High uncertainty and larger risks

Genevieve Signoret

Macro Views

The week was dominated by news from Greece, which we wrote on here and here. But the U.S. jobs report also made a splash. Strong non-farm payrolls, the drop in unemployment, and flat real wages confirmed our central-scenario view that the Fed will act in September but move slowly.

Next week’s news will be dominated by… Greece! For once we haven’t a very strong view: as Genevieve writes in today’s Letter from the President:

We expect Greeks to vote “Yes” and talks to continue after Sunday 5 July but can’t be sure of this, or know how markets would react either way. Forced to guess, we’d say a “Yes” vote would spark euphoria.

In addition to goings-on in Greece and the euro area, we’ll be watching with some trepidation China’s stock market crash for any sign that our forecast assumption that China won’t suffer an all-out financial crisis might be violated.

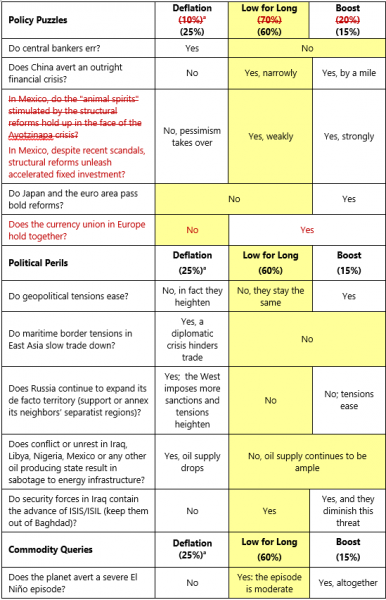

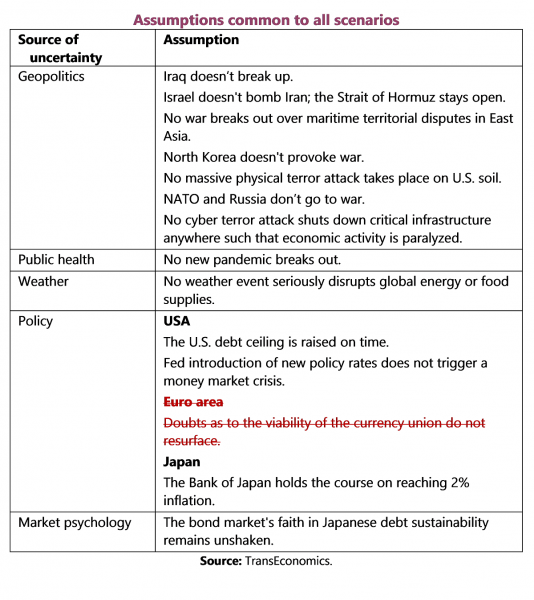

Speaking of forecast assumptions, we have updated them. When we wrote our latest Quarterly Outlook last January, we were viewing the risk that Greece would leave the euro area as a mere tail risk. Now, of course, we identify it as a large one—one that could derail global economic recovery.

We have also revised in the direction of pessimism the subjective probabilities that we assign to our three scenarios. We now assign to our downside risk scenario a 25% probability, up from 10%. Not only Greece but also the stock market crash in China have dampened our erstwhile optimism.

Our forecast assumptions now read as follows:

Las próximas cuatro semanas

Events in red are those most likely to shake markets.

Monday 6 July

- Japan: Bank of Japan governors meeting.

- Germany: Manufacturing orders (May)

- USA: Markit services PMI (Jun, final), ISM nonmanufacturing (Jun).

Tuesday 7

- Euro Area: Markit services PMI (Jun, flash).

- Turkey: Central Bank Report.

- UK: Industrial production (May).

- Germany: Industrial production (May).

- France: Foreign trade (May).

- USA: Foreign trade (May), commercial bank lending (May).

- Mexico: Consumer confidence (Jun)

Wednesday 8

- Japan: Commercial bank lending (Jun), current account (May).

- Korea: Money supply (May).

- Brazil: Consumer prices.

Thursday 9

- China: Consumer prices (Jun).

- Japan: Money supply (Jun), private machinery orders (May).

- Korea: Monetary policy decision.

- UK: Monetary policy decision (TransEconomics: Bank Rate unchanged at 0.5% and size of Asset Purchase Program unchanged at £375 Bn).

- Germany: Foreign trade (May).

- USA: Unemployment claims.

- Mexico: Consumers prices (Jun).

Friday 10

- PS + 1 and Iran: Deadline nuclear deal between Iran and world powers.

- Turkey: Current account (May).

- UK: Foreign trade (May).

- France: Industrial production (May).

- Italy: Industrial production (May).

- USA: Fed Janet Yellen speaks.

- Mexico: Industrial production (May).

Monday 13

- China: Foreign trade (Jun).

- Japan: Industrial production (May, final).

- India: Consumer prices (Jun).

- Mexico: Formal Job creation (Jun).

Tuesday 14

- Japan: Bank of Japan Monetary Policy Meeting.

- Euro Area: European Central Bank lending survey (2Q), industrial production (May)

- Turkey: Central Bank Report.

- UK: Consumer prices (Jun).

- Germany: Consumer prices (May), ZEW business survey (Jul).

- Italy: Consumer prices (May)

- Spain: Consumer prices (May)

- USA: Retail sales (Jun).

Wednesday 15

- China: Industrial production (Jun), retail sales (Jun), GDP (2Q).

- Japan: Monetary policy decision (TransEconomics: 0.1%; no change in the annual pace of increase of the monetary base of “about 80 trillion yen”), Governor Kuroda’s press conference.

- Turkey: Unemployment (Apr).

- UK: Employment report (Jun).

- France: Consumer prices (May)

- USA: Industrial production (Jun), Beige book.

Thursday 16

- Japan: Bank of Japan monthly economic report.

- Euro Area: Foreign trade (May), Consumer prices (Jun, final), monetary policy decision (TransEconomics: no change in the 0.3% reference rate or in the €60 bn monthly pace of asset purchases).

- France: Foreign trade (May)

- USA: Unemployment claims.

Friday 17

- Russia: Retails sales (Jun), Unemployment (Jun), Investment (Jun).

- USA: Consumer prices (Jun), U. Michigan consumer sentiment and inflation expectations (Jun, final).

Monday 20

- Euro Area: Current account (May)

Tuesday 21

- Japan: Bank of Japan Monetary Policy Meeting minutes.

Wednesday 22

- UK: Bank of England Monetary Policy Meeting minutes.

- USA: FHFA house prices (May).

- Mexico: Retails sales (May).

Thursday 23

- Korea: GDP (2Q, flash). Consensus: 2.5% y/y.

- USA: Unemployment claims.

- Mexico: Consumer prices (Jul) (TransEconomics: 2.91%).

Friday 24

- China: Markit manufacturing PMI (July, flash).

- Euro Area: Markit composite, manufacturing and services PMI (July, flash).

- Germany: Markit manufacturing PMI (July, flash).

- USA: New home sales (June)

- Mexico: Economic activity index (Apr), unemployment (Jun).

Monday 27

- Euro Area: Money supply (Jun).

- USA: Durable goods orders (Jun).

Tuesday 28

- UK: GDP (Q2, 1st estimate).

- USA: Monetary policy decision (TransEconomics: unchanged at 0.00–0.25% and no change in the size of the balance sheet), S&P Case-Shiller House Prices Index (May).

Wednesday 29

- UK: Money supply (Jun), commercial bank lending (Jun).

Thursday 30

- Japan: Industrial production (Jun, flash).

- Germany: Unemployment (Jul), consumer prices (Jul, flash).

- Spain: Consumer prices (July, flash), GDP (2Q, flash).

- USA: GDP (Q2, 1st estimate. TransEconomics: 2.5%).

- Mexico: Banxico monetary policy decision (TransEconomics: unchanged at 3.00%).

Friday 31

- Japa: Consumers prices (Jun), unemployment (Jun).

- Korea: Industrial production (Jun).

- Russia: Unemployment (Jun).

- Euro Area: Unemployment (Jun).

- Italy: Consumer prices (Jul), unemployment (Jun).

- USA: Michigan consumer sentiment and inflation expectations (Jun, final).

Update History:

- 7 July 2015: Friday 10. Deadline nuclear deal between Iran and world powers