening

ICE BofA U.S. High-Yield Index Option-Adjusted Spread, in the 5 years to 8 Sep 2022

Source: FRED.

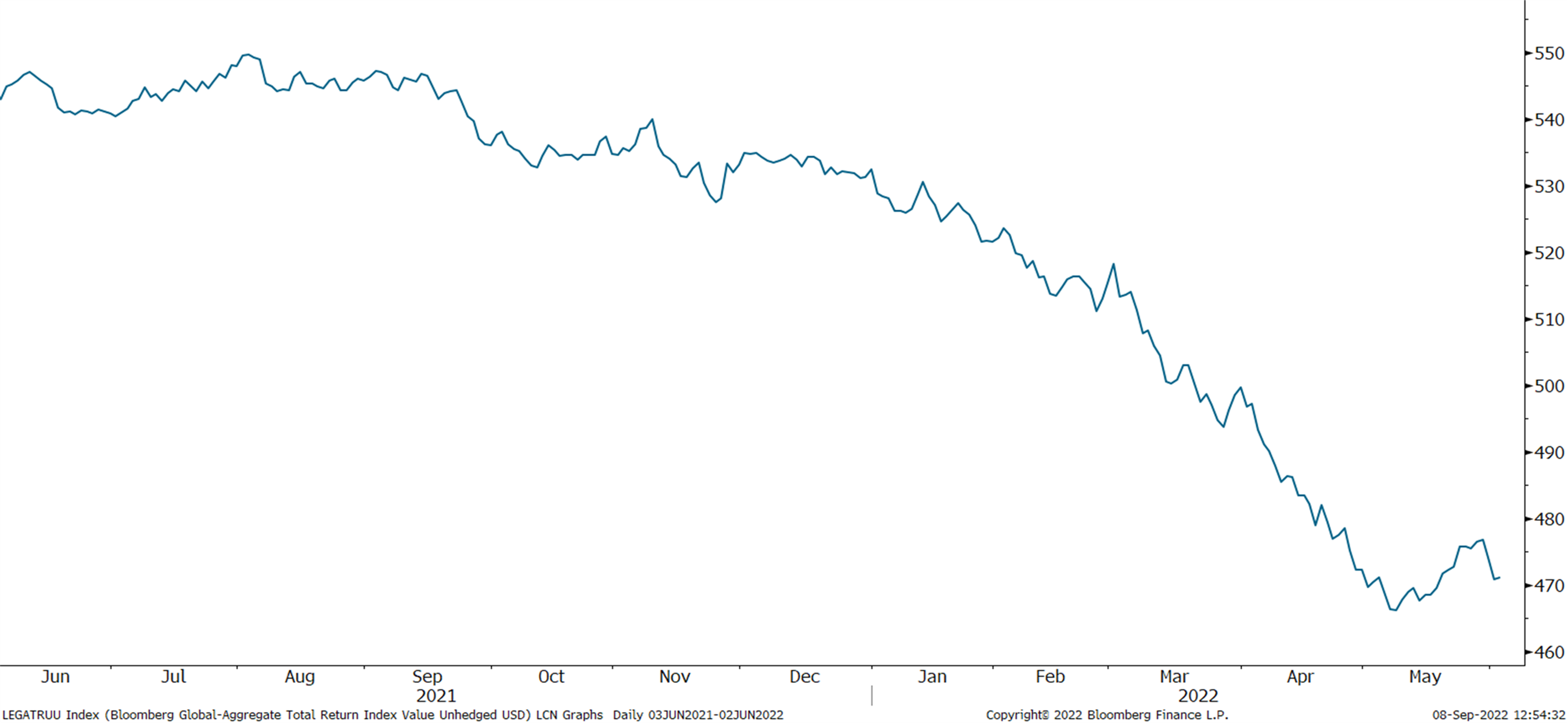

Rising bond yields of course mean higher incomes, but the boost has been insufficient to offset falling valuations—the total return on global fixed income this year has been awful.

Global fixed income total returns in the past year have been awful

Bloomberg Global Aggregate Total Return Index (a benchmark global investment-grade fixed income index), in the 12 months to 8 Sep 2022

Source: Bloomberg.

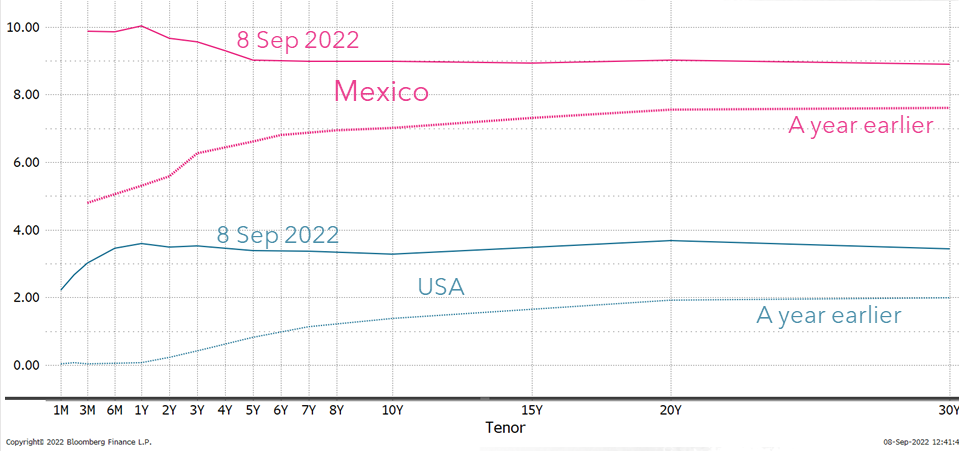

Yield curves in Mexico and the United States have shifted up —in Mexico sharply and in the United States slightly—. We read from this yield curve inversion that markets are expecting a recession.

Yield curves in Mexico and the United States have shifted way up and are inverted

USA and Mexico: Yield curves for government debt securities on 8 September 2022 and a year earlier (% per annum)

Source: Bloomberg.

Equity returns so far this year have been negative also; the bear market persists.

Equity investors remain in a bear market

MSCI ACWI Index (a benchmark world stock index), year to 8 Sep 2022

Source: Bloomberg.

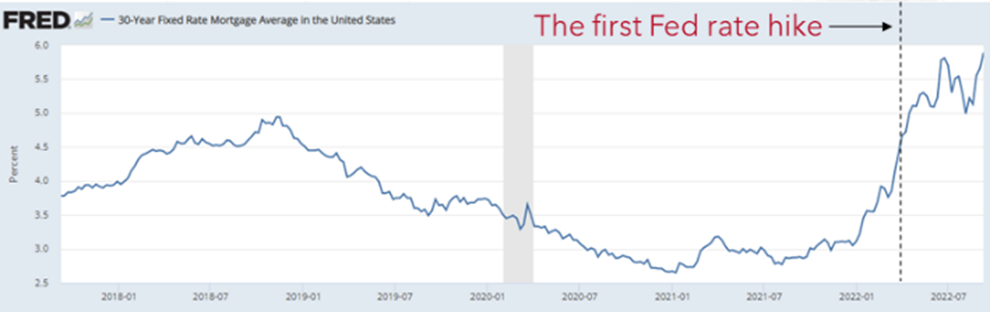

Our comment on the timing of monetary policy transmission to asset markets pertains not only to public markets only but also to private markets. You can see this in U.S. mortgage rates.

The U.S. mortgage market moved well before the Fed started to tighten

U.S. average 30-year fixed mortgage rate, in the 5 years to 8 Sep 2022 (% per annum)

Source: FRED.

With mortgage rates rising, U.S. house prices are flattening. In fact, we expect them to soon start to fall on average, as they are doing already in various submarkets.

House prices in the United States are flattening and will likely start to fall on average

USA: S&P/Case-Shiller 20-City Composite Home Price Index, in the 5 years to June 2022 (Jan 2000 = 100)

Source: FRED.

Commercial real estate prices are of course flattening also.

Commercial real estate prices in the United States are flattening too

U.S. Commercial Real Estate Price Index, in the 5 years to Q2 2022 (Jan 2005 = 100)

Source: FRED.

It is well known that public and private equity valuations are positively correlated, so one can assume that valuations are currently in the downturn for closely held companies as well.