Demand is overheated in the USA, but weak in Mexico and the euro area

Genevieve Signoret

(Hay una versión en español de este artículo aquí.)

The following is an excerpt from Quarterly Outlook. Click here to read the full report.

Although we have not shifted our view that supply shocks largely explain global and U.S. inflation, we have done so with regard to demand: we now believe that, in the United States particularly, demand in the aggregate became overheated during Covid and that, at least through Q1, it has remained so.

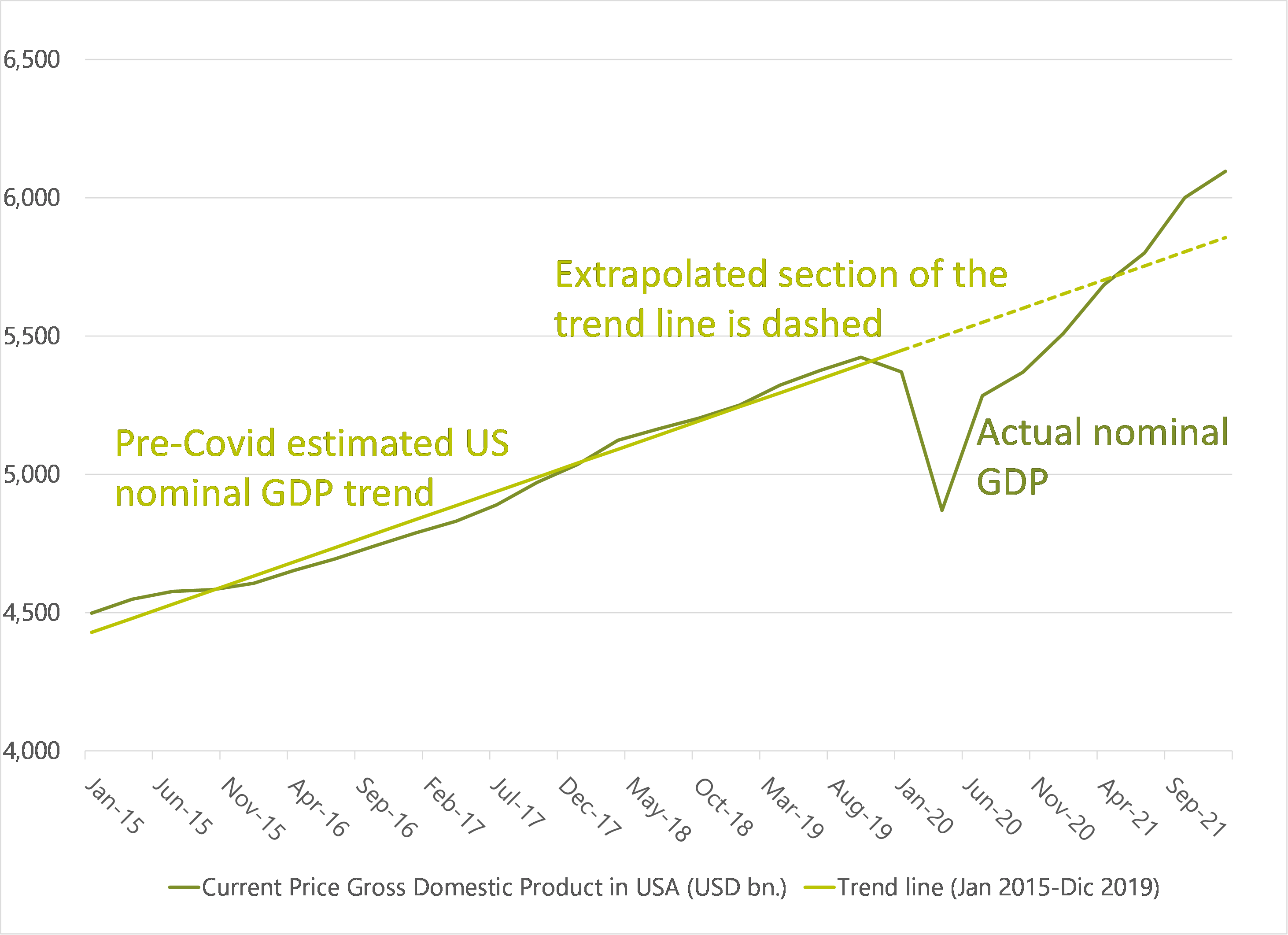

To see this, notice in the following chart how the path of aggregate demand as measured by nominal level GDP through Q1 2022 had overshot its pre-Covid trend.

In the USA, aggregate demand is overheated (surging nominal GDP has crossed its pre-Covid trend from below)

USA: Nominal GDP and GDP projected via extrapolation from pre-pandemic trend, Jan 2015 – Dec 2019 (USD bn.)

Note: We estimated the pre-Covid nominal GDP trend by fitting a regression line to U.S. nominal GDP from Q1 2015 through Q1 2020 (solid green line), then extrapolated through Q1 from that line to show what nominal GDP would have been had it stayed on trend through Q1 2022 (dashed green line).

Source: FRED, TransEconomics.

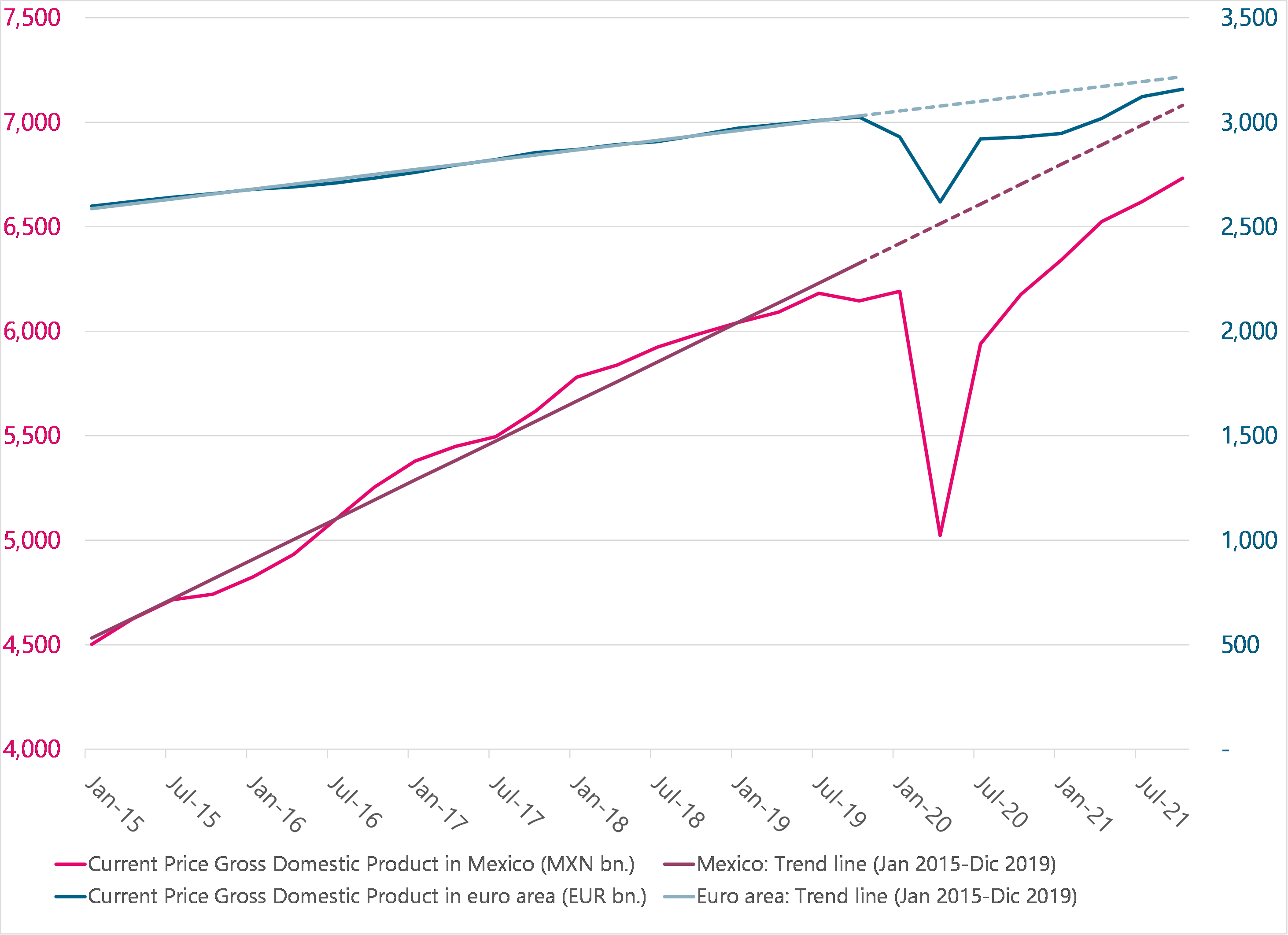

In the euro area and Mexico, by contrast, we see demand as weaker still than it had been before Covid:

By contrast, neither in the euro area nor in Mexico has aggregate demand returned to its pre-Covid trend

Euro area and Mexico: Nominal GDP and GDP pre-Covid trend and trend projected via extrapolation, Jan 2015 – Dec 2019 (EUR bn, MXN bn)

Source: FRED, TransEconomics.

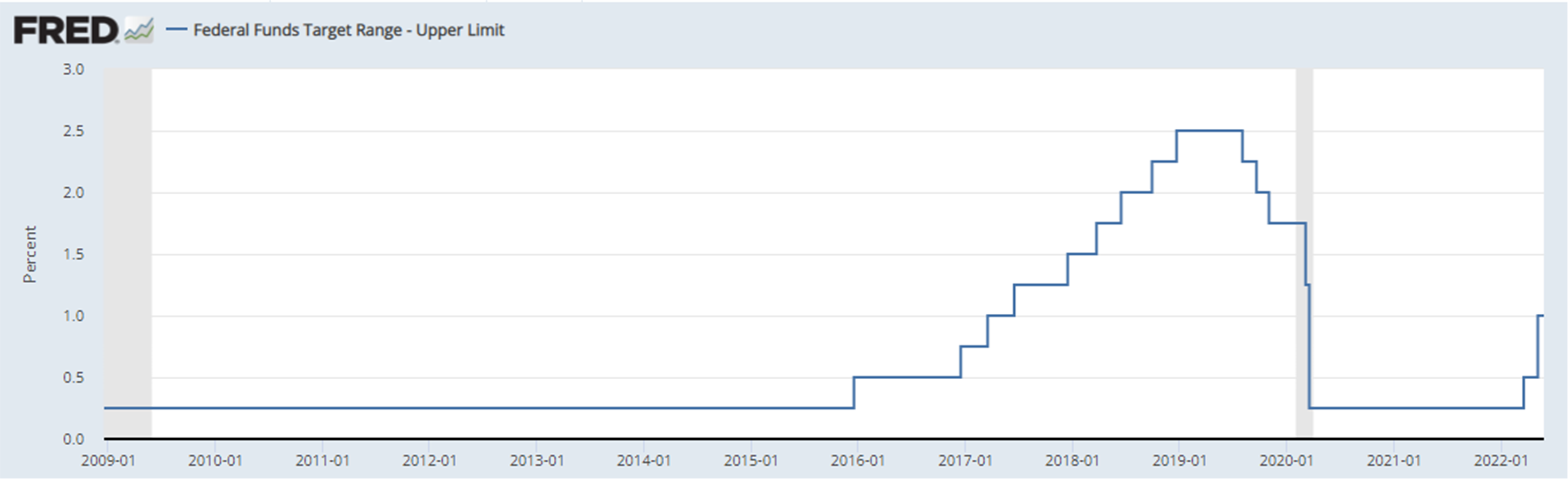

The Fed, like us, now believes that higher-than-targeted inflation is being driven not by supply shocks alone but also by overheated demand. Hence, it is now talking tough and, since March, hiking rates.

The Fed has hiked rates twice and is signaling more hikes to come

USA: Federal funds target range, upper limit (% rate per annum)

Source: FRED.

Research assistance by Estefanía Villeda. Editing by Andrés Aranda.