Global inflation trends support our rate outlook

Genevieve Signoret

Prices

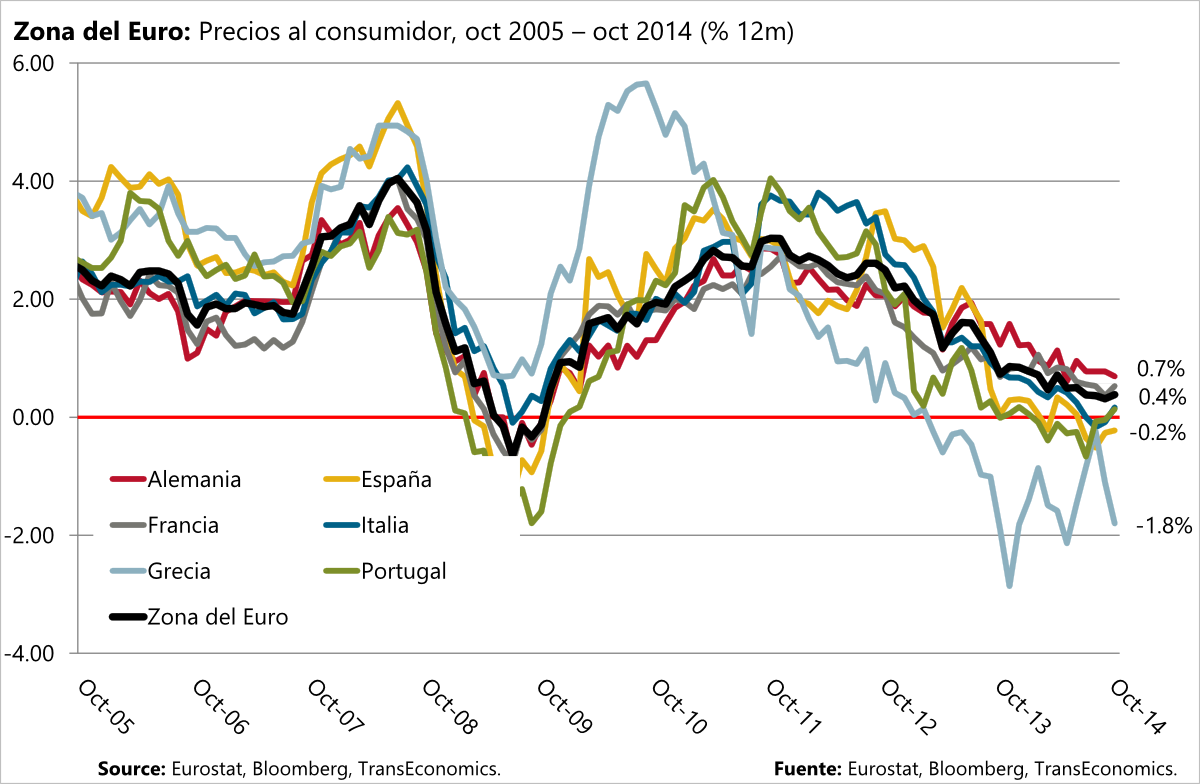

Although we still forecast that the ECB will act to avert euro deflation, we admit that, by the looks of the data, the risk that the ECB will fail has never looked higher.

So what is the basis for our optimism? Current ECB actions and words: unlike a few years back, now the ECB admits to the risk and seems bent on acting to avert it. The question no longer is, does the ECB have the will to act? But rather a technical one: is there still time?

We forecast low interest rates far into the future, a view supported by today’s inflation trends.

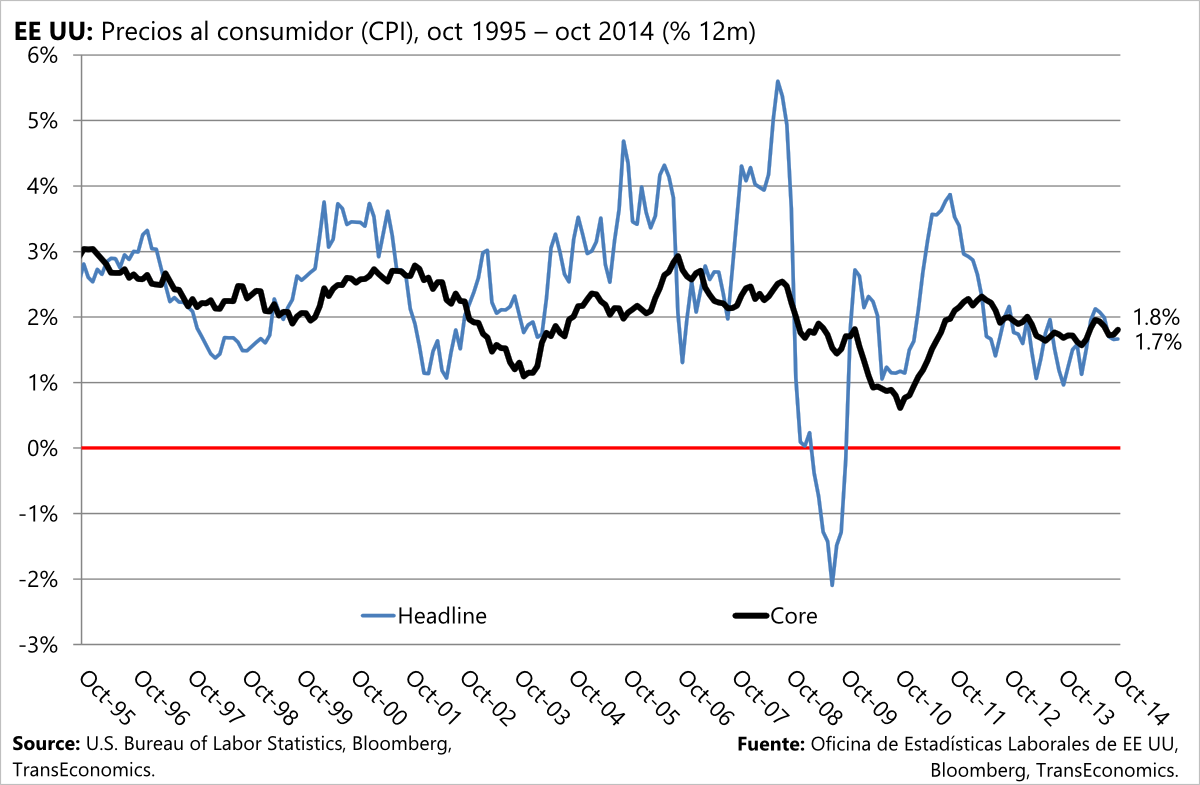

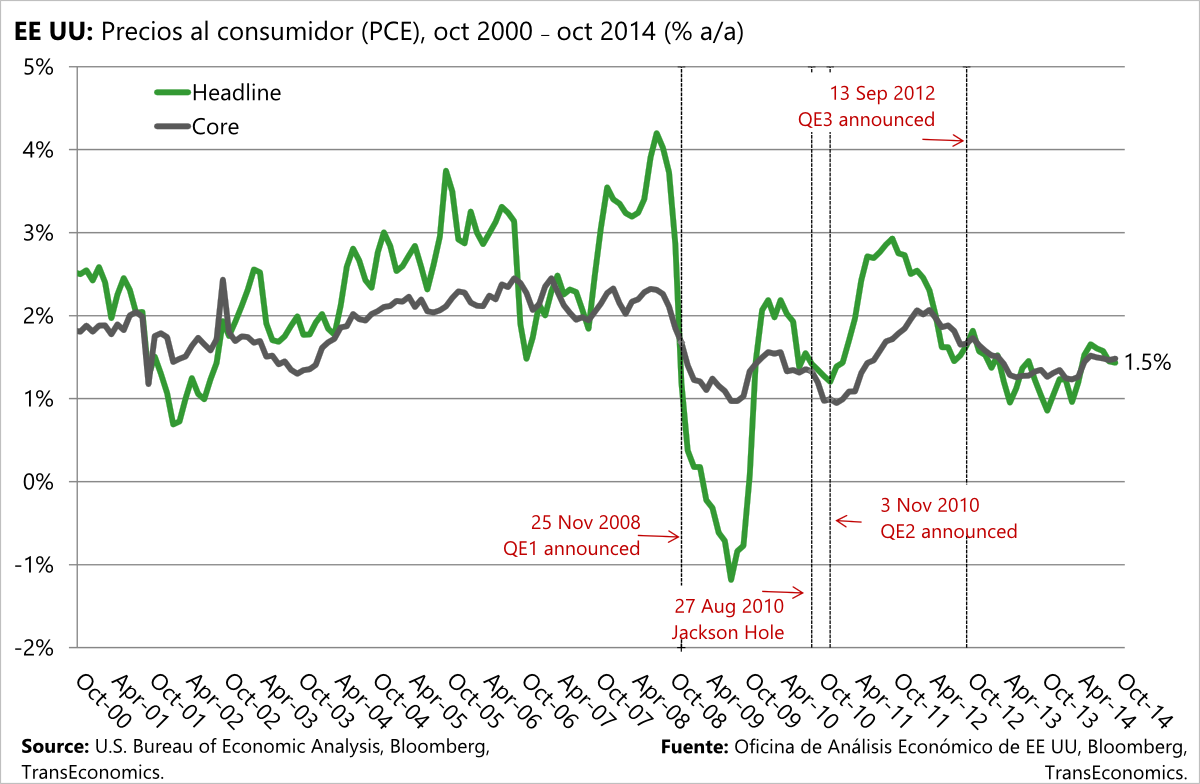

Developed market inflation is decelerating. While U.S. CPI inflation trends look ideal at just under 2.0% and stable, core PCE inflation is barely clinging to the bottom of the Fed’s preferred range (1.5–2.0%). And, although we still forecast that the ECB will act to avert euro deflation, the risk that it will fail has never looked higher.

Two final comments:

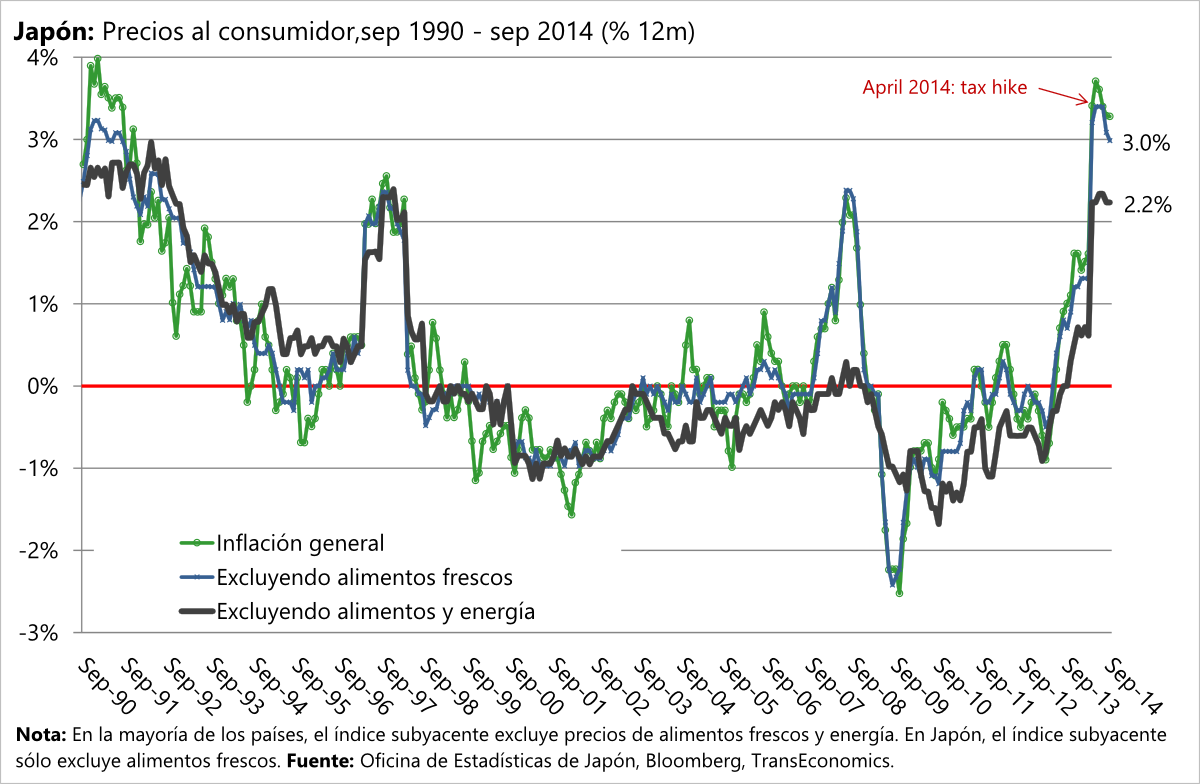

- Last April’s VAT rate hike has rendered Japan’s inflation data temporarily hard to interpret.

- For Mexico, we now forecast that inflation will slow all the way down to 3.1% from today’s 4.3% in 2015.

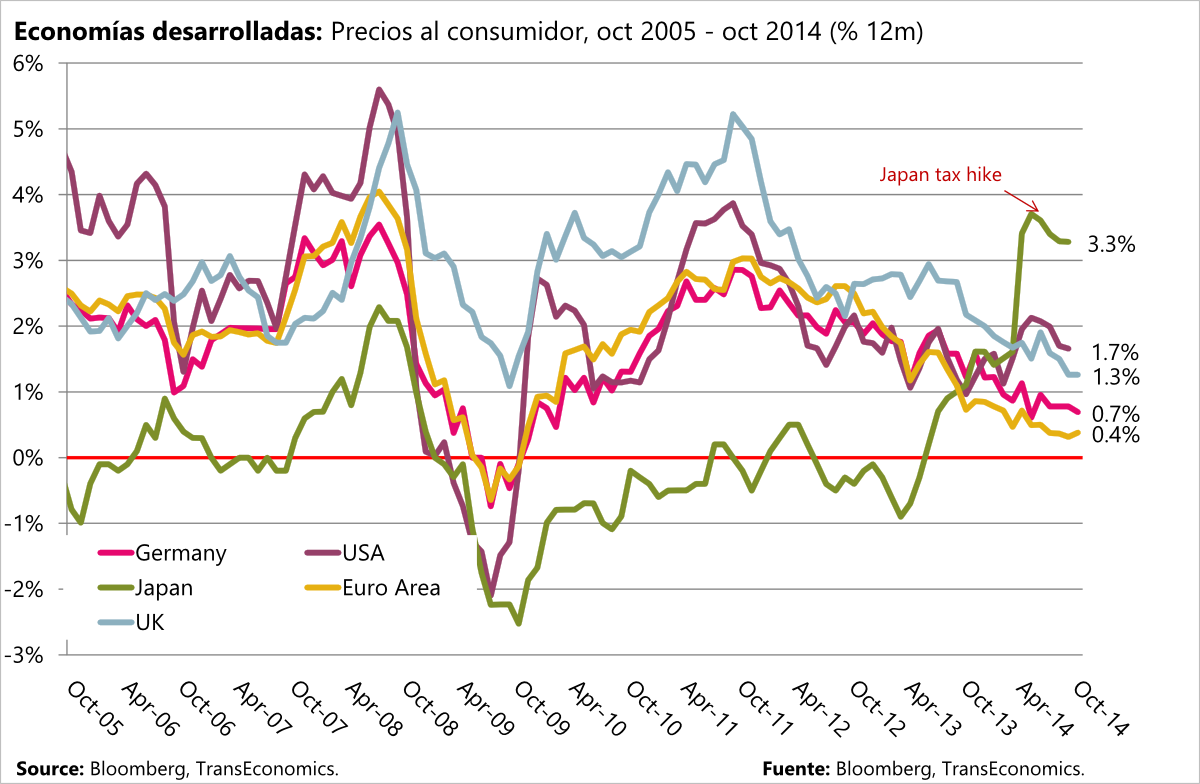

Developed market inflation is decelerating

While U.S. CPI inflation trends look ideal at just under 2.0% and stable…

…core PCE inflation is barely clinging to the bottom of the Fed’s preferred range (1.5–2.0%)

And, although we still forecast that the ECB will act to avert euro deflation, the risk that it will fail has never looked higher

Last April’s VAT rate hike has rendered Japan’s inflation data temporarily hard to interpret

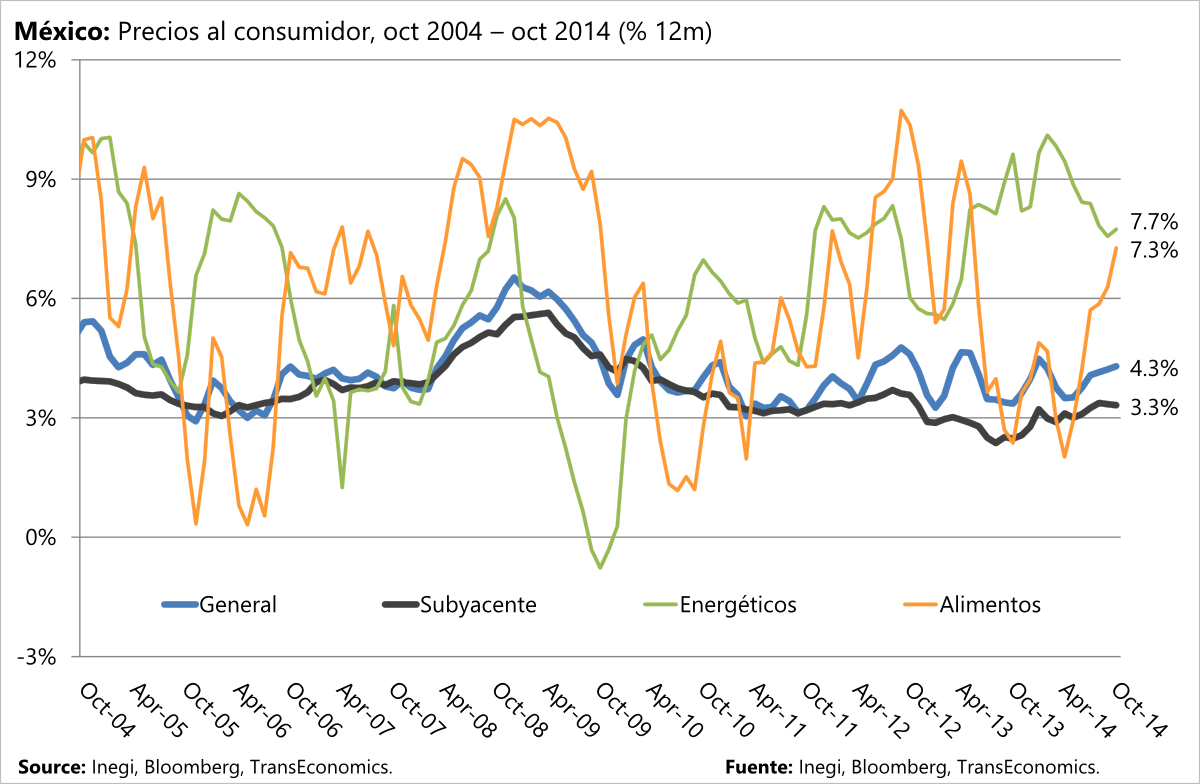

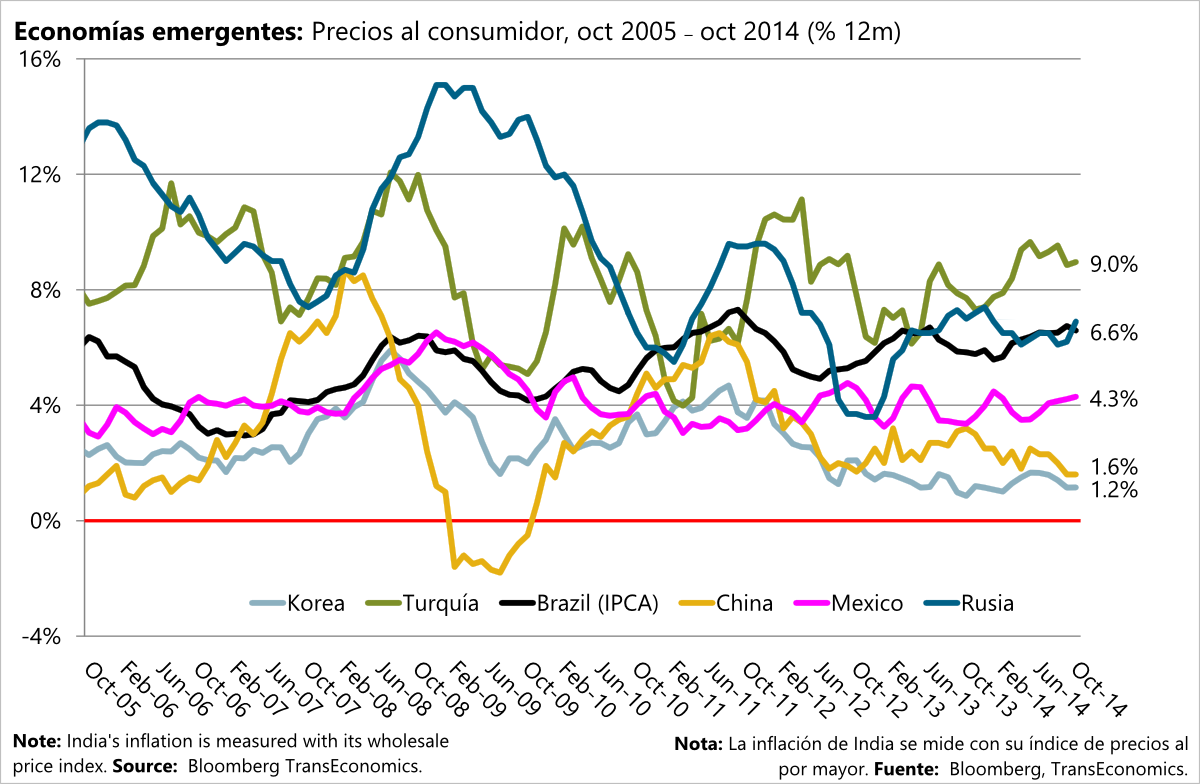

Emerging market inflation trends remain mixed

For Mexico, we now forecast that inflation will slow all the way down to 3.1% from today’s 4.3% in 2015