Our central scenario: U.S. Soft Landing

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

The following is an excerpt from Quarterly Outlook. Click here to read the full report.

In our central scenario, Brent crude prices reach over $140 a barrel this year to average $110 for the year as demand weakens, some new supply comes online, and it becomes clear that no embargo on Russian oil will take effect before 2024.

Federal Reserve officials observe weakening U.S. demand and persistent increases in Brent oil prices and end all talk of possibly hiking rates by 75 basis points in June.

June comes, and they hike by a mere half a percentage point. And in subsequent FOMC member speeches and the release of meeting minutes, market participants glean that the Fed officials not only are concerned about the demand component in inflation but also are sharply aware of recession risks and intend to avoid overdoing tightening. And, in fact, the Fed stops tightening in December after having raised its target federal funds range to a zone it sees as neutral rather than tight, 2.25–2.50%.

Fed jawboning gets through to market participants. Also, stock markets are assumed in this scenario immune from possible contagion from crypto markets. These facts compound for a slow and volatile resumption of the U.S. bull market and a sustained return to markets of the traditional negative correlation between stocks and investment-grade bonds. The yield on a 10-year Treasury security peaks at 3.24% in quarter two 2023 and ends 2023 at 3.17%.

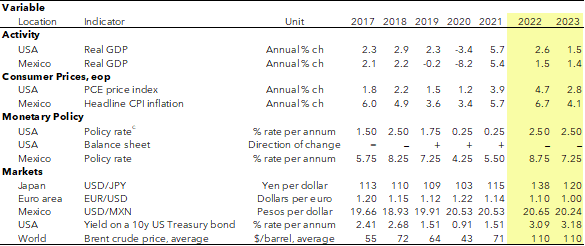

Weakening demand in response to high oil prices and a bit more supply from non-Russian producers push oil prices back down to $110 in 2023, where they hover. U.S. PCE inflation slows down by year end to 4.7% from March’s 6.6% and moves all the way down to 2.8% in 2023. Driving it down are a weakening of demand due to the Fed’s removal of monetary stimulus and an easing Covid-related global supply disruptions in manufacturing in China once it finally relaxes its zero-Covid policy until late in 2023.

Of course, because we are assuming in all scenarios that the Russia–Ukraine war continues for at least two more years, relief from supply-side shocks cannot comes exclusively from repairs on global supply chains post-Covid. The war persists as a source of supply shocks and consequent persistent global inflationary pressures, chiefly through commodity prices.

Offsetting those pressures, besides an easing of Covid-related supply chain disruptions (on the manufacturing side), is weakening demand because of long bouts of confinement in China, wealth shrinkage from the market selloff occurring in the first half of 2022, and, above all, central bank tightening.

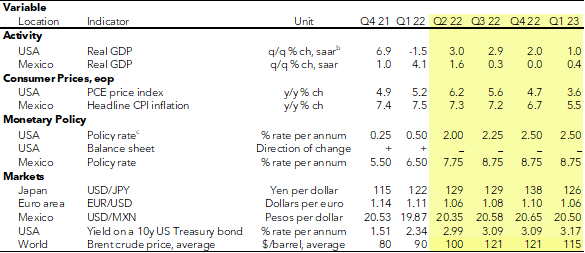

Although U.S. real GDP recovers in the second quarter of this year to a quarter-on-quarter annual rate of 3.0%, it decelerates to 2.0% by the final quarter of 2022 and all the way to 0.2% in the third quarter of 2023. This Q3-2023 GDP growth bottom marks the landing. It is a soft landing, because growth picks back up again subsequently, to 3.0% in Q4 of 2023 for a growth rate of 1.5% for all of that year.

Mexico and the euro area, alas, fare worse than the United States, because their monetary policymakers err by removing stimulus too quickly and too far at a time when aggregate demand hasn’t yet recovered to its pre-Covid path. Both go into two-quarter mild recessions in 2023.

Quarterly forecast assuming our central scenario, U.S. Soft Landing (probability=55%)a

Notes: a. End of period, unless otherwise indicated. b. Seasonally adjusted annual rate. c. Upper limit of the Fed’s target range.

Source: TransEconomics.

Annual forecast assuming our central scenario, U.S. Soft Landing (probability=55%)a

Notes: a. End of period, unless otherwise indicated. b. Seasonally adjusted annual rate. c. Upper limit of the Fed’s target range.

Source: TransEconomics.

Research assistance by Estefanía Villeda. Editing by Andrés Aranda.