Despite great U.S. jobs report, we hold to our Fed forecast

Genevieve Signoret

Activity: Factor Markets

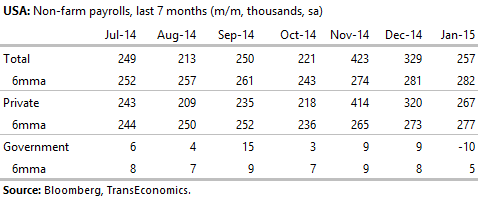

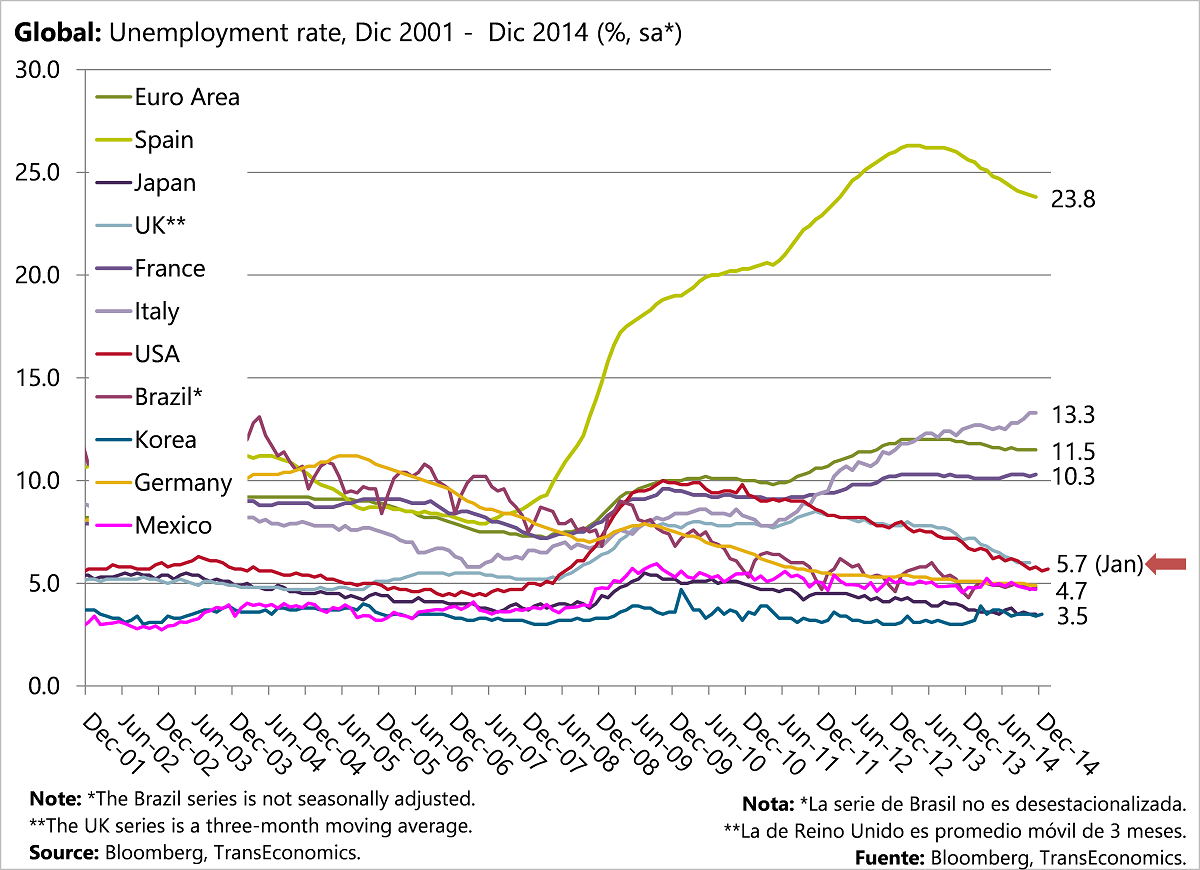

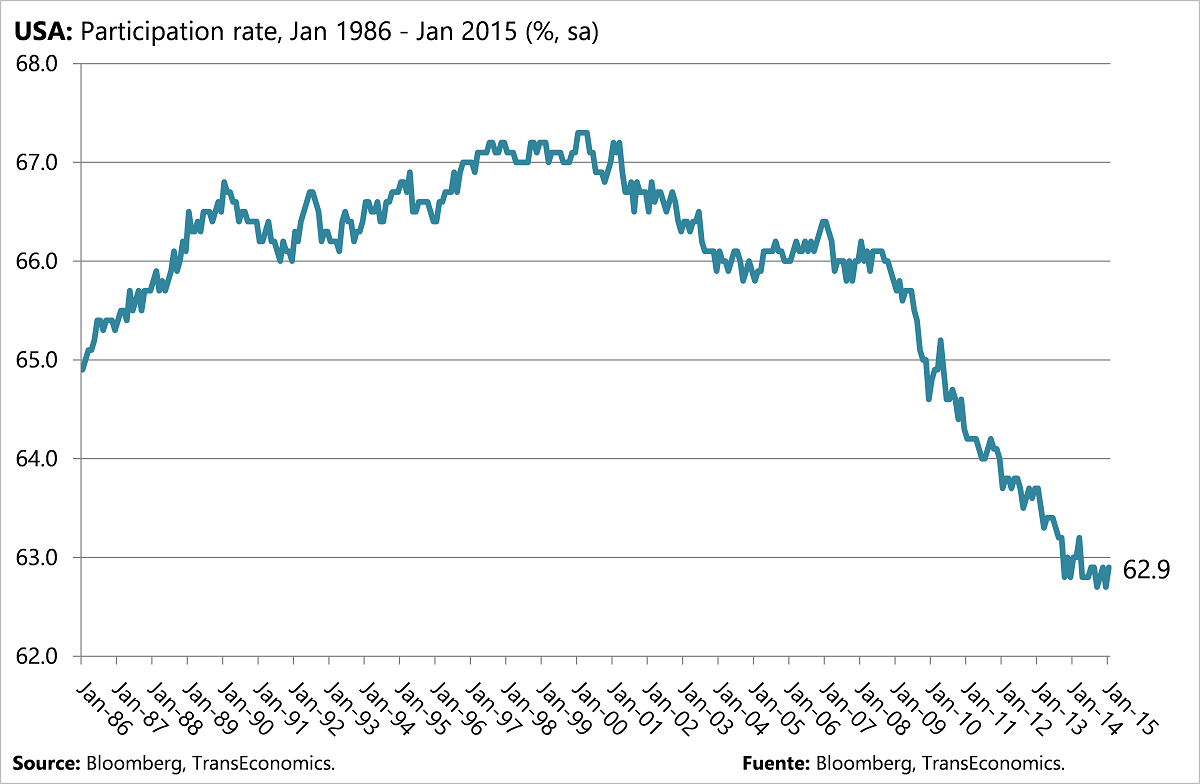

In January, U.S. nonfarm payrolls increased by a strong 257K. The unemployment rate rose by 0.1 percentage point to 5.7% as a result of a higher participation rate (62.9% from 62.7% in December). Nominal wages were up 2.2% y/y from 1.7% in December.

These results raise the risk that our forecast for a Fed rate hike in the second half of 2015 will prove wrong and it will come in June. While we perceive this increased risk, we hold to our forecast.

Our model[1] and client portfolio strategies remain unchanged. They already contain hedges against the risk of a June rate hike.

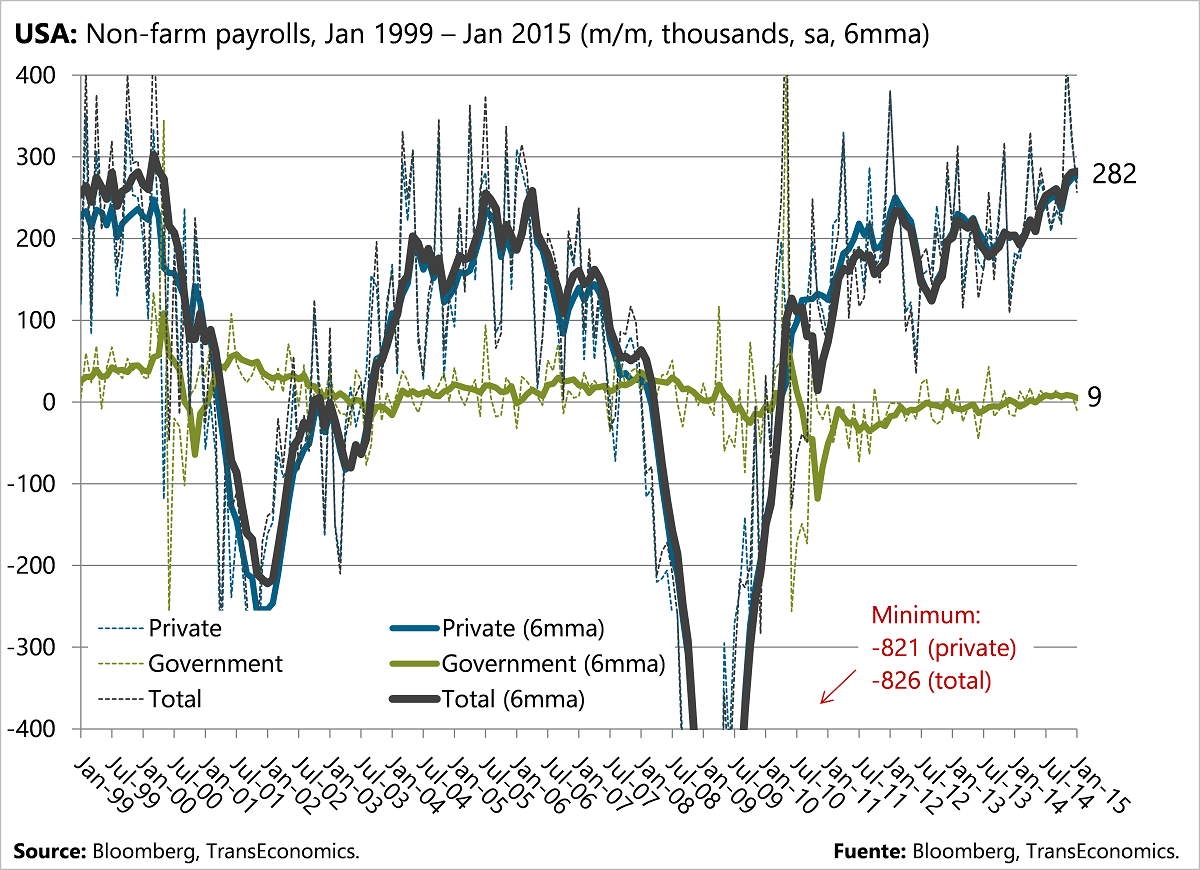

In January, U.S. nonfarm payrolls increased by a strong 257K

Non-farm payrolls have been trending up since September 2013

The unemployment rate rose by 0.1 percentage point to 5.7%…

… as a result of a higher participation rate (62.9% from 62.7% in December)

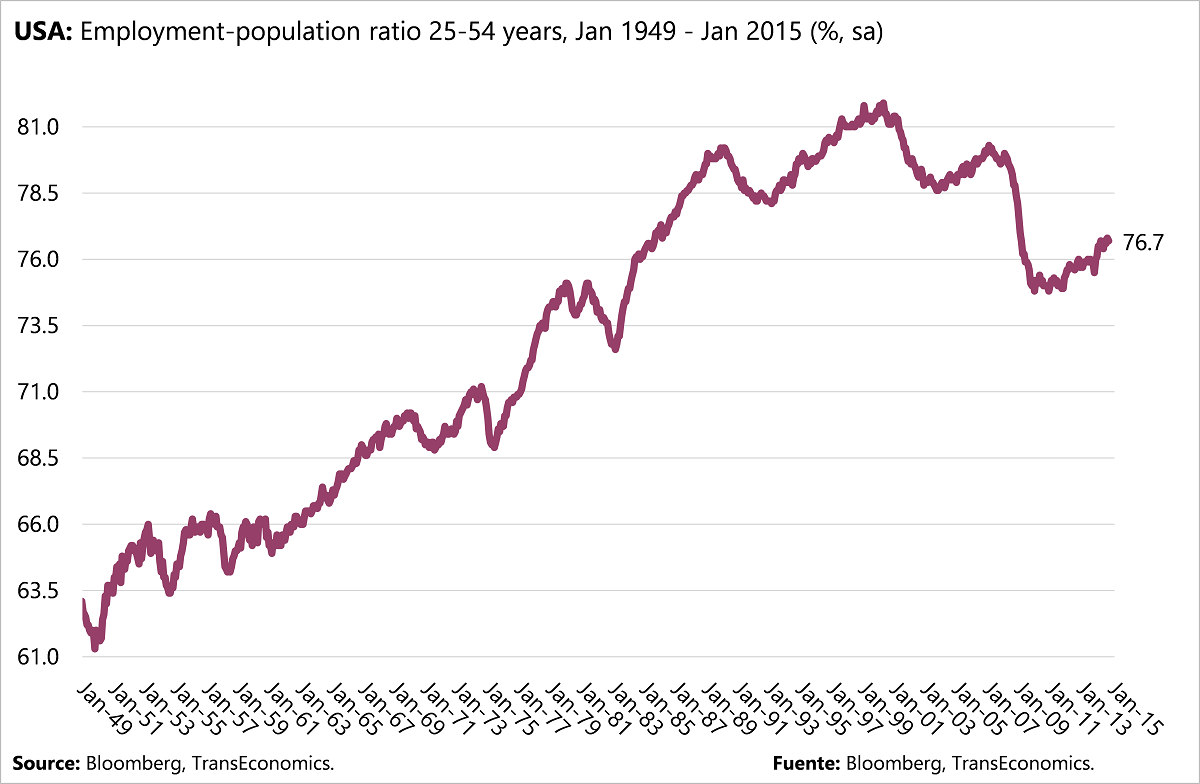

The employment-population ratio has yet to recover to its pre–Great-Recession level

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.