Fed and Banxico held firm, BoR announce a surprise cut

Genevieve Signoret

Monetary policy

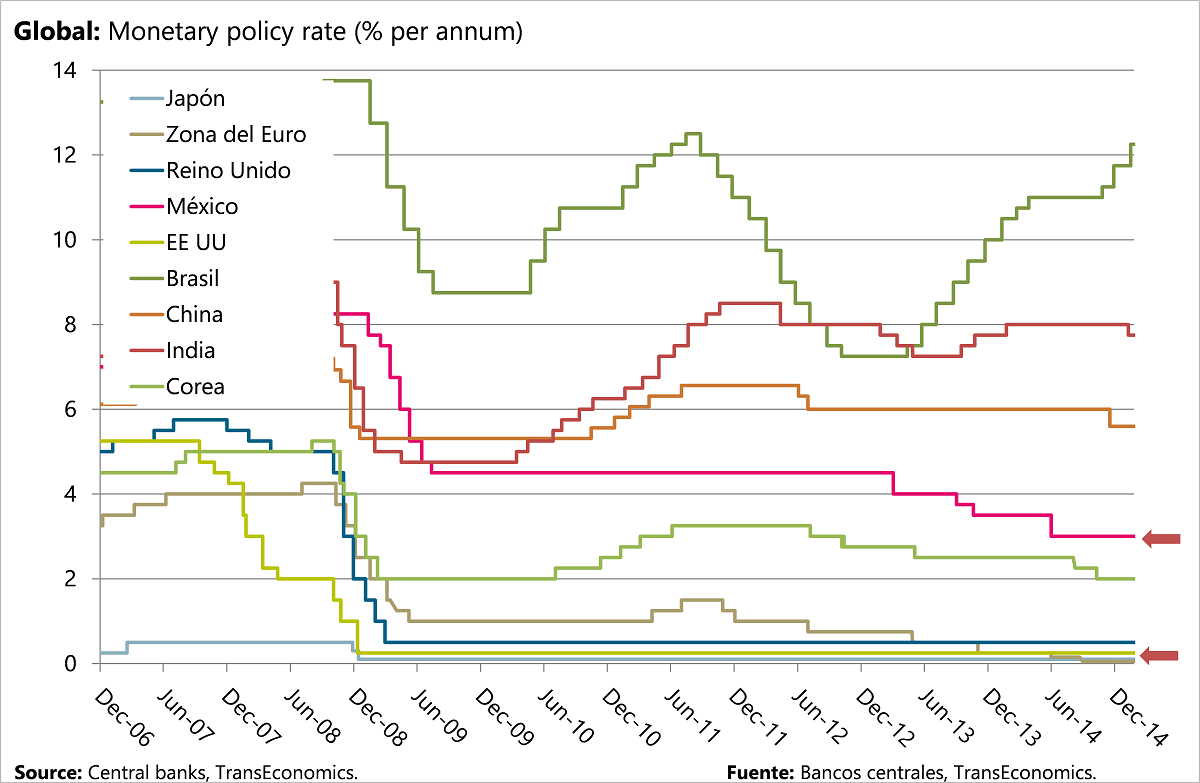

The U.S. Federal Open Market Committee (FOMC) statementconfirmed our view that the Fed will hike rates hike in Q3 2015. The Fed left unchanged its monetary policy rate at 0.00–0.25%. The FOMC was unanimous in this decision. Whereas before the Fed described economic activity as “expanding at a moderate pace,” now they see it “expanding at a solid pace.” We picked up no signal from the communiqué suggesting that the first hike will come later than our forecast date range of Q3 2015.

Banxico left its monetary policy rate unchanged at 3.00%. The Governing Board said it still sees important downside risks for growth, including weak private consumption and inefficient government spending. Banxico admits that prolonged peso weakness creates an upside risk for inflation. Overall, we read Banxico’s tone to be neutral. We hold to our forecast of 3.75% by end 2015 and 4.25% by December 2016. On her Twitter account, Genevieve commented:

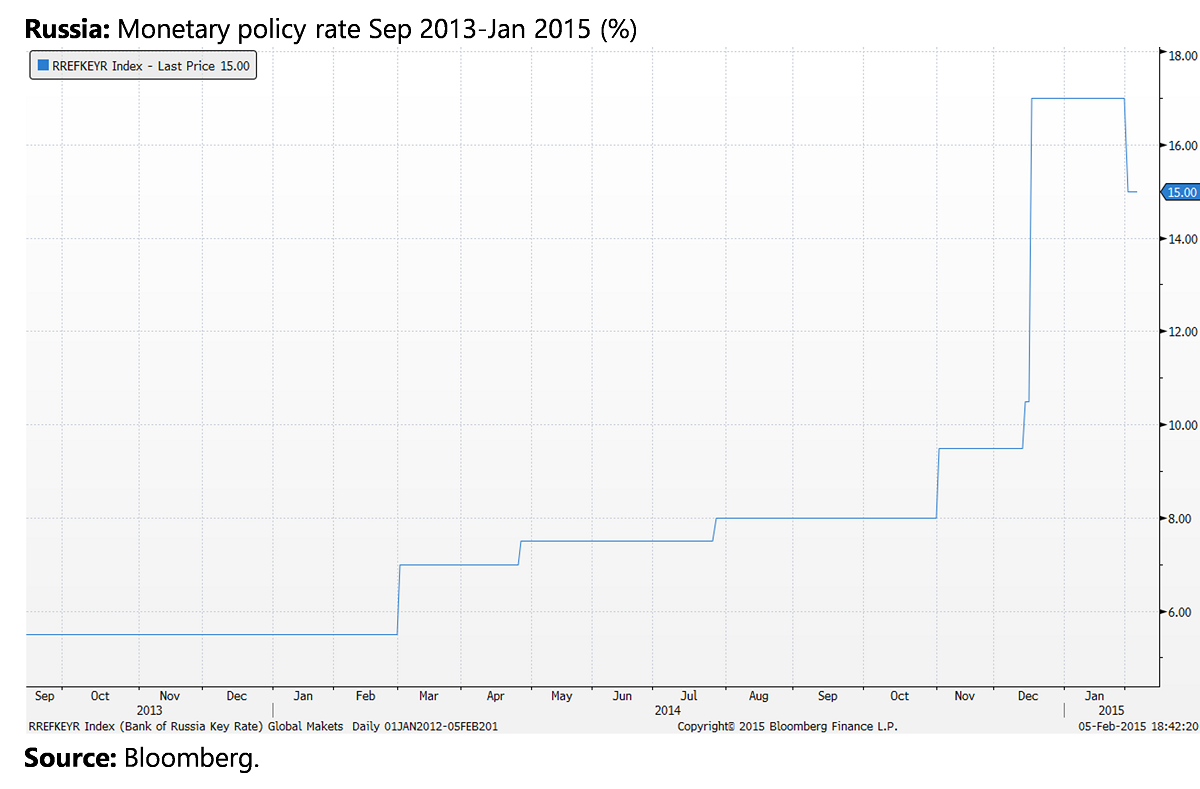

In a surprise move, the Bank of Russia (BoR) cut its monetary policy rate by 200bp to 15.00%. In their statement, the BoR mentioned that “inflation pressure will be contained by decrease of economic activity.” Russia’s annual inflation came in at 11.4% in December.

Turkey and Russia central banks seem to be taking stabs at policy. Unsure whether higher or lower rates will defend currency.

— Genevieve Signoret (@gsignoret) February 2, 2015

The Fed and Banxico left their policy rates unchanged

In a surprise move, the Bank of Russia (BoR) cut its monetary policy rate by 200bp to 15.00%