Don’t shoot the piano player, Part 4: What about the central banks?

Alastair Winter

(Hay una versión en español de este artículo aquí.)

This is Part 4 of a four-part series by Alastair Winter. Parts 1–3 are found here:

Don’t shoot the piano player, Part 1: central bankers under fire

Don’t shoot the piano player, Part 2: how did central bankers err?

Don’t shoot the piano player, Part 3: the next two years and beyond

Alastair Winter of course writes on his own views, not those of TransEconomics or Genevieve Signoret.

With their credibility at stake, central bankers will have to do more than talk tough. They will have to keep hiking through to the end of 2022 and, even during a recession, delay any cuts until well into 2023 and only once inflation is definitely falling back (Figure 3).

Even then, lower interest rates will not magically propel growth. The Australian government announced in July an independent review of “Australia’s monetary policy arrangements”. It will be most interesting to see if it reaches conclusions that are relevant to their counterparts in other developed economies. Are central banks taking sufficient account of complex interacting (geopolitical, macroeconomic, microeconomic, and social) factors? Do they make allowances for unintended consequences? At the risk of pushing the metaphor too far, the “piano players” need to change their “repertoire” and get other “players” to join them in the concert. That would certainly be preferable to their “being shot” (lose independence).

Some final thoughts on the UK. Central bank independence may sound rather dry and technical, but a review of the Bank of England would almost certainly generate much controversy. It would expose the mounting damage from Brexit, from deteriorating public services (including privatized utilities) and from decades of under-investment in both public and private sectors. It would reveal why UK growth and productivity trails other developed economies, why the British people are getting poorer, and why (potentially inflationary) tax cuts are not the answer. I sense that the new prime minister (whoever he or she may be), as leader of the party of government over the last 12 years, would rather not find out!

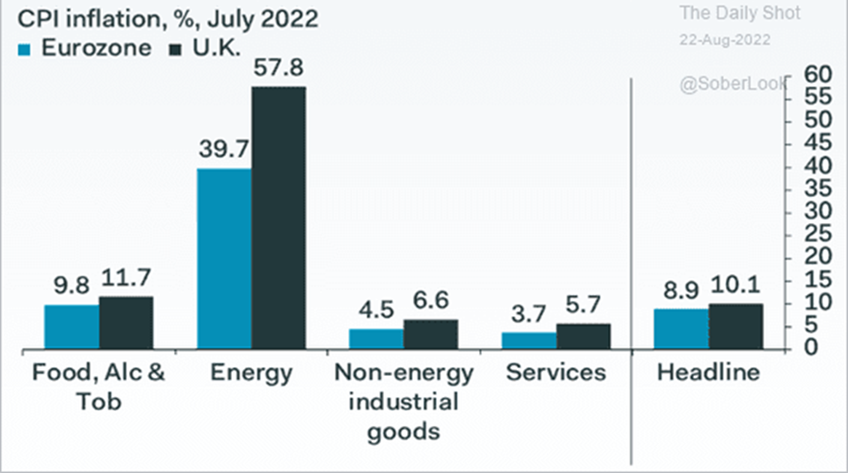

Figure 4: Inflation in Europe and UK. Energy and Food prices for now, wages next?

Source: Pantheon Macroeconomics