Safe-haven assets outperform

Genevieve Signoret

Our Performance

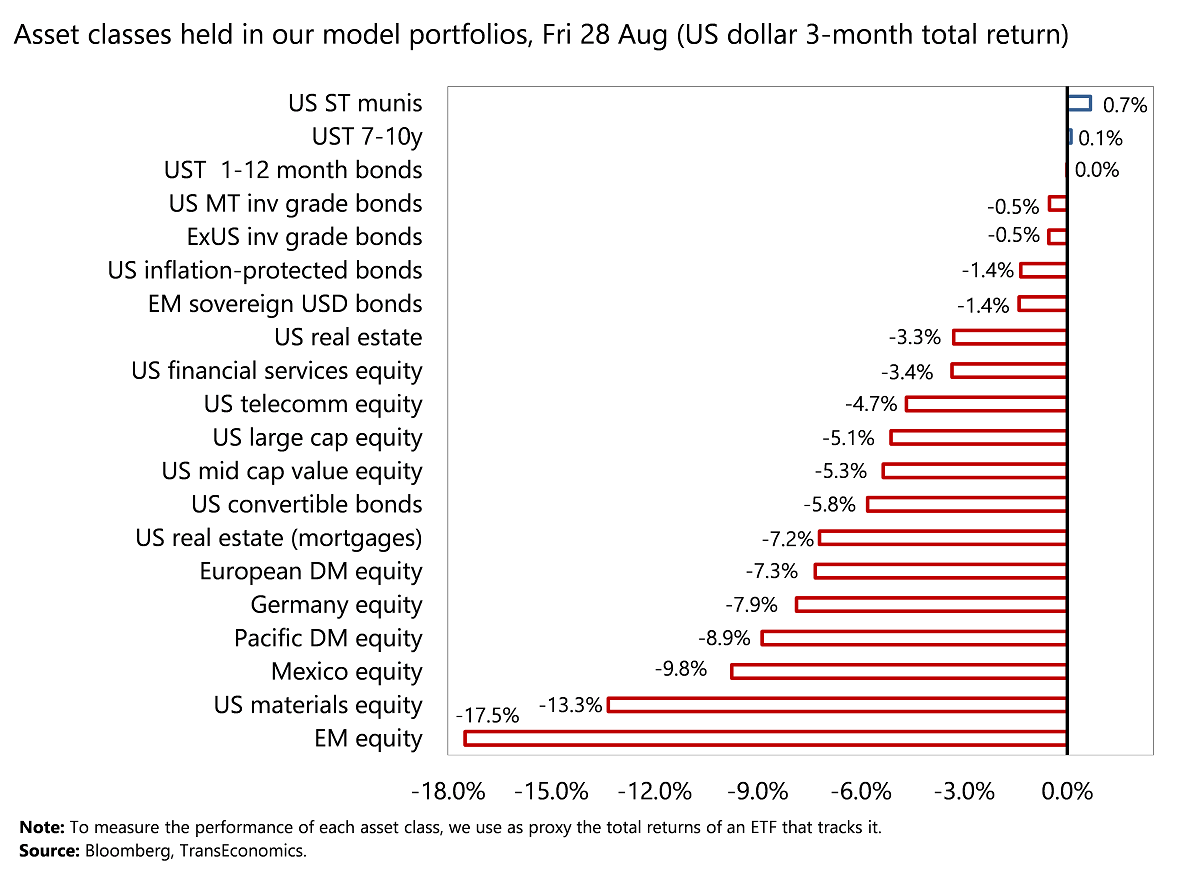

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar returns were U.S. investment-grade municipal bonds (+0.7%), 7-10-year U.S. Treasury bonds (+0.1%) and 1–12-month U.S. Treasury bills (0.0%).

Producing the lowest returns (in dollar terms) were emerging market equity (‒17.5%), U.S. raw materials equity (‒13.3%), and Mexico equity (‒9.8%).

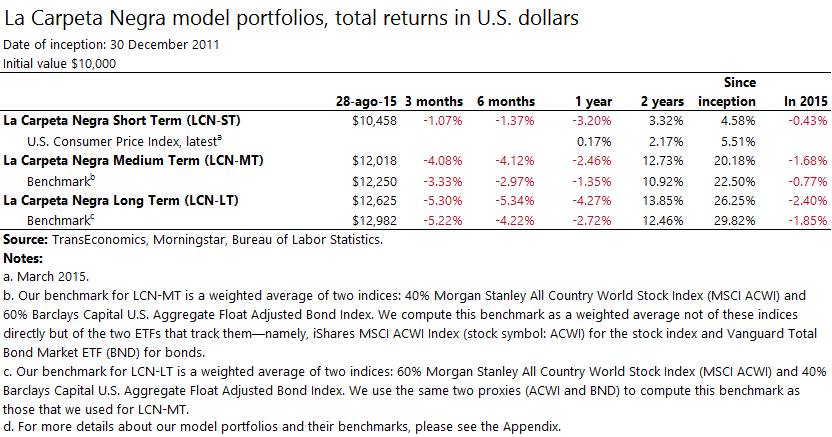

Over the past 12 months, none of our model portfolios outperformed its benchmark:

- LCN-ST ‒3.20% (benchmark 0.17%)

- LCN-MT ‒2.46% (benchmark ‒1.35%)

- LCN-LT ‒4.27% (benchmark ‒2.72%)

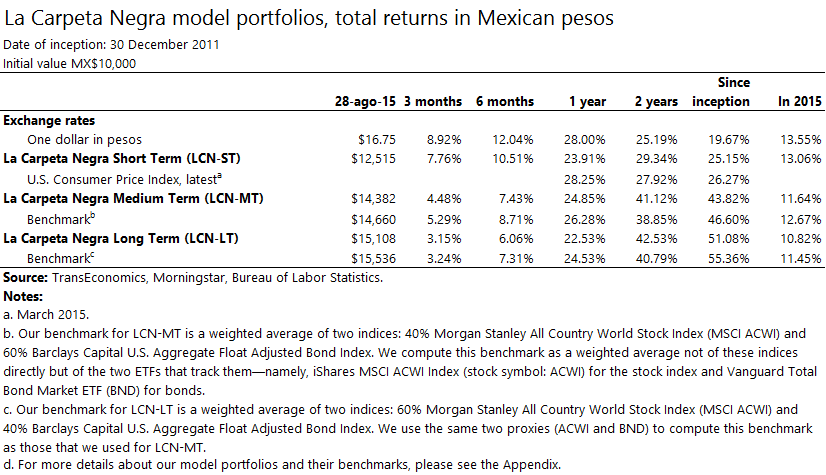

In peso terms, our 12-month performance was as follows:

- LCN-ST +23.91% (benchmark +28.25%)

- LCN-MT +24.85% (benchmark +26.28%)

- LCN-LT +22.53% (benchmark +24.53%)

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.v