We revise Brent down

Genevieve Signoret

Alternatives

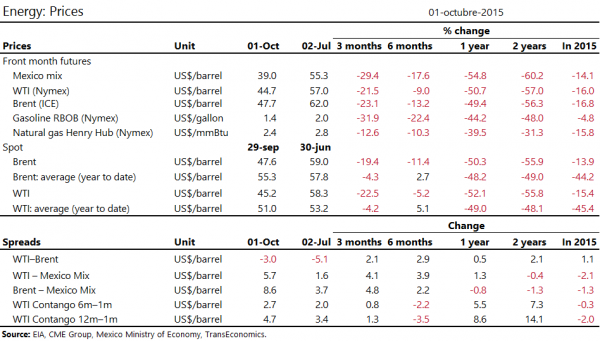

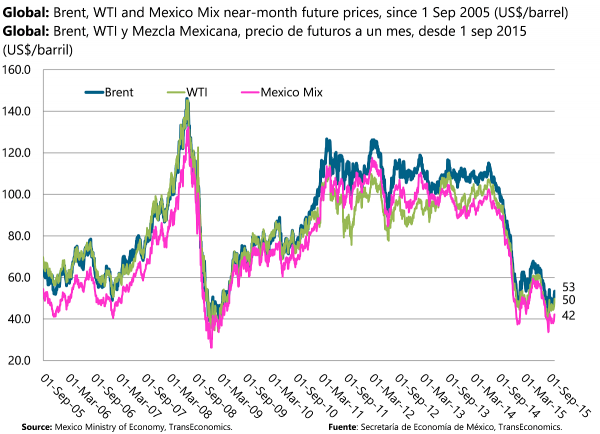

A week ago, we revised down our oil price forecast, as follows:

A Murphy’s Law you may not have heard of

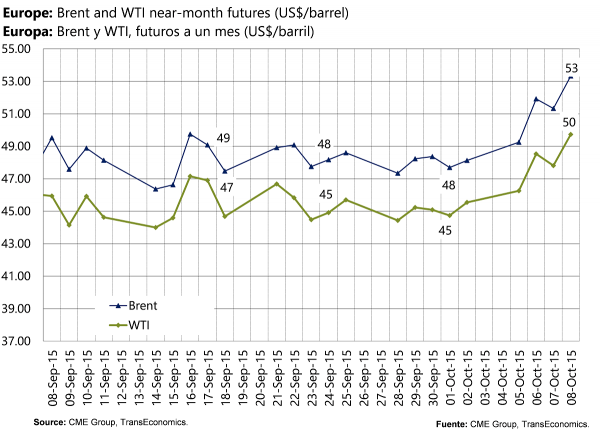

Of course, as soon as we did review down Brent, it rebounded—thus works Murphy’s Law of Forecasting.

We’re staying cool

We’ll watch Brent oil for a while before lurching to another revision.

Don’t be hung up on precise numbers

Our precise number for the Brent oil prices, of course, is not what you as an investor should care about. You should care about the central message revealed by that number, which is that we see oil prices remaining weak for at least the next five quarters.

We hold no commodity derivatives, just commodity-linked equity

Only our clients with long-term (5–10-year) and very-long-term (10+-year) investment horizons hold any direct exposure to commodities. This exposure comes through commodity-linked equity. We currently hold no commodity-linked derivatives in client portfolios.

Client indirect exposure is small too

Clients have dabs of indirect exposure. They hold New Zealand and Australian equity through small allocations to the Pacific country equity fund we’ve bought for medium-term (2–5-year) investors and the broad emerging market equity fund we hold in the long- and very-long–term client portfolios. In each case, our portfolio weight on the fund is no larger than 5% and, within the fund, net commodity exporting countries have minority weights.

Remember: we’re asset allocators

By the way, we make no apologies for holding some (small) exposure to commodities, even as they fall. We’re asset allocators: we always have at least some exposure to nearly all asset classes, regardless of our view. We do expect commodities and inflation both to remain weak. But we can’t be sure; things happen. A hurricane, war, or terror attack could turn the oil price trend around at any time. In that scenario, commodity-linked equity would spike, likely offering gains or at least some inflation protection to our clients. Also, long-term trends change. So, in long-term portfolios, by buying into sell-offs, we build up large positions in asset classes that in the long run are apt to come roaring back.

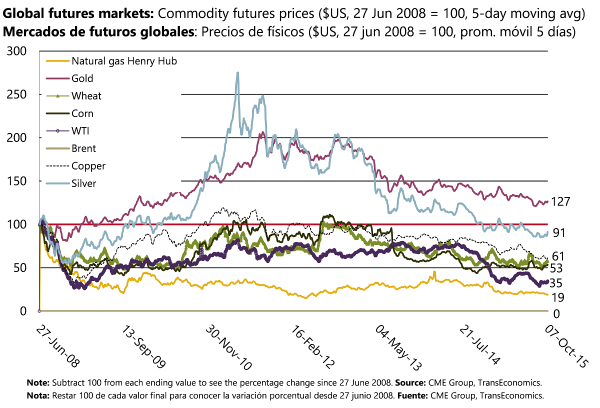

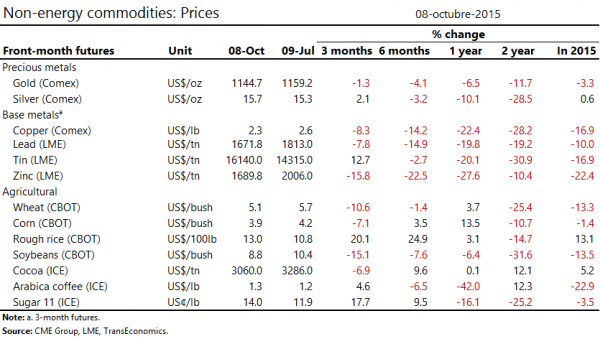

Global commodity prices continue to trend down

Despite all the red ink below, we do hold small positions in commodity-linked equity. Thus we hedge our medium-term forecast risk and position clients for a long-term rebound.

We’ve revise down our forecast for Brent oil to a 2015 average of $54 /barrel and a 2016 average of $45.

Of course, as soon we revised down our forecast, Brent oil rebounded (Murphy’s Law of Forecasting at work)

Relative to energy products, non-energy commodities have suffered a milder drop