Euro area money supply’s recovering, Mexico business credit too

Genevieve Signoret

Financial conditions

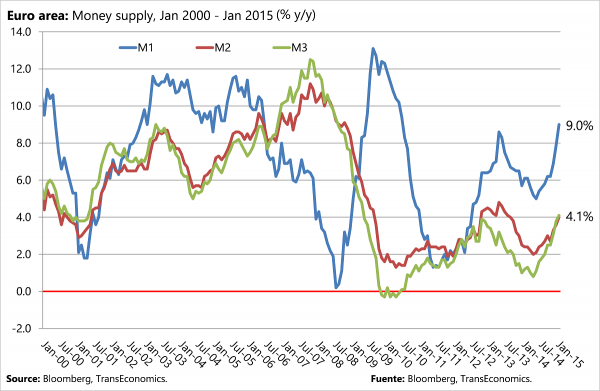

Money supply growth in the euro area continued to accelerate in January.

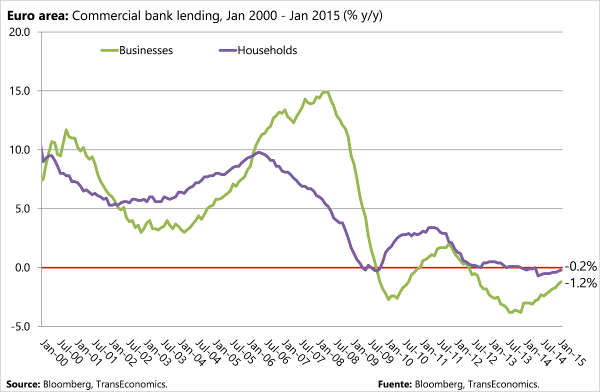

M3, a broad measure of money supply, swelled by 4.1% from the previous year, marking an accelerating trend from year-on-year growth rates of 3.8% in December and 3.1% the month before. Credit continued to contract but at a slower pace than previously.

These excellent signs support of our central scenario view in which the euro area avoids deflation—by which we mean a downward trend in a broad range of prices, not just energy prices.

Money supply growth in the euro area continued to accelerate in January

Credit continued to contract but at a slower pace than previously

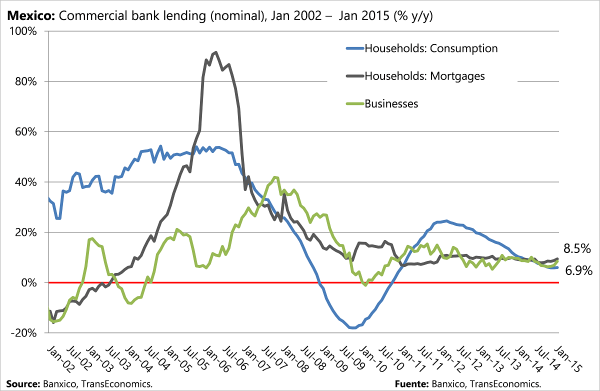

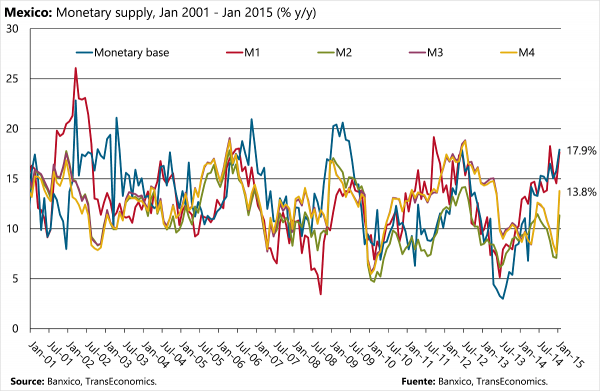

Mexico money supply accelerated sharply in January. The monetary aggregate M3 grew 13.7% year on year from 7.5% the previous month. Mexico’s M3 had slowed down during the second half of 2014. Commercial bank lending is accelerating for businesses and mortgages but consumption credit growth continued to be subdued.

Mexican money supply has accelerated since July 2014

Bank lending to businesses is accelerating in Mexico, while growth in lending to consumers remains strong and stable