Unless China correction sparks contagion, our portfolios are safe

Genevieve Signoret

Equity

Summary

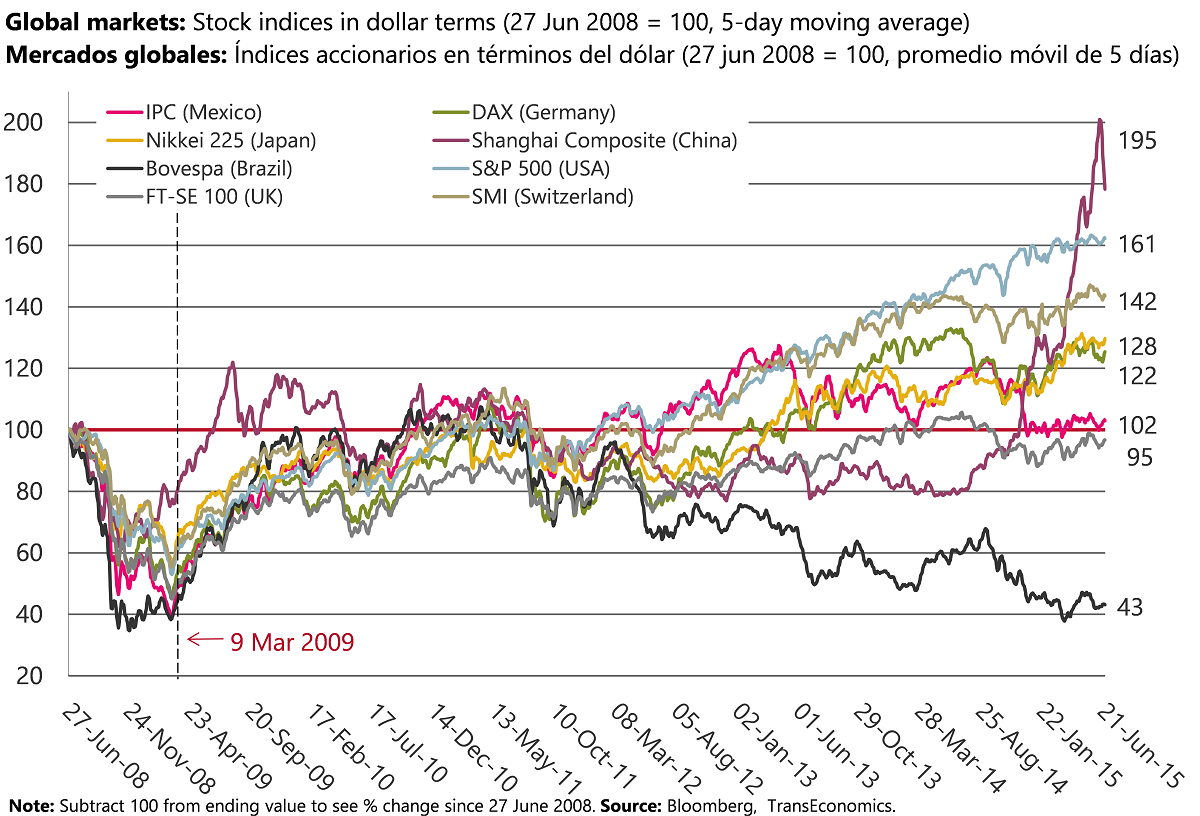

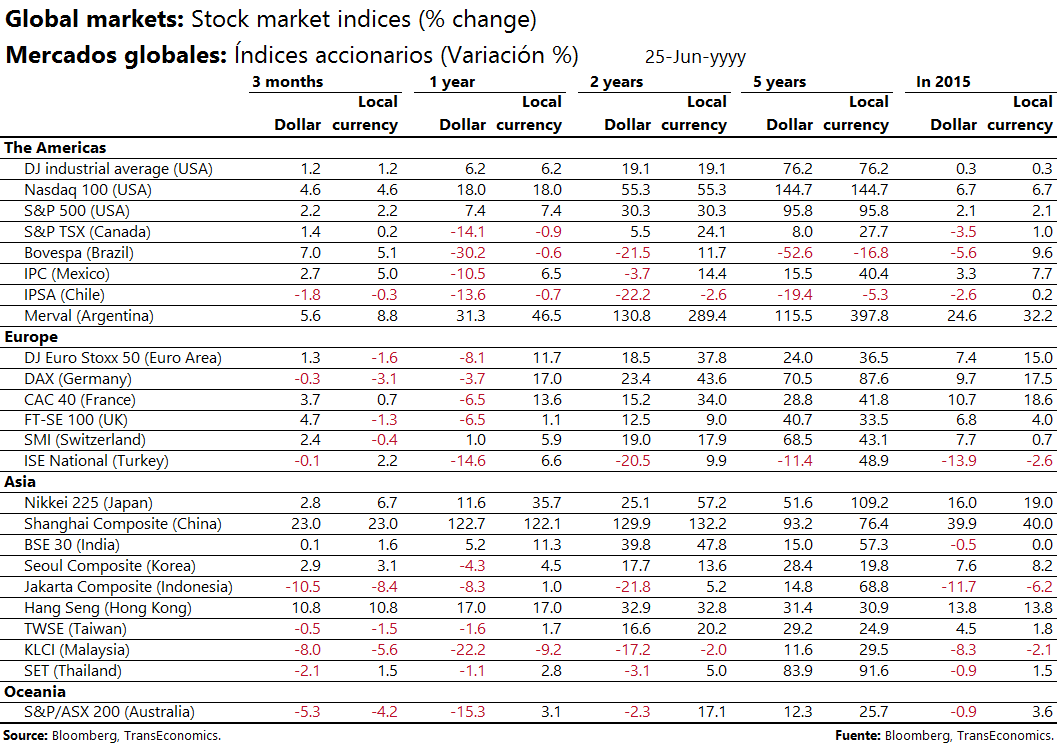

As you can see by the graph below, China’s stock market had been bubbling and now is correcting. The correction began on June 11 and through Friday 26 June measured 11.3% in USD terms. So far, our clients are scarcely feeling a thing.

Only clients with investment horizons exceeding five years have any meaningful direct exposure to Chinese stocks and even their portfolios assign only slightly more than 1% weights to China. Of course, if the correction spreads like a virus to other markets, emerging or mature, the impact can escalate.

Detail

We build individualized client portfolio strategies, but our La Carpeta family of model portfolios[1] do reflect the general approach we’re taking with clients, so we’ll answer in terms of these portfolios.

First we should distinguish between direct and indirect exposure. Direct exposure refers to actual Chinese stocks in our portfolios, as opposed to stocks in companies doing a great deal of business with China.

Our short-term model portfolio, LCN-ST, has no direct Chinese equity exposure at all.

Our medium-term model portfolio, LCN-MT, assigns a 5% weight to a Pacific stock ETF that in turn assigns a weight to Chinese stocks smaller than 0.56%. So LCN-MT has virtually no direct exposure to this correction (its direct exposure to Chinese equity is a mere 0.028%).

Our long-term model portfolio, LCN-LT, like LCN-MT, holds a 5% position in the same Pacific stock ETF. But it also holds an emerging market stock fund in which Chinese equity constitutes a 22.52% weight. So Chinese stocks make up a mere 1.13% of LCN-LT.

In conclusion, only our (“average”) clients with long-term (5+year) investment horizons hold any direct exposure to China’s stock bubble or its ongoing correction at all, and even their exposure is minimal (just over 1%). This leaves as the chief risk from the Chinese stock market correction to client portfolios moving forward that of contagion.

Unless China correction spreads, our potfolios are virtually immune

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.