Capacity utilization rates globally confirm our views

Genevieve Signoret

Activity: Factor markets

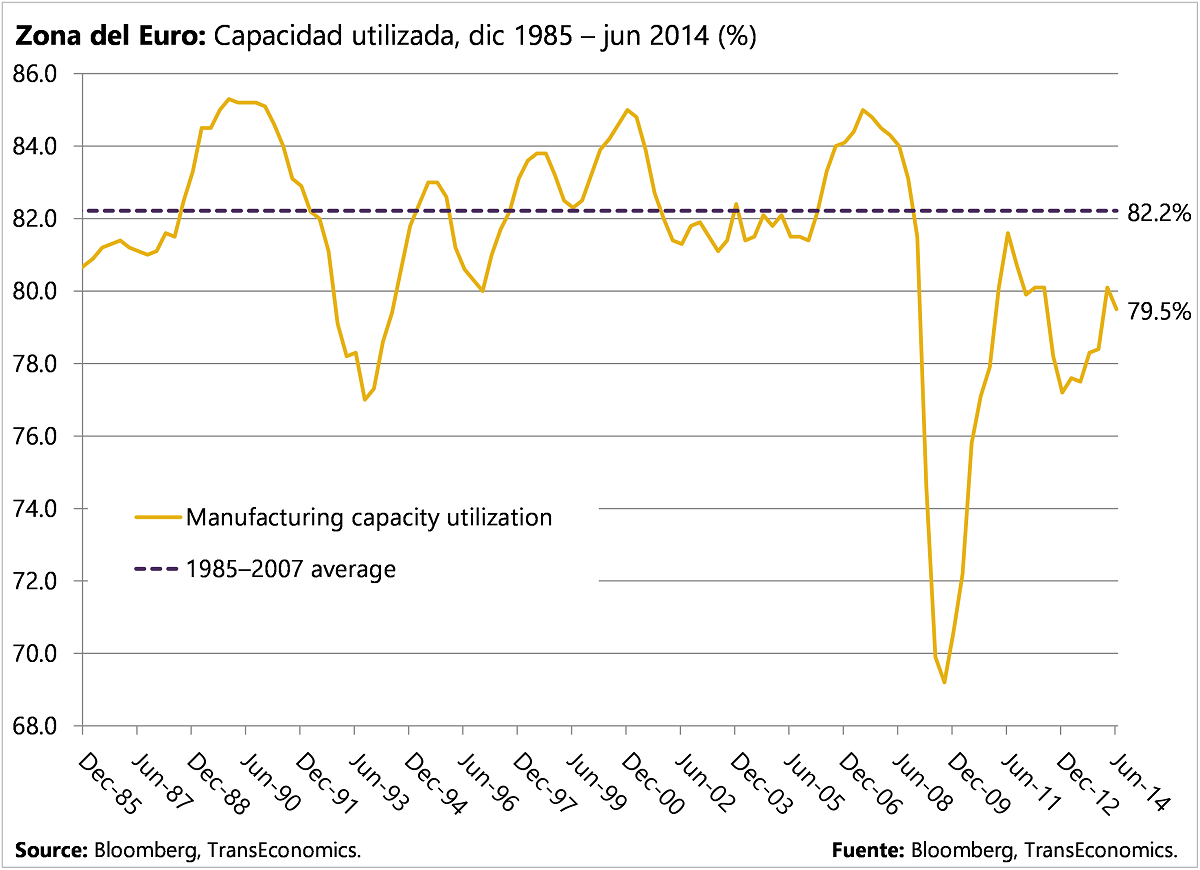

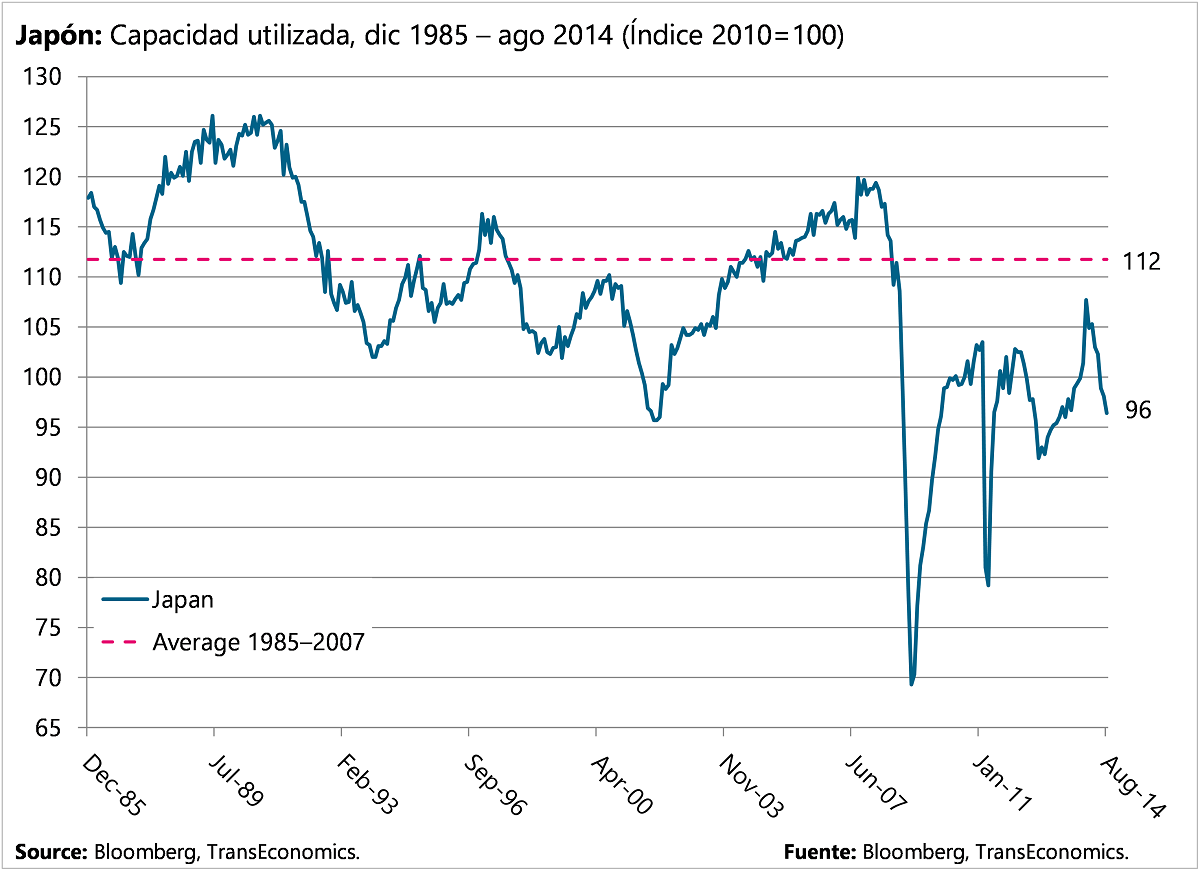

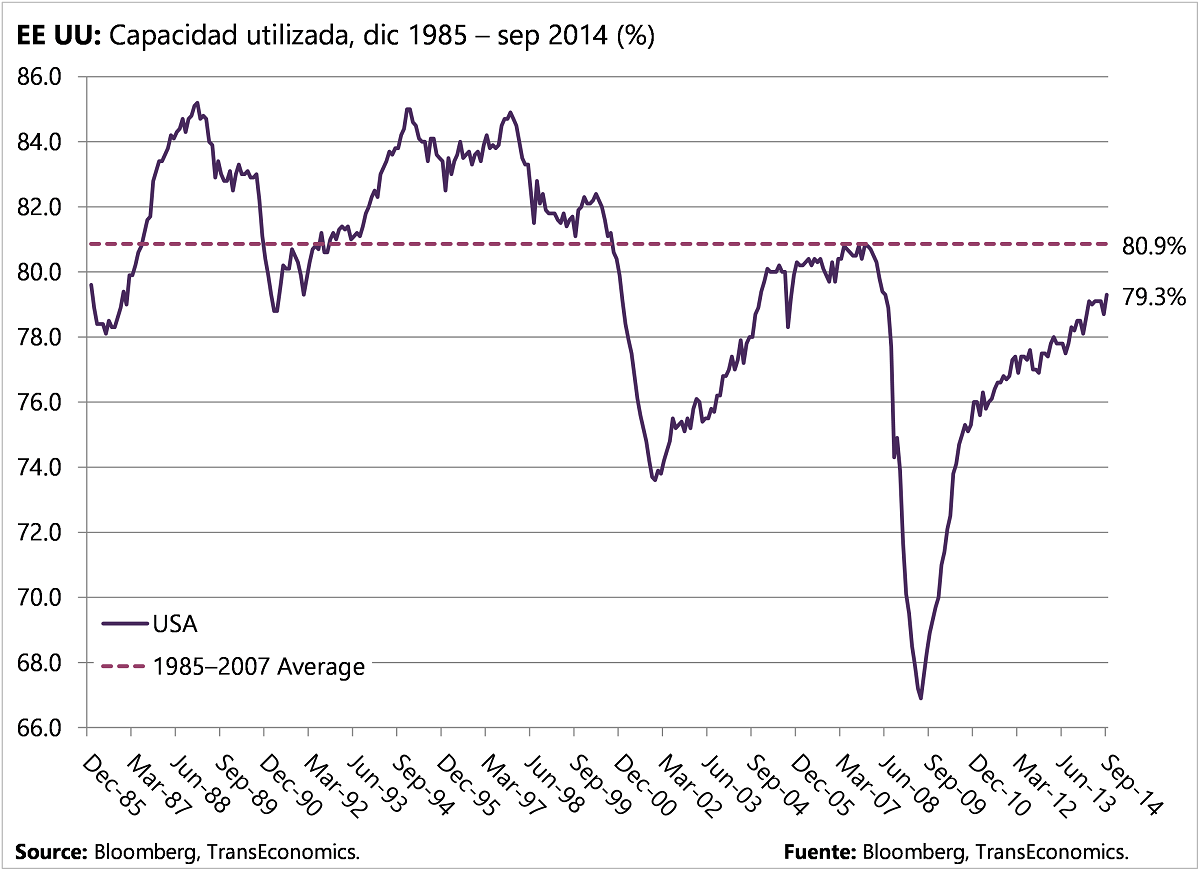

While industrial capacity utilization in the USA continues to recover, it has not yet rebounded to its pre-crisis average, whereas, in the euro area, it’s sputtering, and in Japan, it’s in decline.

These results support our central-scenario view that inflation globally will remain slow for some time to come. Also that, even after the Fed starts to raise rates (an action we expect it to take in the second half of next year), it won’t take rates very high very fast. And, finally, our view that, in the next two years, Japan will keep its quantitative easing program in place, while the euro area ramps up and diversifies its own program launched this month.

U.S. inflationary pressures remain low. Industrial capacity utilization in the USA continues to recover but has yet to rebound to its pre-crisis (1985-2007) average.

Meanwhile, capacity utilization in the euro area is sputtering….