Tackling Teaching Tails: What Tail Risks Are and How We Handle Them

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

In building our scenarios, we distinguish between “tail risks” and “pivotal risks” . In this article, I tackle teaching about tail risks and how we handle them in our multi-scenario approach to forecasting.

What is a tail risk?

A tail risk is a possible future event, positive or negative, that fulfills three criteria:

- It is highly unlikely.

- We can imagine it; it is on our radar.

- Should it come to pass, it would cause our entire forecast structure to collapse; we’d have to build all new scenarios.

Why is it called a “tail” risk?

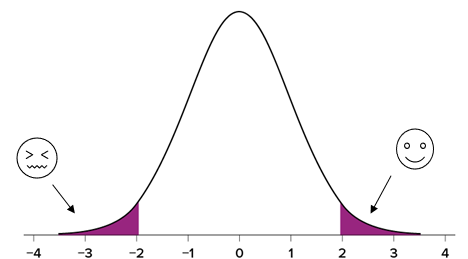

It’s called a “tail” risk because, in a probability distribution, unlikely events appear at the extremes.

Can you give me an example?

A great example is a pandemic. Since around 2004 when we began forecasting under the scenario approach, we’ve consistently identified the breakout of a pandemic as a tail risk.

Twice since then, the risk has materialized. The first time was in 2009, when the Swine Flu broke out in Mexico. We threw out our global macro scenarios and started over.

The second time, of course, was in 2020 with Covid-19. Again, the world had changed.

Is a tail risk the same as a black swan?

We’re so glad you asked. Often we hear the term “black swan” in reference to what in fact is a tail risk.

A tail risk is an extremely low-probability outcome that we can identify. A black swan is one that no one has ever even imagined. When it comes to pass, it “comes out of nowhere”.

The 9-11 terror attack is a prime example of a black swan. Was that risk on your radar? Probably not.

How do you handle tail risks in your modeling?

We handle tail risks in our modeling by explicitly assuming them away. That is, we scan the horizon to identify them, assume that each will not materialize over the forecast horizon, write down that list of assumptions, and publish it in Quarterly Outlook. We call it the list of “Assumptions Underlying All Our Scenarios”.

As you can see, these assumptions are foundational; our entire scenario framework rests on them.

How can I learn more?

You can learn more about our multi-scenario approach to forecasting here, and find sources on how to adopt the scenario approach in conducting your own strategic planning here.

Oh—and you can see it in action! Just sign up for our September 8 webinar, “Our Outlook and Your Wealth”.