Latest Labor Data Confirm our Views

Genevieve Signoret

Activity

Overview

Emerging labor market trends are in line with our central scenario forecast for the global economy and monetary policy stances.

Unemployment rates in most important global economies have come down or at least stabilized. However, slack remains large, not just in the euro area, where unemployment rates remain quite elevated compared with their pre-Great-Recession levels, but also in the USA.

Labor market slack is combining with oil price declines to put downward pressure on inflation rates. Thus, market participants and analysts are revising down their outlooks for the Fed monetary policy rate to levels closer to our lower-than-consensus views.

While payrolls have not yet grown fast enough to use up take up all the slack inherited from the Great Recession of 2007–2008, in the USA and Mexico, payrolls are growing at healthy rates. This fact bodes well for personal consumption spending in both countries. In the USA, an additional boost is coming from a downward trend in gasoline prices.

These labor market trends U.S. confirm our views—namely, that U.S. and, especially, Mexican, GDP growth rates will pick up speed next year, while Fed and other central banks will keep their policy stances quite loose for a long time to come.

Factor markets: labor market slack

Global unemployment rates

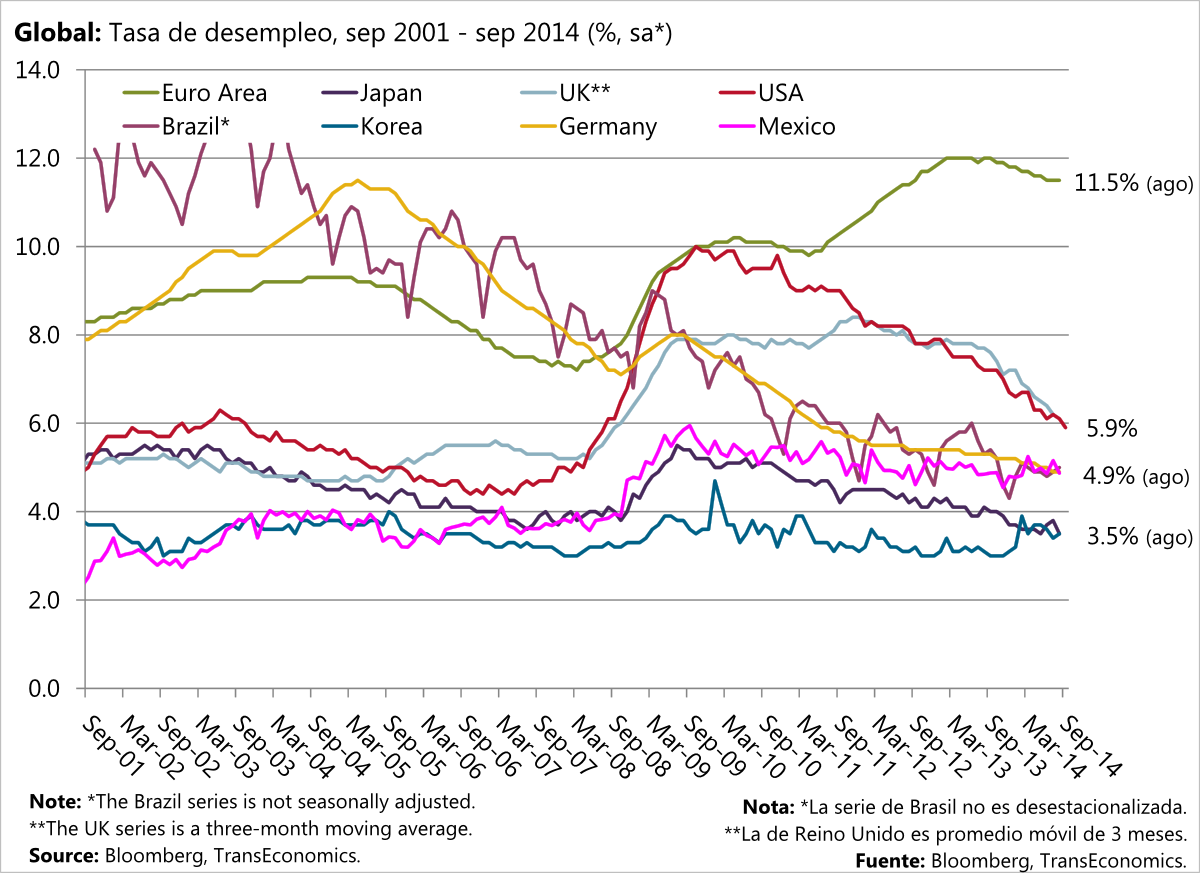

Global unemployment rates have generally come down or at least stabilized. In the USA, the unemployment rate of 5.9% is creeping steadily toward its December 2007 level of 5.0%. Euro area unemployment rates quite elevated, however, relative to their pre-recession levels.

Global unemployment rates have generally fallen or stabilized

U.S. unemployment

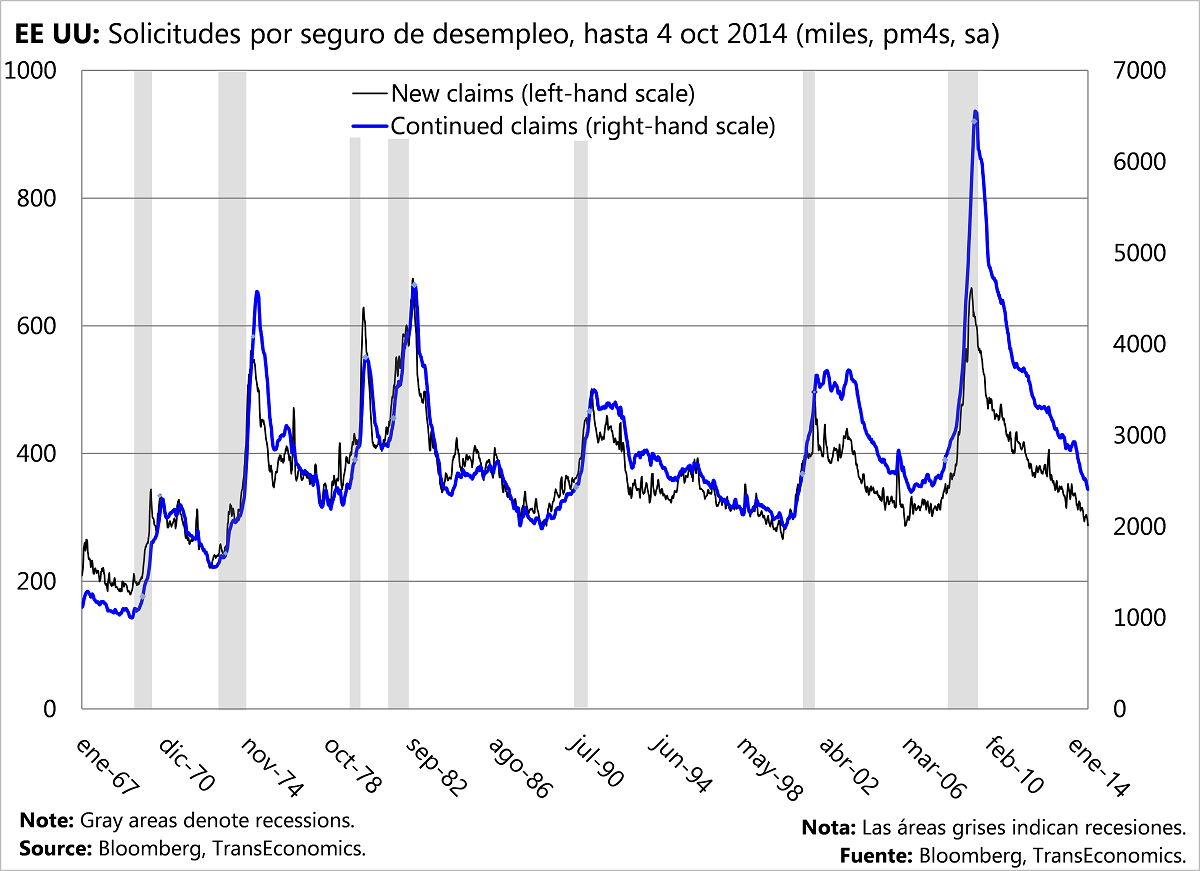

Layoffs have slowed way down in the USA, and job creation has gathered speed. These currents have allowed new and continuing unemployment insurance claims in the USA to fall all the way down to pre-Great-Recession levels.

In the USA, unemployment claims have dropped to pre-Great-Recession levels

Additional indicators of U.S. labor market slack (and dislocation)

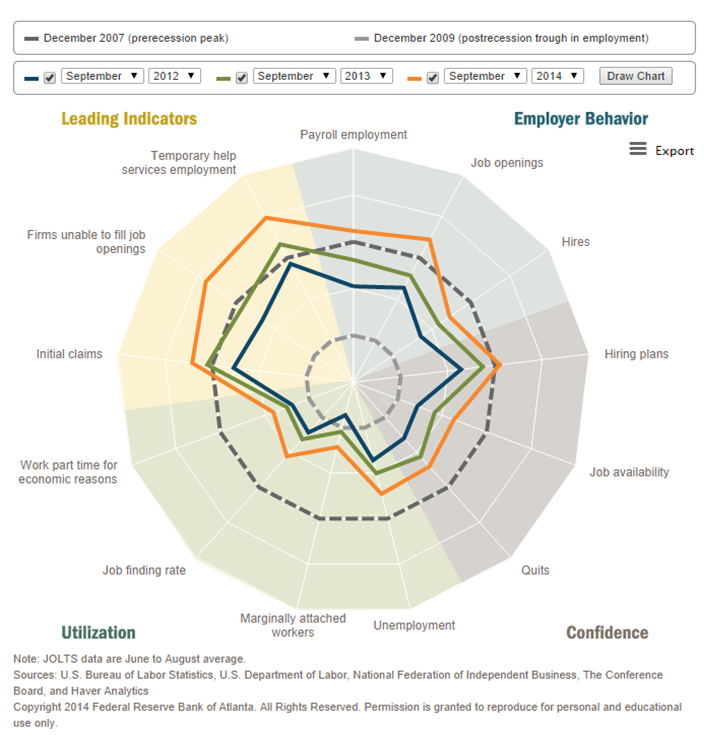

However, while indeed U.S. unemployment rates and unemployment insurance claims have greatly improved, a slew of alternative indicators indicate that labor market slack remains high, and that the labor market exhibits a skills mismatch. To see these trends, consider the Atlanta Fed’s spider chart below showing how various Yellen Dashboard and other useful labor market indicators today compare with their December 2007 levels.

Other indicators of U.S. labor market slack, however, show a gloomier picture

Source: Atlanta Fed.

Now, the spider chart does reveal some good news. Payrolls, the hiring of temps, and hiring plans all exceed pre-recession levels.

It shows more bad news, however, than good. A large number of workers are working fewer hours than they’d like to because that’s the best they can do, weekly initial unemployment claims exceed their pre-recession pace, firms are hiring less than they did before the slump, workers sense the availability of jobs to be constrained, and too many workers have given up on finding a job.

Oddly, at the same time, many more firms than at the peak of the last cycle report having trouble filling job openings. This suggests that the labor market is undergoing “dislocation”: temporarily (it is hoped), the job skills of many of the unemployed miss the mark of what’s needed.

Economists judge that various factors are contributing to the mismatch. These include ongoing structural (long-term) changes in the economy such as rapid growth in the knowledge industries, as well as the cyclical phenomenon that is job skills depletion stemming from long average periods of unemployment for a disadvantaged chunk of the labor force.

Euro area unemployment broken down

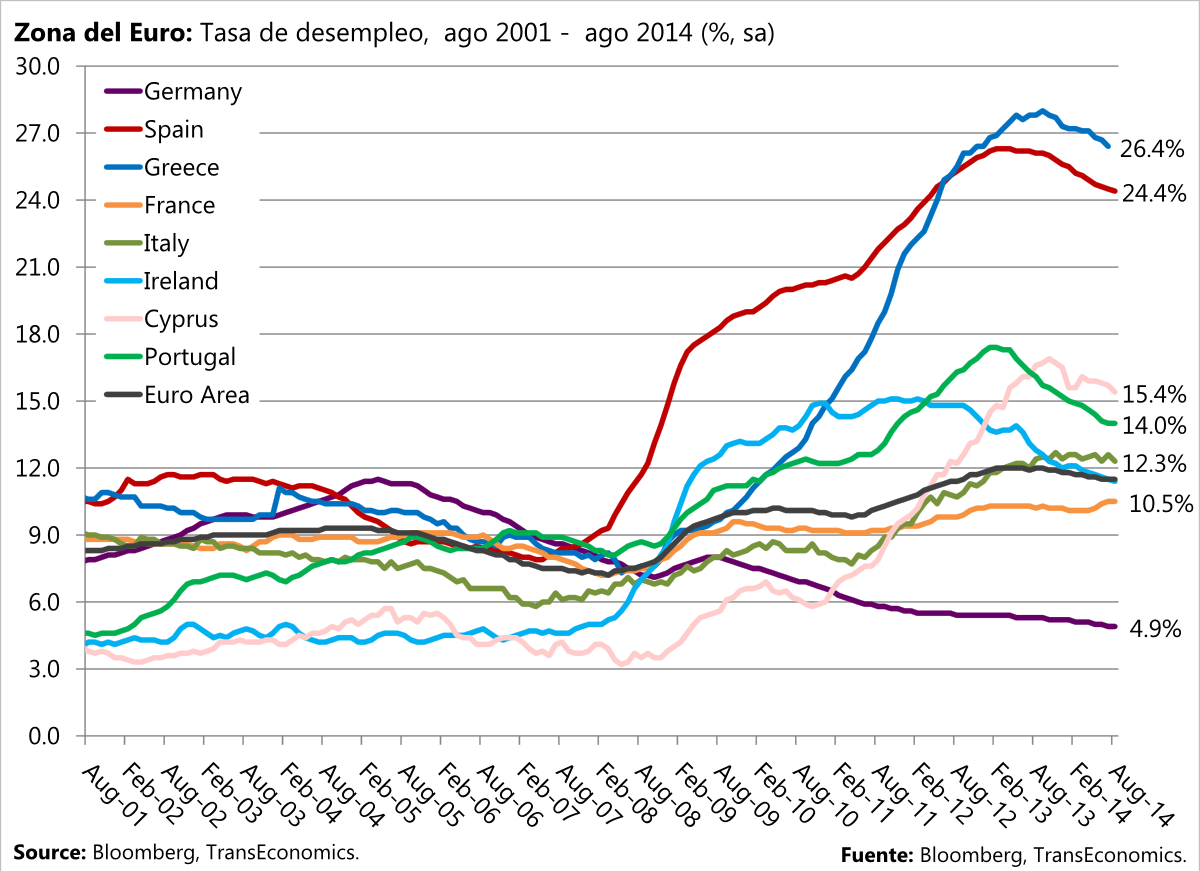

The sole euro area country exhibiting an upward trend in unemployment is France.

Euro area unemployment is trending down everywhere except in France

Mexico’s unemployment and underemployment

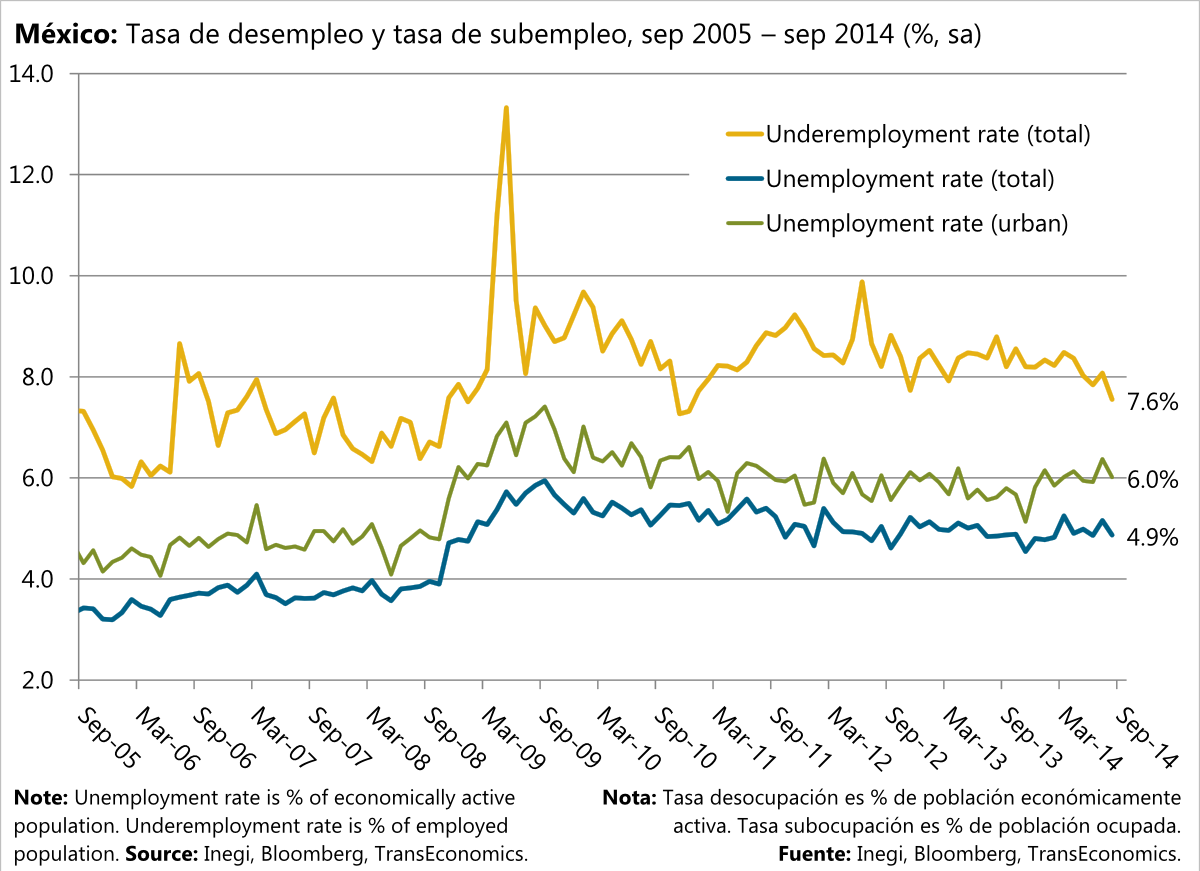

Although Mexico’s urban unemployment rate at one point had improved to well below 6%, it’s now back up at 6.0%. Its underemployment rate (the % of our work force employed but working less than desired), however, at 7.6%, has been on a downward path for the past 18 months.

Mind you, both rates are still considerably higher than they stood before the Great Recession, when urban unemployment measured only 5.0% and underemployment just 6.9%.

Oddly, Mexico’s unemployment and underemployment rates are trending opposite to each other. Both exceed their Dec 2007 readings.

U.S. and Mexican payrolls are expanding in relative and absolute terms

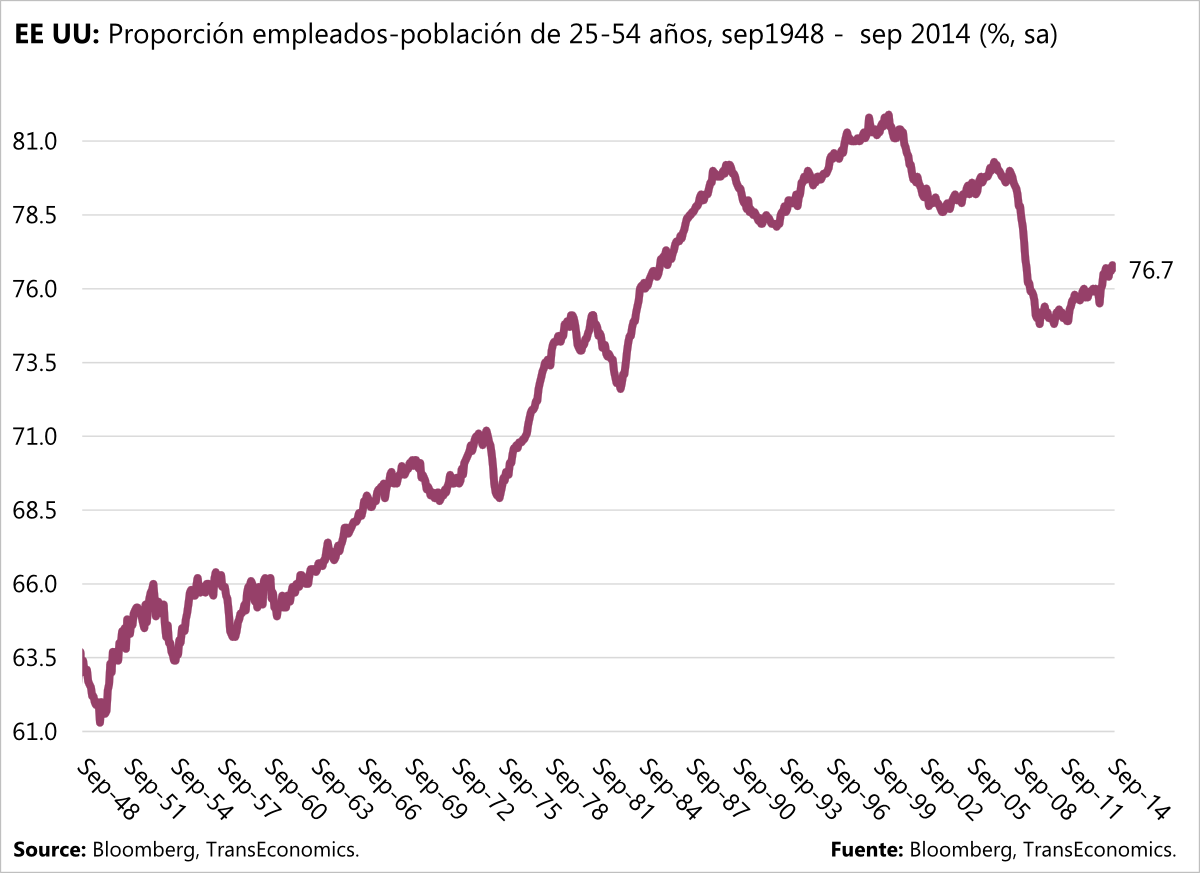

A growing proportion of the American population holds a job. At 76.7%, however, this proportion today is still 3.5 percentage points smaller than the 80.2% observed in March 2007.

The proportion of Americans who hold a job is recovering but remains far lower than in 2007

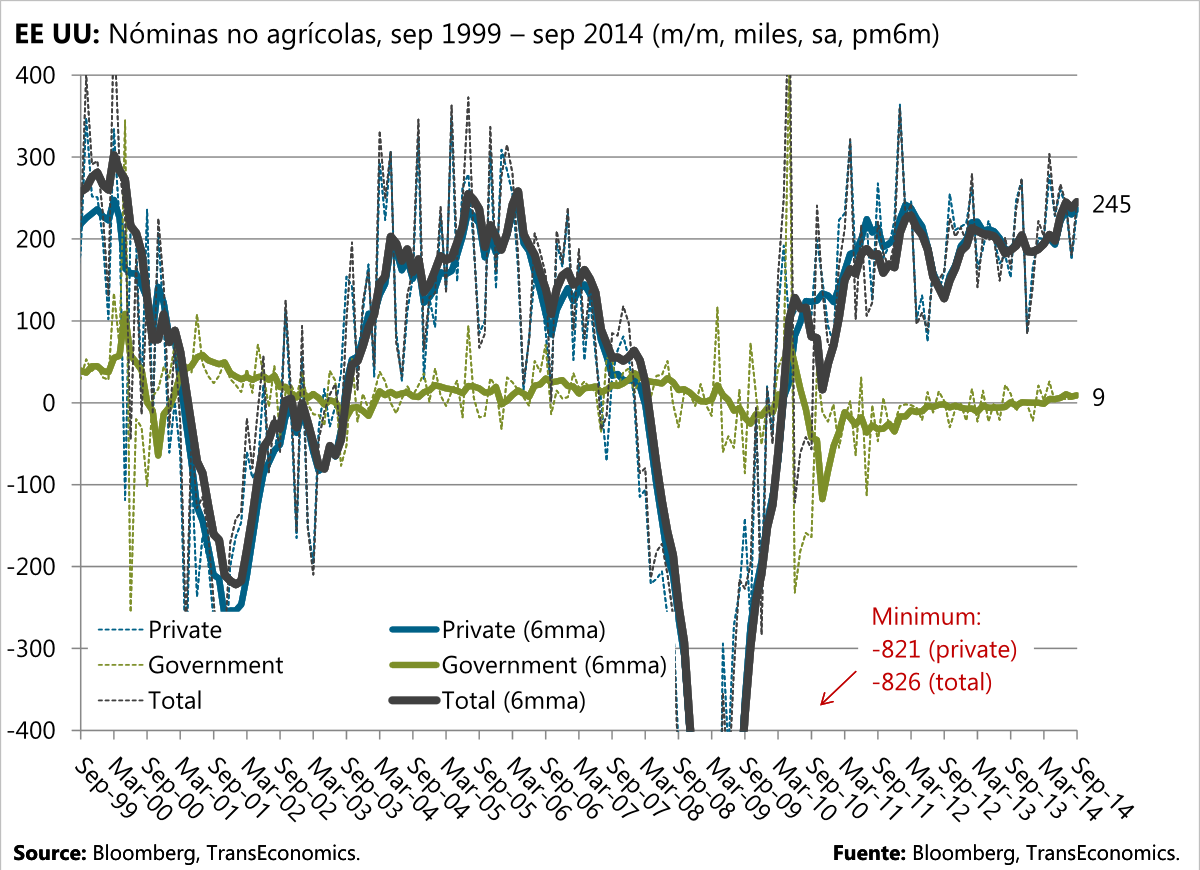

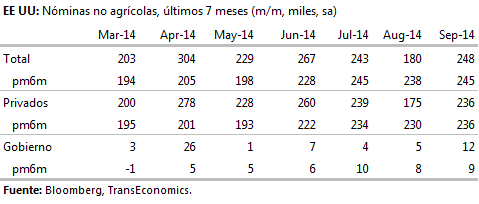

U.S. payrolls continue to rise at an average pace exceeding 220 thousand jobs per month—a healthy pace. These payroll trends combine with falling gasoline prices to bode well for U.S. private consumption.

Jobs growth in the USA has exceed 220K/month since June

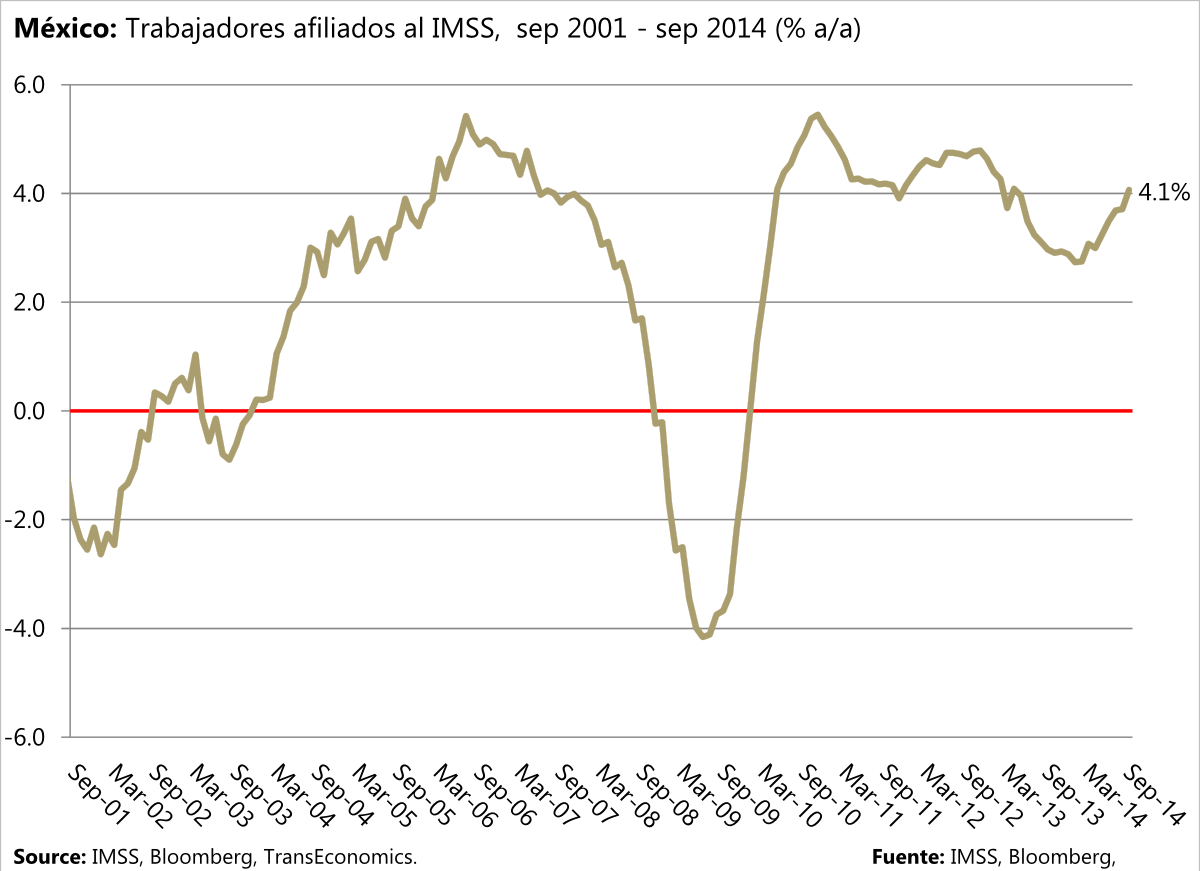

In Mexico, payrolls as measured by persons covered by IMSS are accelerating. As in the USA, this trend augurs well for household spending.

Meanwhile, in Mexico, formal jobs growth is picking up speed

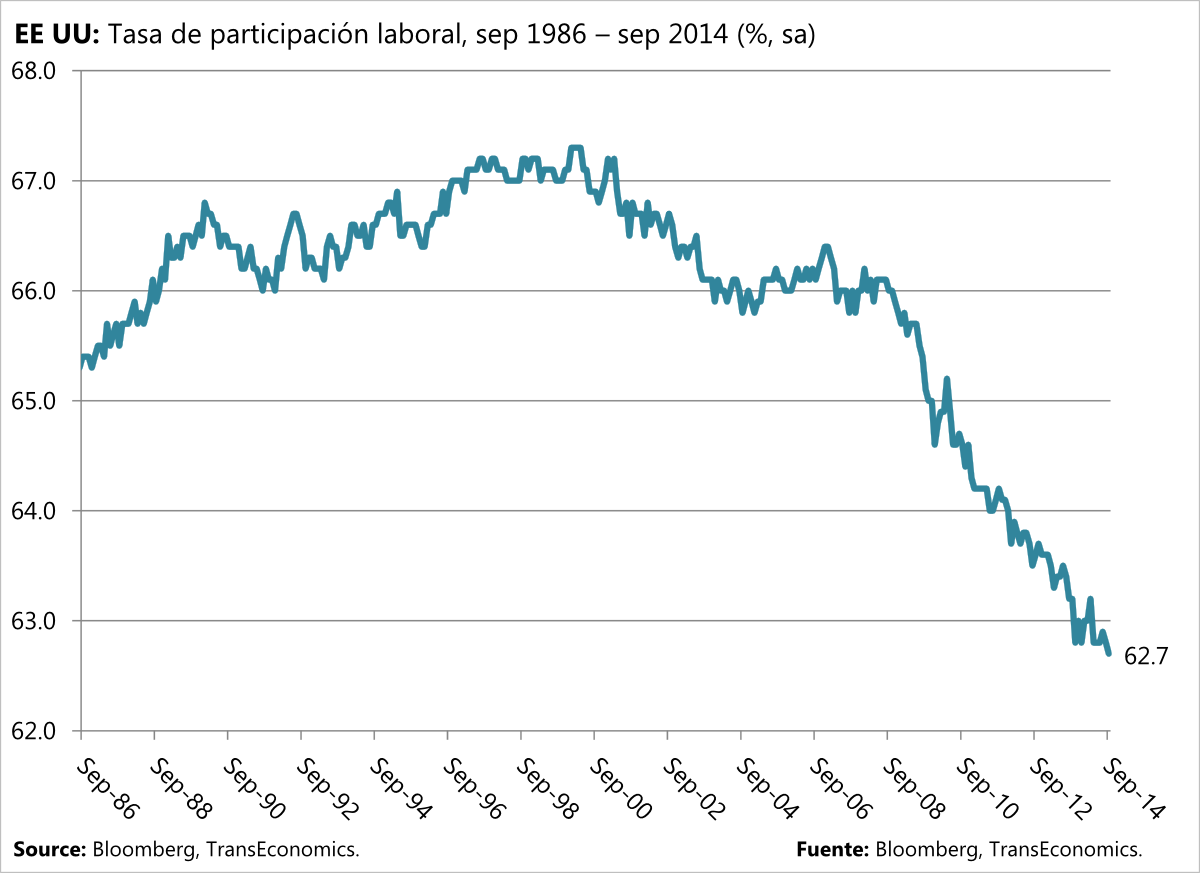

A falling U.S. labor participation rate is hurting potential GDP

The downward trend in the U.S. labor participation rate continues. Economists continue to debate to what degree this trend is structural (stemming from long-term demographic trends such as the retirement of baby boomers) trend versus related to the business cycle (via job skill depletion from long-term unemployment and the tendency of jobless young people to return to school or prolong their schooling).

U.S. labor force participation rates continue to fall, a negative for potential GDP

Correction 17 October 2014

A previous version of this post wasn’t clear as to which unemployment rate (total or urban) we were discussing in the Mexico’s unemployment and underemployment section. The paragraph is now clear.