Swimming Downstream in Commercial Real Estate

John Greenman

Letter from Denver

In “Colorado and the West are winning the post-recession marathon of job gains“, the Denver Post illustrates an important principle of commercial real estate investment, which is that the best way to make a successful property acquisition is to use a “top-down” approach—start with confidence in a geographic market on a macroeconomic level before considering which individual property would be best to buy.

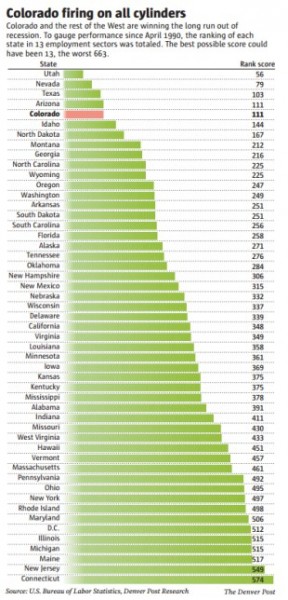

The article includes this nifty chart ranking U.S. states by long-term jobs growth:

Notice that the cities TransEconomics monitors most closely for office investment—Denver, Phoenix, and the four major cities of Texas—are all located in the top five states. By focusing on these markets, we give our investors the advantage of what I call “positive demographics”.

Of course, we must still carefully analyze the merits of each individual property to find the best fit for our investor’s risk-return profile. But our top-down approach provides momentum at the macro level that in my experience boosts investment performance relative to performance in markets suffering from slow growth or outright shrinkage.

“Slow growth” or “outright shrinkage”, unfortunately, describe most geographic areas of the Northeast and Mid-Atlantic in the USA. Note their low ranking in the chart above.

Some investors say it’s still possible to make successful investments in weak markets by discovering the very best asset available therein. I find it hard to make money that way.

As a former business partner of mine liked to say, “It’s always easier to swim downstream.”