Our downside risk scenario: U.S. Recession

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

The following is an excerpt from Quarterly Outlook. Click here to read the full report.

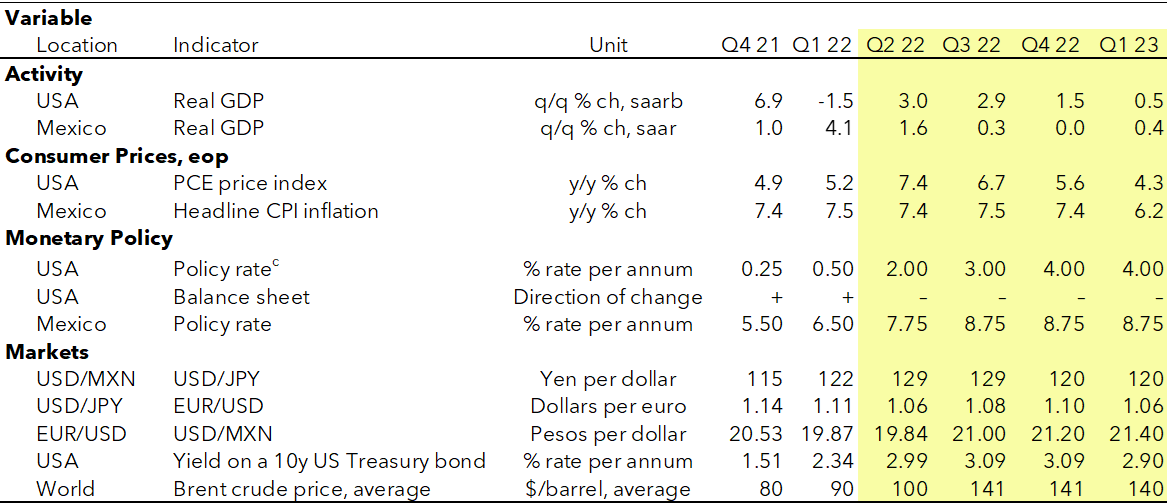

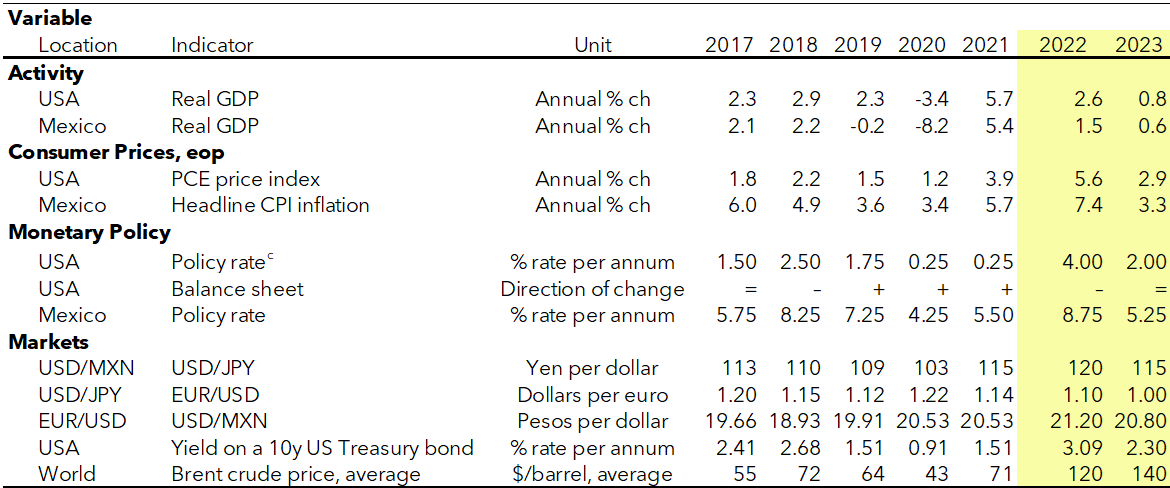

In our U.S.-recession scenario, Western allies agree to slap an embargo on Russian crude oil. Prices reach over $140 a barrel this year and, despite weakening demand and the arrival of some new non-Russian supplies, they hover near that level for the remainder of the forecast period. U.S. inflation persists higher than in our central scenario, and the Fed misreads the data, attributing the persistence to overheated demand. It then sets out on the same erroneous path as the ECB and Banxico, raising the upper limit on its target federal funds range to 4.00% before realizing its error in Q2 of 2023 and starting to cut rates and halt quantitative tightening. Stocks enter a secular bear market.

This turn of war-related oil market events means that ECB and Banxico tightening, which even in our benign oil scenario proves unduly aggressive, in this scenario proves fatal. Both countries experience deeper recessions than the shallow ones we project under U.S. Soft Landing.

Quarterly forecast assuming our downside risk scenario, U.S. Recession (probability=45%)a

Notes:a. End of period, unless otherwise indicated. b. Seasonally adjusted annual rate. c. Upper limit of the Fed’s target range.

Source: TransEconomics.

Quarterly forecast assuming our downside risk scenario, U.S. Recession (probability=45%)a

Notes:a. End of period, unless otherwise indicated. b. Seasonally adjusted annual rate. c. Upper limit of the Fed’s target range.

Source: TransEconomics.

Research assistance by Estefanía Villeda. Editing by Andrés Aranda.