Japan IP: Trend contraction continues

Genevieve Signoret

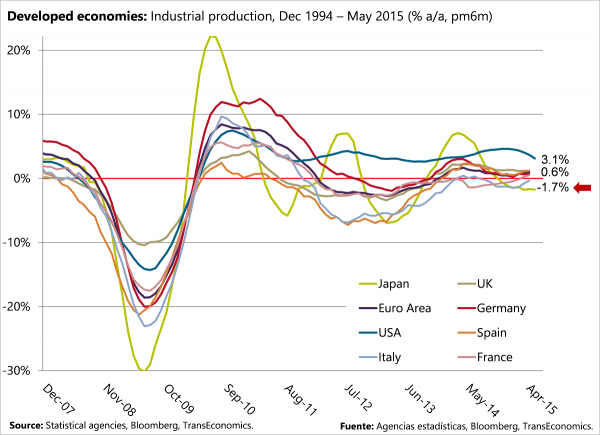

Monday 29 June, Japan published its May industrial production report. The index maintained its six-month moving average (6mma) pace of year-on-year growth of –1.7%, implied by a month-on-month drop of 2.2% (both rates of change are based on seasonally adjusted data). This result marks no change from April in the six-month trend rate of contraction. However, its release surprised analysts to the downside and led Barclays to infer that “the economy slowed in Q2.”

Barclays still believes that Japan is recovering, and our own reading of the data is consistent with that view. In support of our reading, we put forth that the –1.7% trend rate of change observed in March and April marks an slight improvement over February (–1.8%).

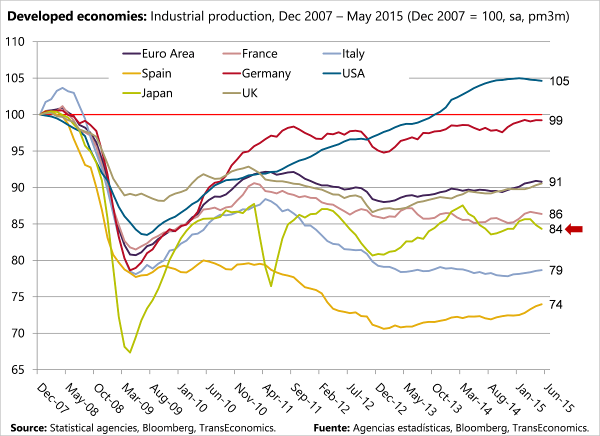

We also note, however, that Japan’s industrial output still remains 16 percentage points lower than its pre–Great-Recession level. This fact supports our view that Japan will continue to apply extraordinary monetary stimulus for not months but years still to come.

Japan’s industrial output is still 16 ppts below that of Dec 2007. With so much slack, we anticipate years still of QE.

Although Japan’s May –1.7% 6-month moving average y/y rate of change in IP is a sad number, it’s less sad than April’s –1.8%