Fed confirms our view, Banxico revises down growth

Genevieve Signoret

Monetary Policy

The Fed minutes didn’t change our view, which was that the first rate hike will come in the second half of 2015, not in June. As Genevieve explains in last week’s Letter from the President, we read evidence that FOMC discussions are moving in the direction of postponing the start of interest rates normalization to beyond June 2015. That is, the Fed itself is now questioning its own forecast of its future decisions.

We share Tim Duy’s reading: “To get a reasonably sized consensus to support a rate hike, two conditions need to be met. One is sufficient progress toward full-employment with the expectation of further progress. I think that condition has already been met. The second condition is confidence that inflation will indeed trend toward target. That condition has not been met. To meet that condition requires at least one of the following sub-conditions: Rising core-inflation, rising market-based measures of inflation compensation, or accelerating wage growth. If any were to occur before June, I suspect it would be the accelerating wage growth.” All eyes will be on next week’s Chair Yellen’s testimony.

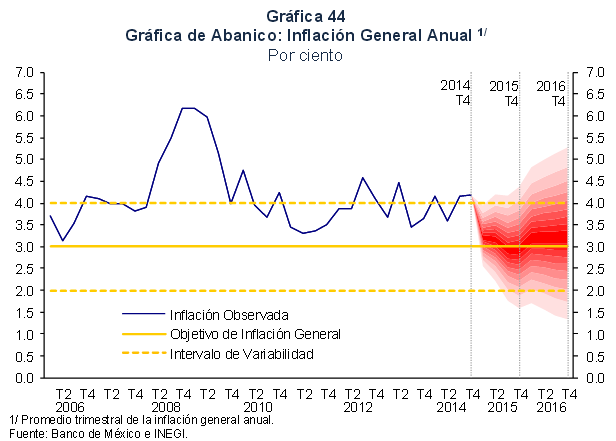

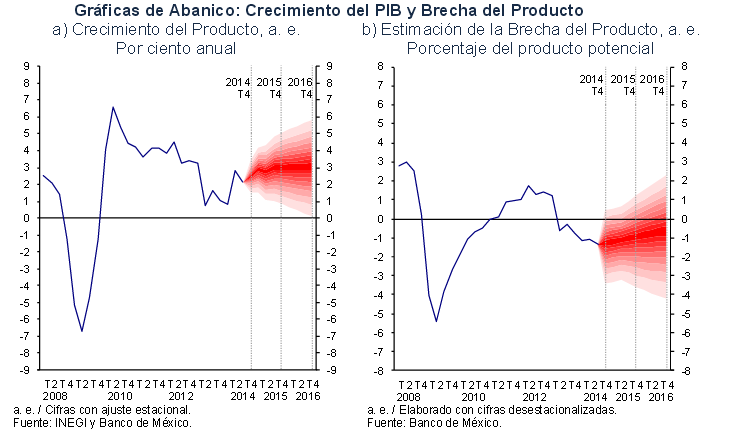

Banxico revised down by 50bp its GDP growth forecast for 2015 and by 30bp 2016′s in its last Quarterly Inflation Report. Now the Bank forecasts 2.5%–3.5% for 2016 and 2.9%–3.9% for 2016. Banxico praised the recent government spending cut while citing external factors, a lower oil output, and internal demand weakness as causes for their having downwardly revised their growth outlook. The Bank changed its inflation forecast little: it still sees headline inflation rates near 3% in 2015 and 2016.

Banxico revised down by 50bp its GDP growth forecast for 2015

Banxico still sees headline inflation rates near 3% in 2015 and 2016