China joins currency war, we revise down peso and euro

Genevieve Signoret

Currencies

China joins currency war

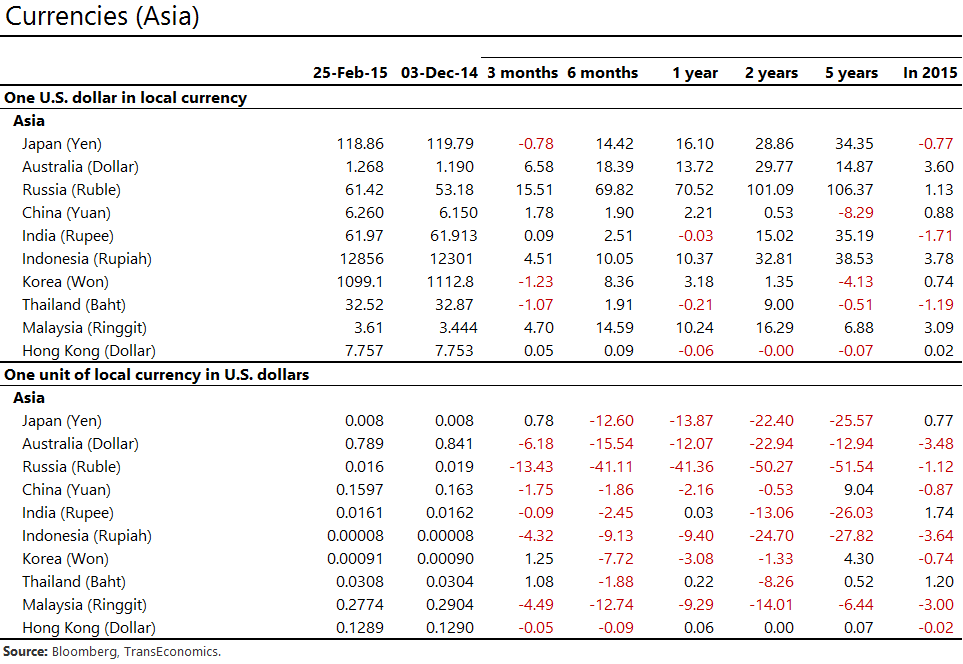

Last Friday, the People’s Bank of China (PBOC) lowered the daily fixing rate for the USD/CNY 6.1475 from its prior 6.1376. The PBOC allows the yuan to trade 2% above or below this daily reference rate. Later that day, China’s yuan fell 6.2722 to the dollar, its weakest level since October 2012.

We revised down the euro and peso

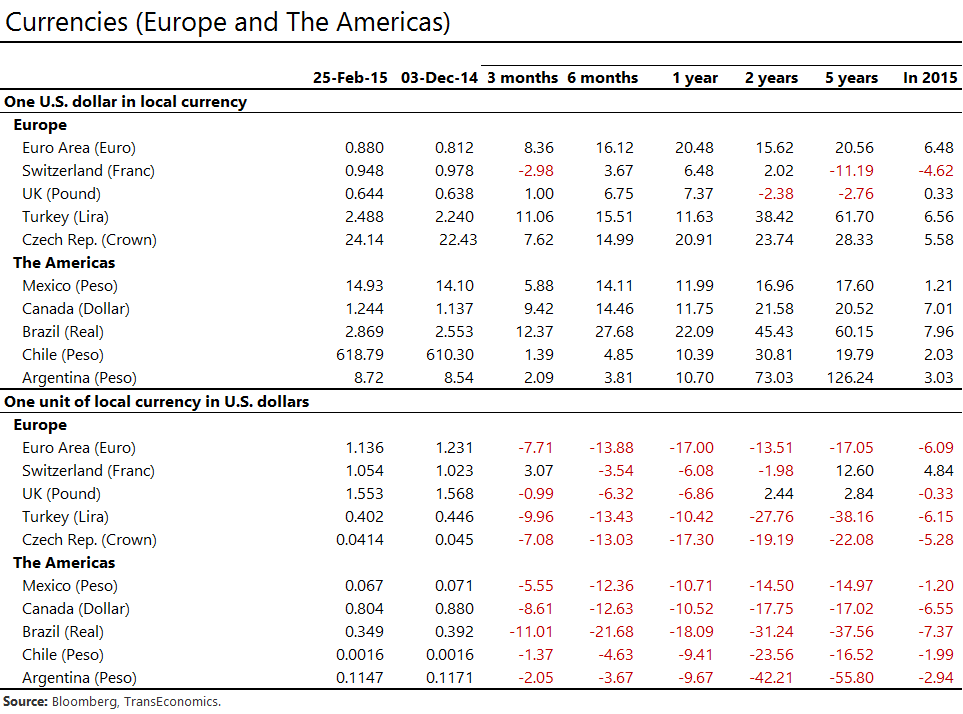

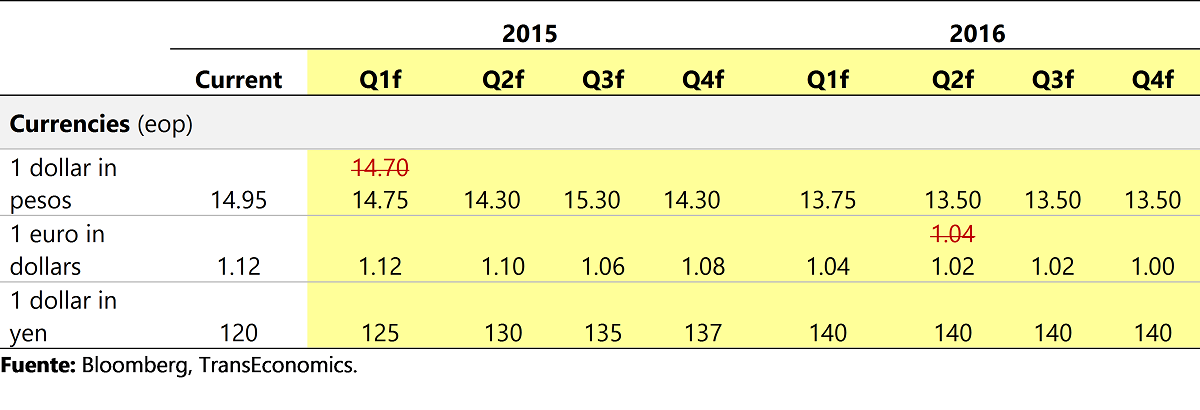

To incorporate incoming foreign exchange data, we have revised down our outlook for the peso and euro as follows:

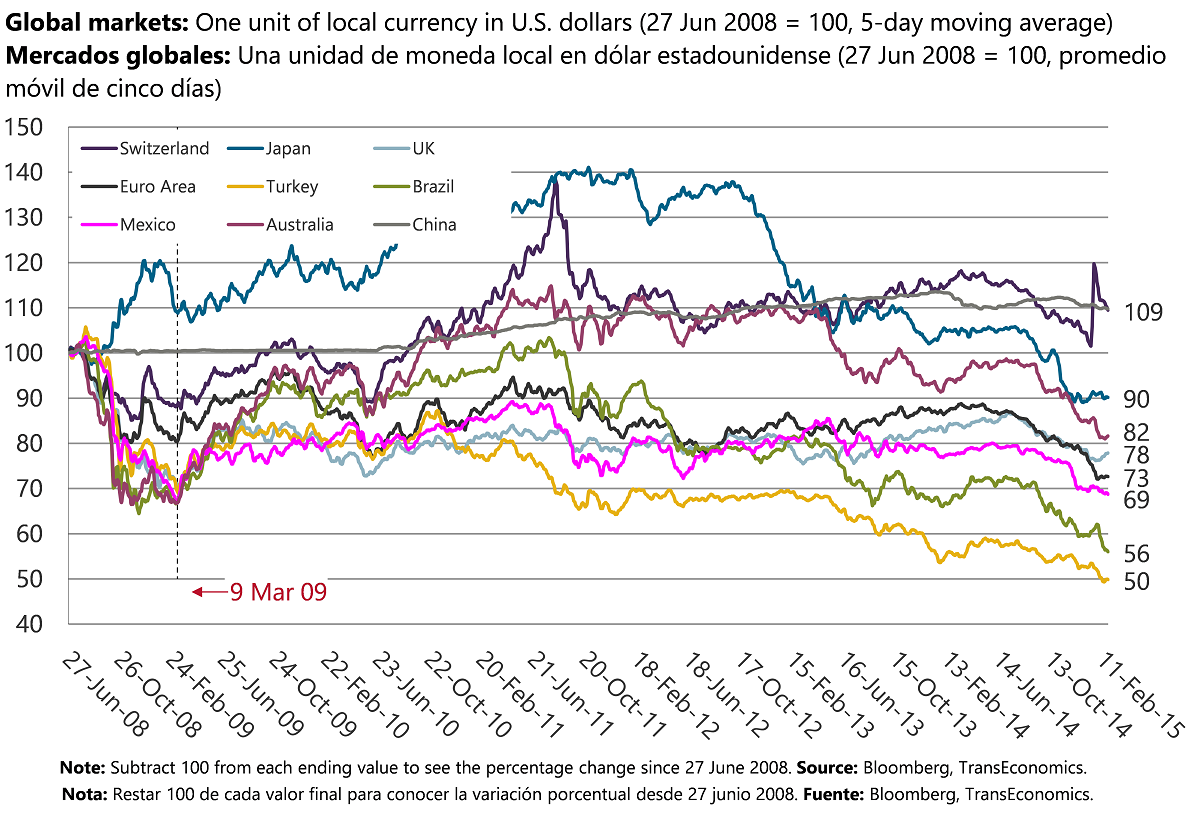

The USD continues to strengthen

We expect the peso to depreciate to $1.00=MXN15.30 before recovering to $1.00=MXN14.30 by December 2015

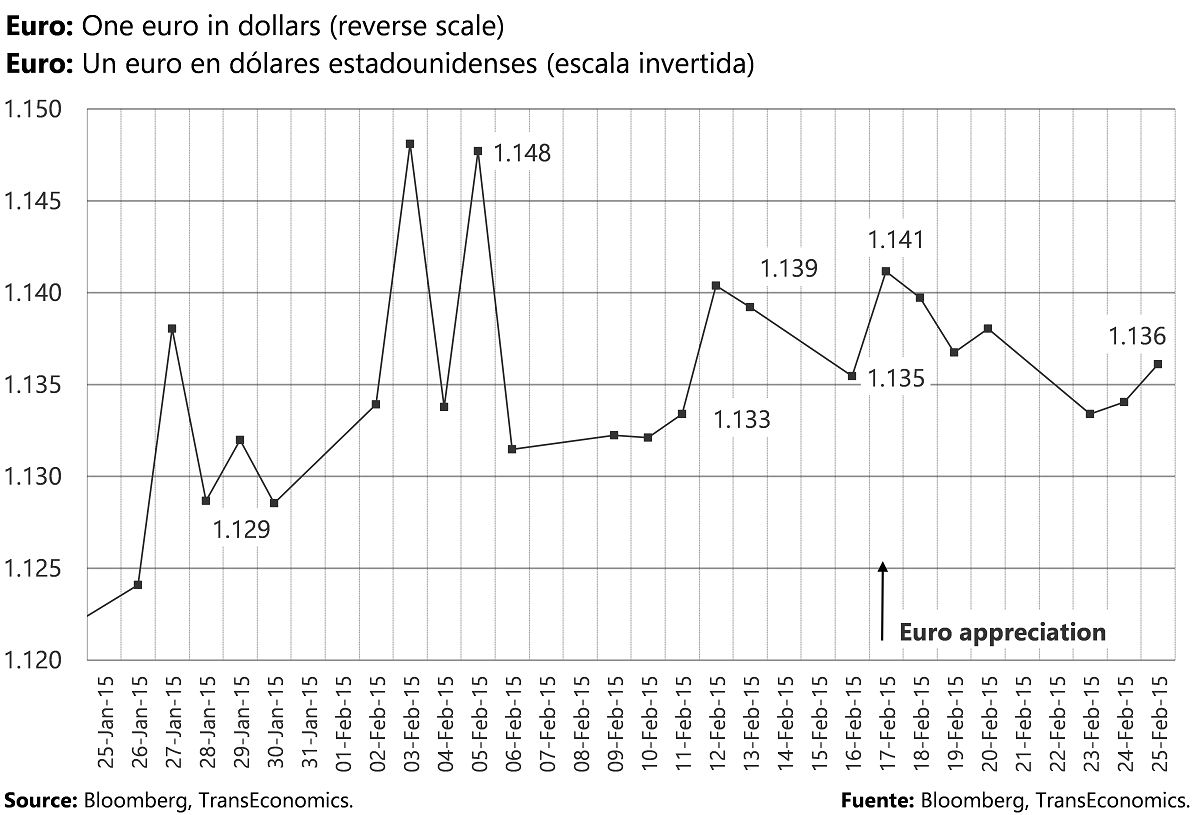

We forecast that the euro will end 2015 at €1.00=$1.08

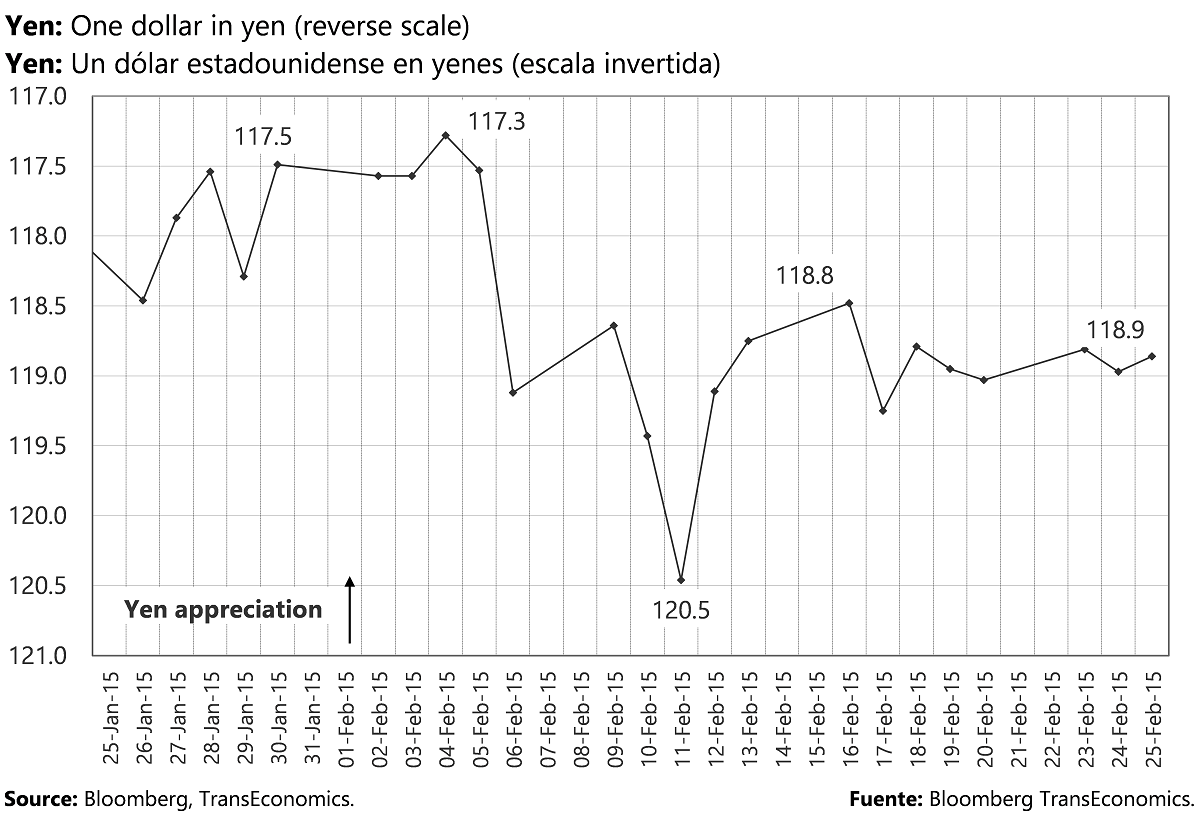

Our outlook for the USD/YEN by December 2015: $1.00=¥137

In the 3 months to Feb 25, the currencies of 4 of these 20 countries —Switzerland, Korea, Thailand, & Japan—appreciated against the dollar