Mexico, Elections and Animal Spirits

Delia Paredes & Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

Today, we update you on one of the risks we identified in our September 12 edition of Quarterly Outlook: to what extent will investor sentiment be affected by the uncertainty arising from the electoral process in Mexico?

First, here are the key dates in the electoral process:

| Date | Event |

|---|---|

| 20 November 2023 | The electoral process begins. |

| 20 November 2023 – 18 January 2024 | The parties nominate their candidates. |

| 22 January 2024 | Voter registration deadline |

| 1 March 2024 – 29 May 2024 | Campaigns are launched. |

| 2 June 2024 | Election Day |

Rarely in history have so many seats been up for grabs on a single Election Day:

- President

- 128 seats in the Upper House

- 500 seats in the Lower House

- 31 local legislatures

- 8 governorships: Chiapas, Guanajuato, Jalisco, Morelos, Puebla, Tabasco, Veracruz, and Yucatán.

- The head of government of Mexico City, as well as its 16 boroughs

- 18,639 municipal and auxiliary positions

Investors are keeping a close eye on two risks. The first has to do with the possibility that AMLO may not recognize the outcome, should anyone other than his favorite, Claudia Sheinbaum, were to win. This would generate a constitutional crisis.

Several polls published so far show her ahead in voter preferences by a wide margin. However, political analysts argue that the race is still open and that the polls may have methodological issues. What would happen if the polls were wrong? How would the president react?

The second risk has to do with the composition of Congress after the election. The president stated in his press conference back on May 9 that, if his party obtains a qualified majority, then his last proposed amendment to the Constitution would be a restructuring of the National Electoral Institute. And more recently he has said that he wants to see reforming the Supreme Court so that justices are elected.

In our central scenario from last September, we assumed that the effect on animal spirits will be present but weak, with a limited economic impact, particularly on the exchange rate.

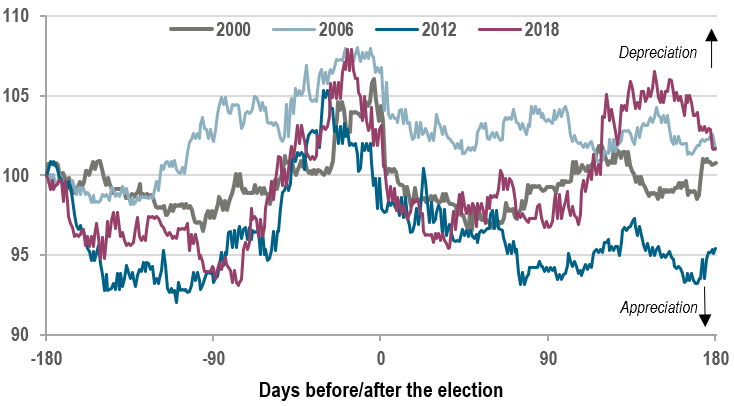

In the chart below, we show the exchange rate around Election Day, during the six months before and after. The peso tends to depreciate in the three months prior to the election, then appreciate to a stronger level than where it stood six months before the election1.

The peso tends to depreciate before presidential elections and recover afterwards

Pesos per dollar around election day

Indices t-180=100 (t is election day)

We hold to our view that the election will have a limited effect on macroeconomic outcomes. At the same time, we expect (downward) volatility during the months close to the election.

1. The sole exception occurs in 2006, when the losing candidate (AMLO) challenged Felipe Calderón’s win. The Federal Tribunal of the Federal Judiciary (Tribunal Electoral del Poder Judicial de la Federación), the official arbiter, declared Felipe Calderón the winner on 5 September 2006. The exchange rate moved up by about 7.5% in the 90 days prior the election (the peso weakened), but, by September 5, it was only 3.5% higher than it had been 180 days earlier (it barely recovered). Back.