Central banks are engaged in currency wars

Genevieve Signoret

Monetary Policy

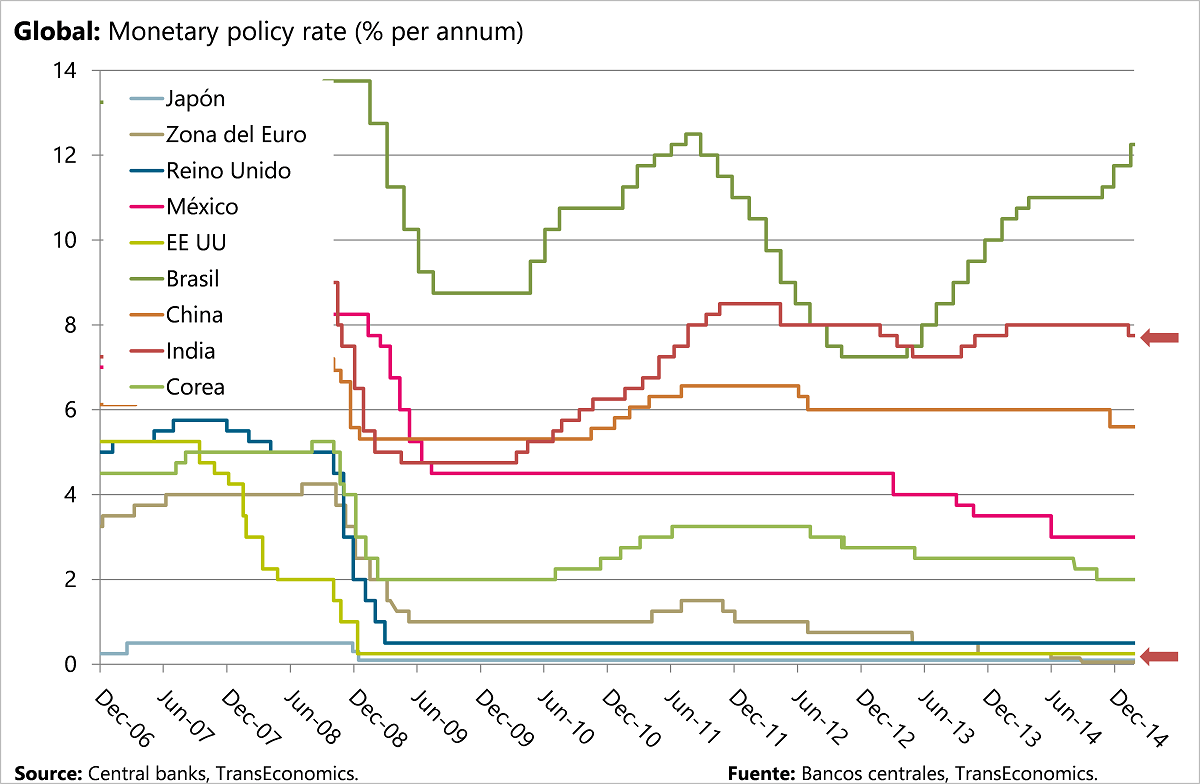

UK. The Bank of England left unchanged both its monetary policy rate at 0.50% and its asset purchase program at £375Bn. We’ll be attentive to the tone and projections included in the Quarterly Inflation Report, due next Thursday.

China. The People’s Bank of China decided to reduce the deposit reserve ratio by 0.5 percentage points to 19.5% from 20.0% and undertake additional measures targeted to the micro and small enterprise sector. This cautious and targeted approach is the government’s attempt to deflate asset price bubbles without causing a growth collapse. We don’t know whether it will work. Our central scenario forecast assumes that it will—narrowly.

India. The Reserve Bank of India left its monetary policy rate unchanged at 7.75%. On January 15, the Bank of India cut its monetary policy rate by 25bp during an unscheduled meeting held after the announcement of a sharp slowdown in inflation. Governor Raghuram Rajan said he did not yet understand the surprisingly strong 2014 fiscal year GDP numbers. This Thursday, India’s January’s inflation numbers come out.

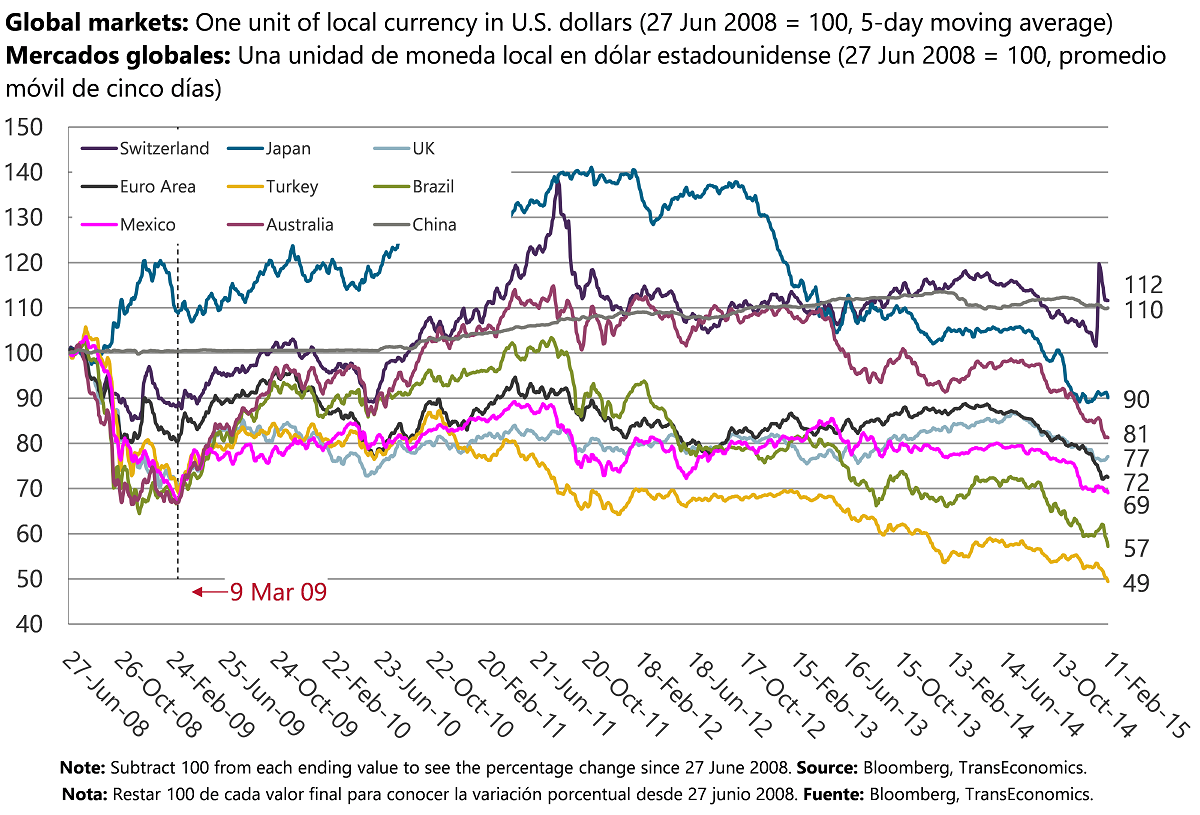

Switzerland. The Swiss National Bank unexpectedly abandoned its ceiling of 1.20 euros per franc on January 15. Last weekend, a local newspaper stated that the Swiss National Bank is now targeting an interval for the franc of 1.05–1.10 to the euro. The Swiss currency closed today at 1.05 euros per franc.

Denmark. The Danish National Bank cut its monetary policy rate for the fourth time in three weeks. The Central Bank cut its interest rate on deposits by 25bp to –0.75%. The move has been interpreted as a new attempt to protect the Danish krone peg to the euro. The Danish krone has been under pressure since the European Central Bank announced their QE program extension. Charles Duxbury and Josie Cox from the WSJ explain the differences between the Swiss and the Danish peg: “Unlike the ceiling on the Swiss franc, which was imposed unilaterally by Switzerland, the Danish peg is supported by the ECB. A European Union agreement, known as ERM II, calls for the central bank to defend the peg if necessary.”

Australia. The Reserve Bank of Australia cut its monetary policy rate by 25bp to 2.25%. The communiqué said that the decision was expected to “provide some additional support to demand, thus fostering sustainable growth and inflation outcomes consistent with the inflation target.” The AUD/USD exchange rate closed the week at a 5-year low.

Ukraine. The hryvnia plunged 30% against the dollar after the National Bank of Ukraine scrapped the currency auctions that were supporting the exchange rate and raised its monetary policy rate by 550bp to 19.5%.

Czech Republic. The Czech National Bank warned that it may intervene on the market to keep the koruna weak against the euro.

Central banks are engaged in currency wars

The Reserve Bank of India and the Bank of England left unchanged their monetary policy rates