Brexit darkens our outlook

Genevieve Signoret

We update global macro-market scenarios now that UK voters have opted for Brexit. Our outlook is now bleaker. This first Timón entry of two on this topic shows how our scenarios names and assumptions have shifted and the subjective probabilities we assign to each one are now more pessimistic than before. In a subsequent Timón installment, we’ll provide updated forecast tables and narratives.

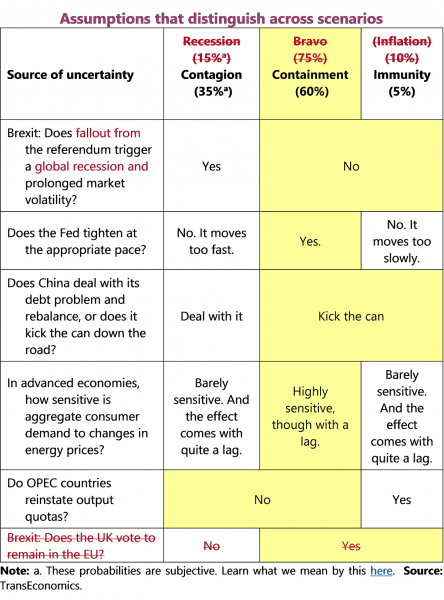

In light of the UK’s June 23 vote to exit the European Union, we update our global macro-market scenarios. The chief source of uncertainty for global investors had been whether the Fed could gradually raise interest rates without, on the one hand, moving so fast as to derail an already slow U.S. and global economic expansion (the downside risk scenario, called Recession) or move so slowly that inflation took off in the USA (a scenario we dubbed Inflation). We judged that the Fed probably would succeed and assigned a confident 75% subjective probability to that scenario, which, to evoke its key assumption of Fed success, we called Bravo. With the British vote to exit the European Union, we now downgrade out outlook.

Our new scenario names are Contagion (subjective probability[1]=35%), Containment (60%) and Immunity (5%). They’ve been formulated to underscore what we now see as the largest source of uncertainty—how resilient the rest of the world will prove to the political, economic, and market fallout from the Brexit vote.

Note that the probabilities we now assign across scenarios are darker than before. We lift the subjective probability assigned to our pessimistic scenario all the way to 35% from 15%, degrade the probability placed on our slow-growth, low-inflation central scenario to 60% from 75%, and lower the odds of our fast-growth, fast-inflation scenario to 5% from 10%.

These changes to our scenario names and assumptions are shown as revisions to our assumptions table that follows:

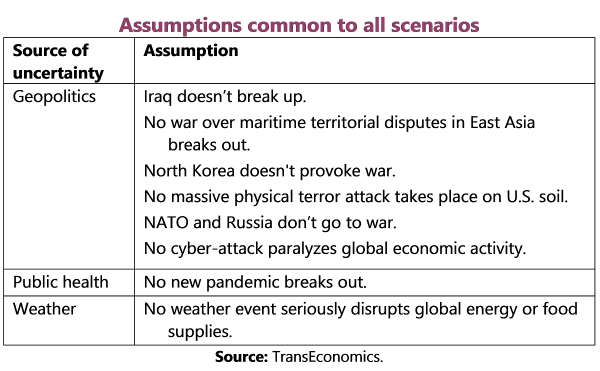

These are what we call “pivotal forecast assumptions”[2]—the ones that distinguish across scenarios. Our assumptions underlying all three scenarios (which, rephrased, compose a list of what we see as tail risks), remain unchanged:

Before we close, we remind you that you can always find our scenario assumptions handy here.

[1]These probabilities are subjective. Learn what we mean by this here.

[2] Read (in Spanish) about our scenario-based approach to macro and market forecasting here.