Our outlook for stock markets in 2H 2015

Genevieve Signoret

Equity

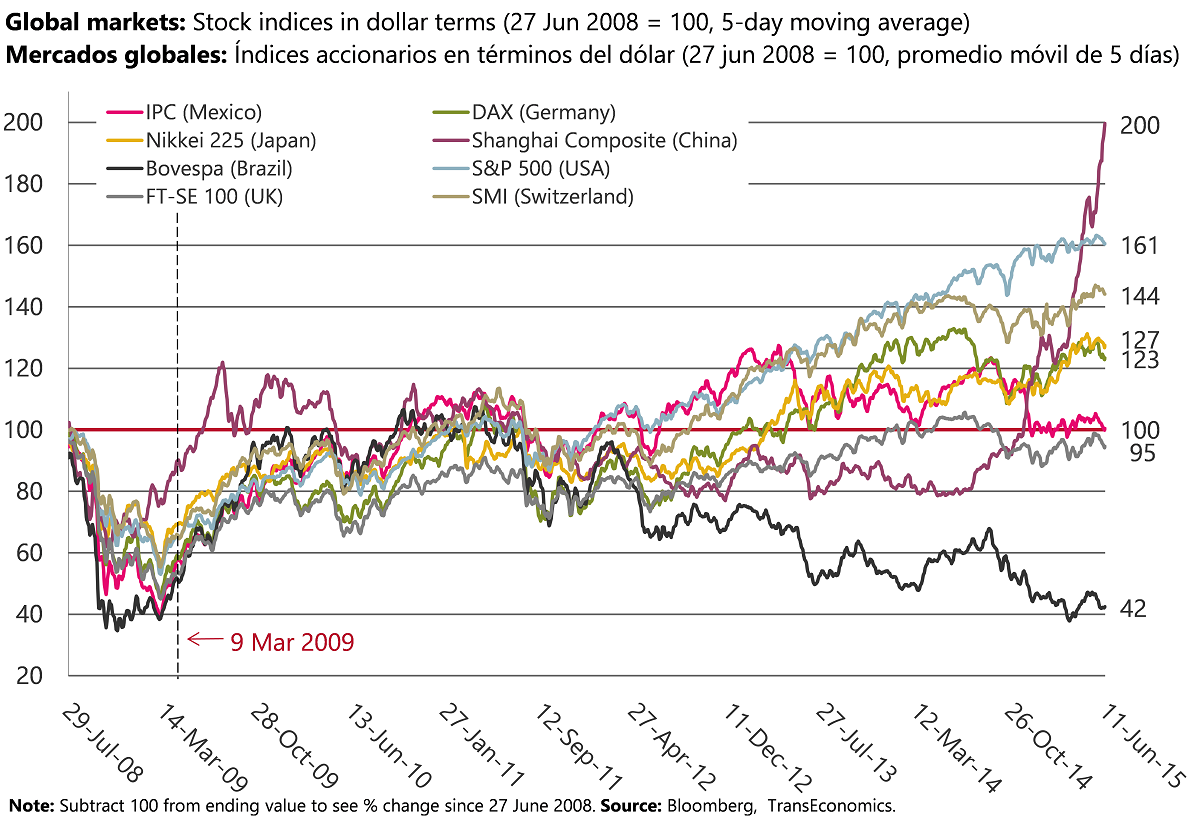

In our central scenario, stock market volatility will now move sharply up and stocks will start trending down and continue to do so over the next few months. Soon after the Fed begins its normalization process (probably in September), however, stocks quickly rebound, by the end of this year recovering fully and perhaps even appreciating further from their valuations of today.

This view is premised on the assumption that the Fed, once normalization begins, will in its communication succeed in persuading markets that it intends to maintain a loose stance: that for now it will leave its balance sheet unchanged in size for now (remember: the size of the balance sheet is a form of stimulus) and keep interest rates low for long.

We see Greece as the chief risk to this outlook. We expect with high confidence that Greece will reach a bridge deal with its creditors this month or next, then be subject to a third bailout program, one that contemplates debt reduction. But of course we cannot rule out the opposite scenario, in which the Greek government defaults on its debt and abandons the euro, imposing on investors capital controls. The Fed in this scenario does not start to normalize this year. Nonetheless, stock markets sink, possibly take quite a while to recover.

A Grexit is a very low-probability risk, in our view, yet one against which we prefer, in client portfolios, to hedge. One way is by taking long positions in 7–10-year U.S. Treasury securities— a painful thing to do in a rising rate environment. Another is by reducing exposure to equity and increasing one’s allocation to U.S. dollar cash. Depending on the portfolio and our mandate, we’re relying on both tactics.