Fed hike in October

Genevieve Signoret

Fixed Income

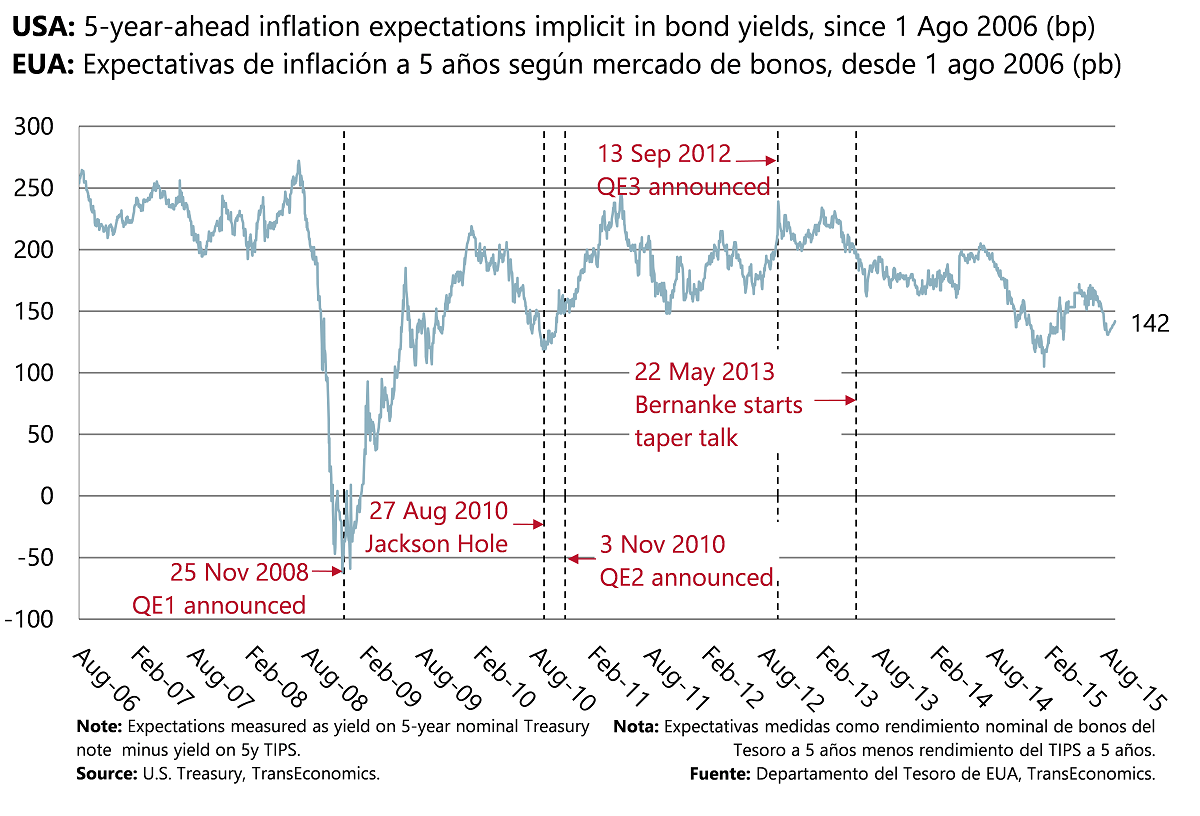

Note that the ongoing volatility seems not to have caused any short-term interbank funding problems. But bond-market–implied inflation expectations for the USA dropped last week to 1.42%. Also, corporate bond spreads have spiked, rendering financial conditions tighter. These two factors weaken the case for a Fed hike in September. Given these two factors and the persistence this week of market volatility, we have revised our view: we now expect the Fed to postpone its first rate hike to October. We premise this revised view on the assumption that market volatility will wind down in September; markets will have begun their recovery by October. Also, on the assumption that incoming U.S. macro data will continue to signal economic expansion.

Market-implied inflation expectations have dropped, weakening the case for a Fed hike in September

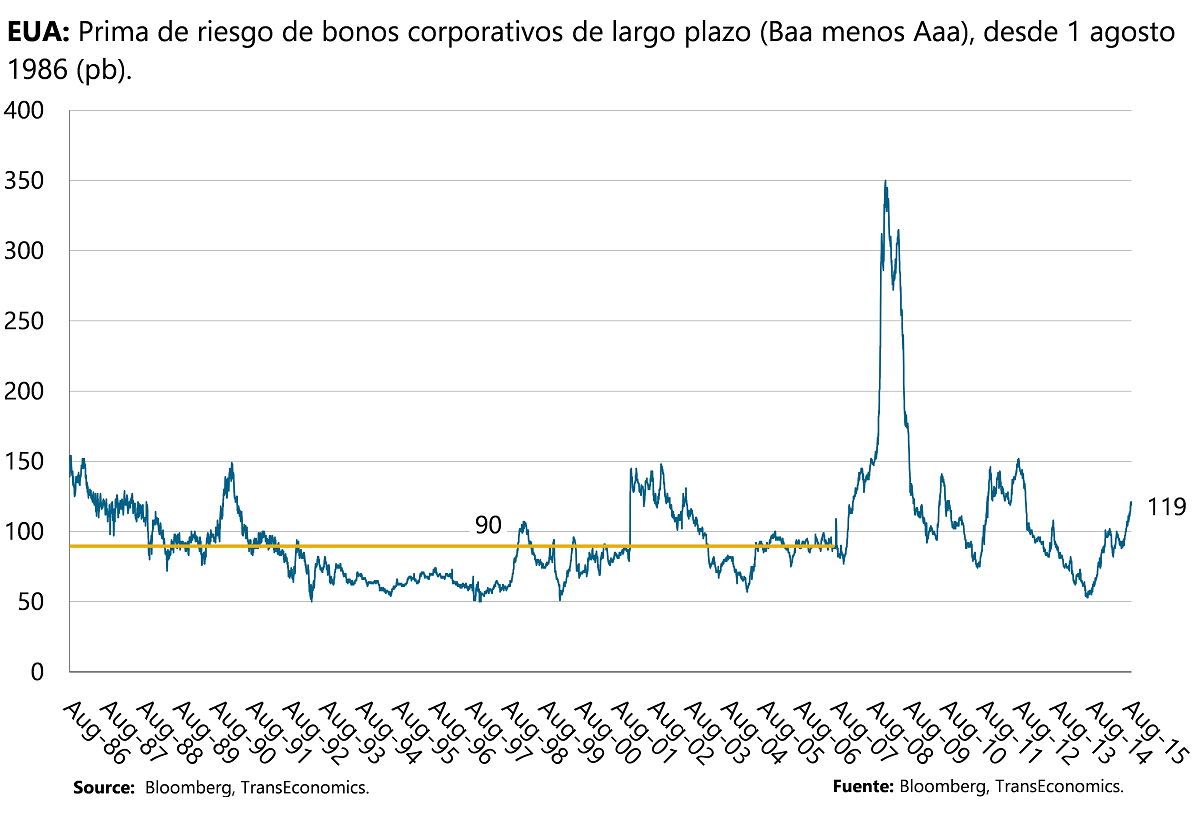

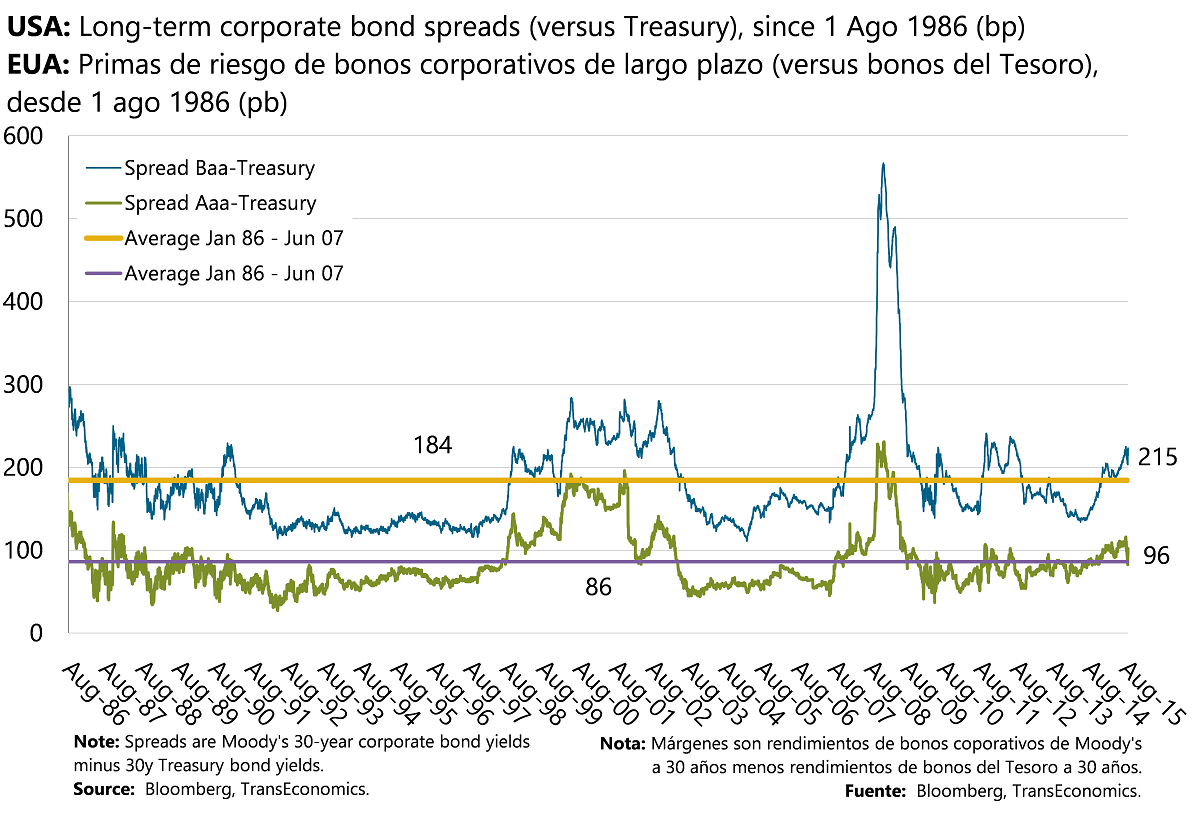

Also, U.S. corporate bond spreads have spiked (de facto tightening is taking place)

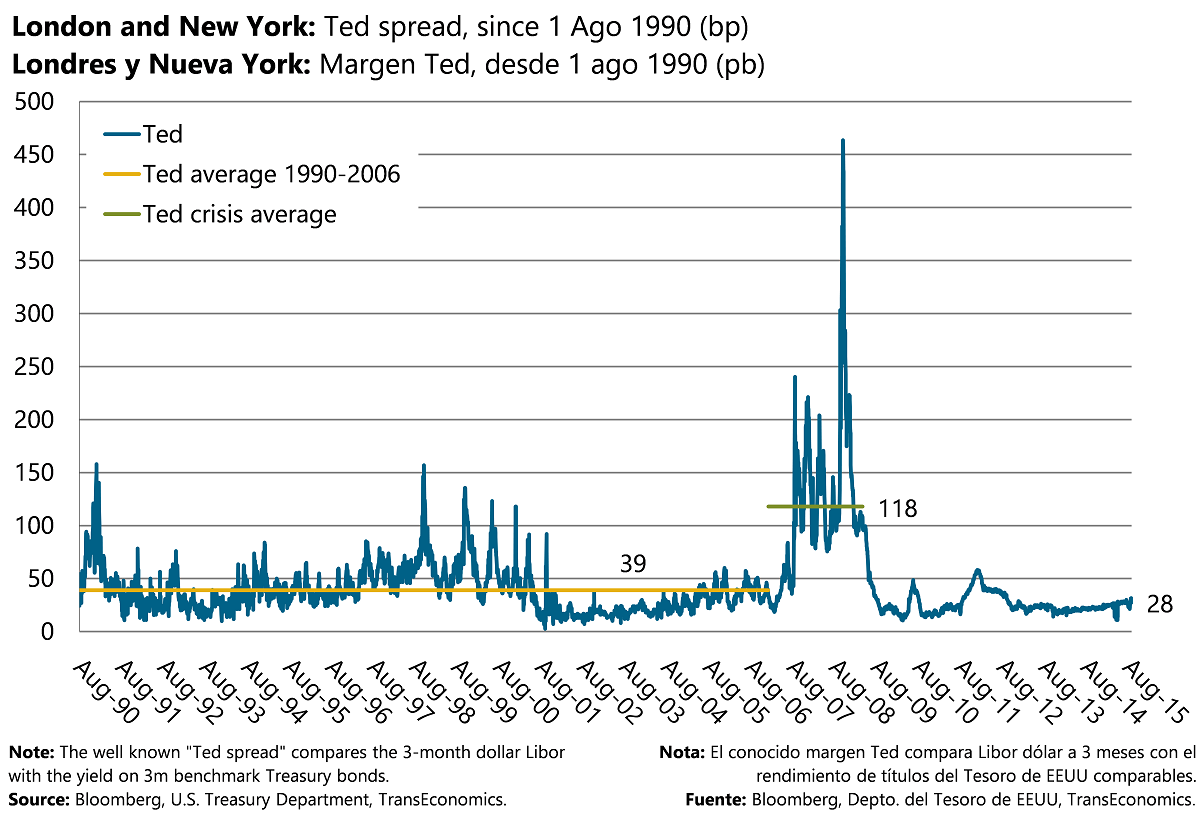

Yet the market correction has caused no apparent funding problems in interbank markets