What is driving sky-high demand for long-term U.S. Treasuries?

Genevieve Signoret

Fixed Income

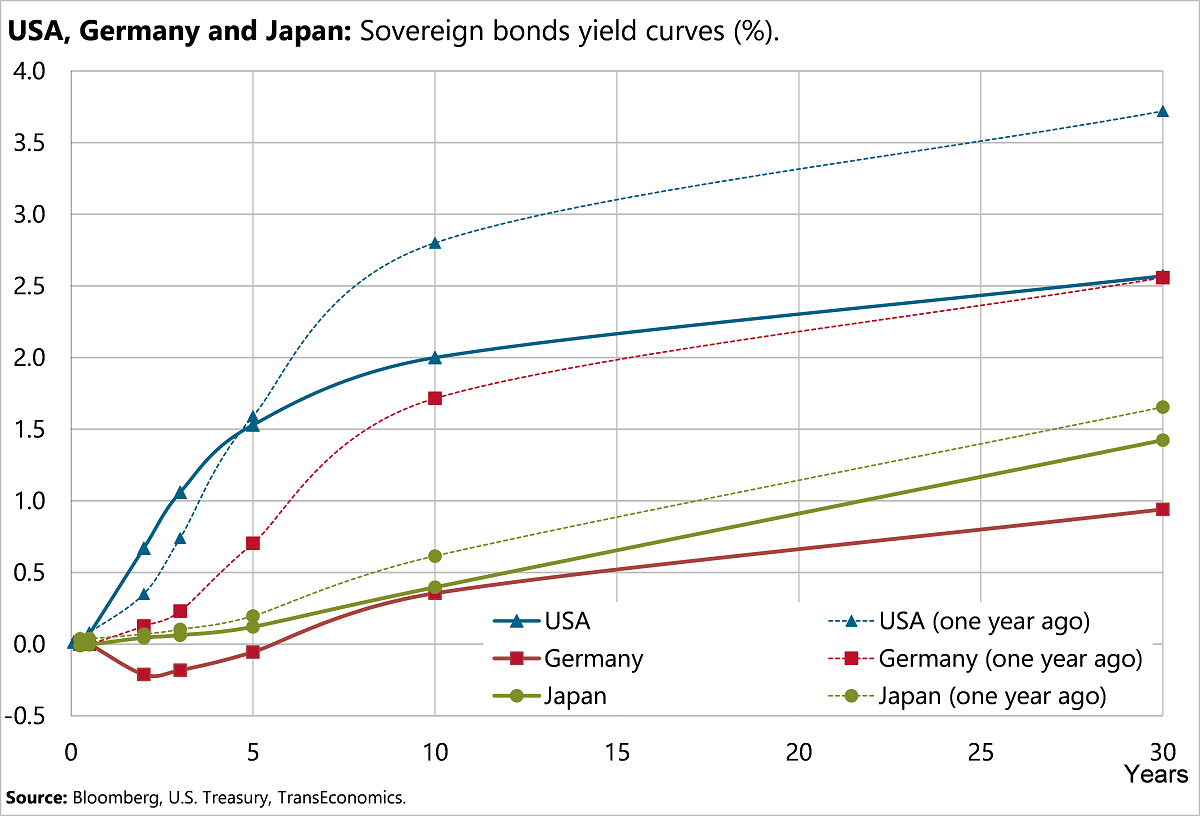

We’re puzzled as to what is driving such high demand (high prices, low yield) for long-term U.S. Treasuries. While for maturities shorter than 5 years, UST valuations have slipped in anticipation of a near-term Fed rate hike, for long-term bonds, valuations have sky-rocketed (the yield curve has become extremely flat).

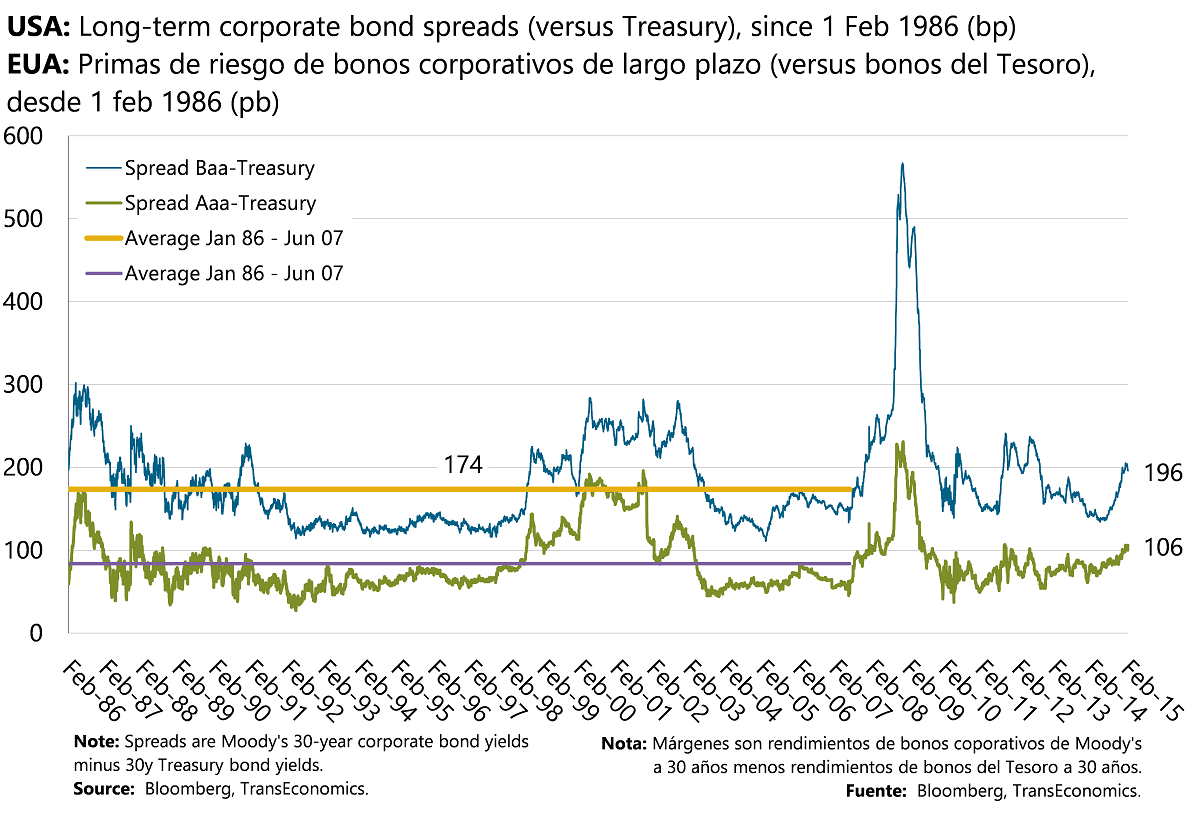

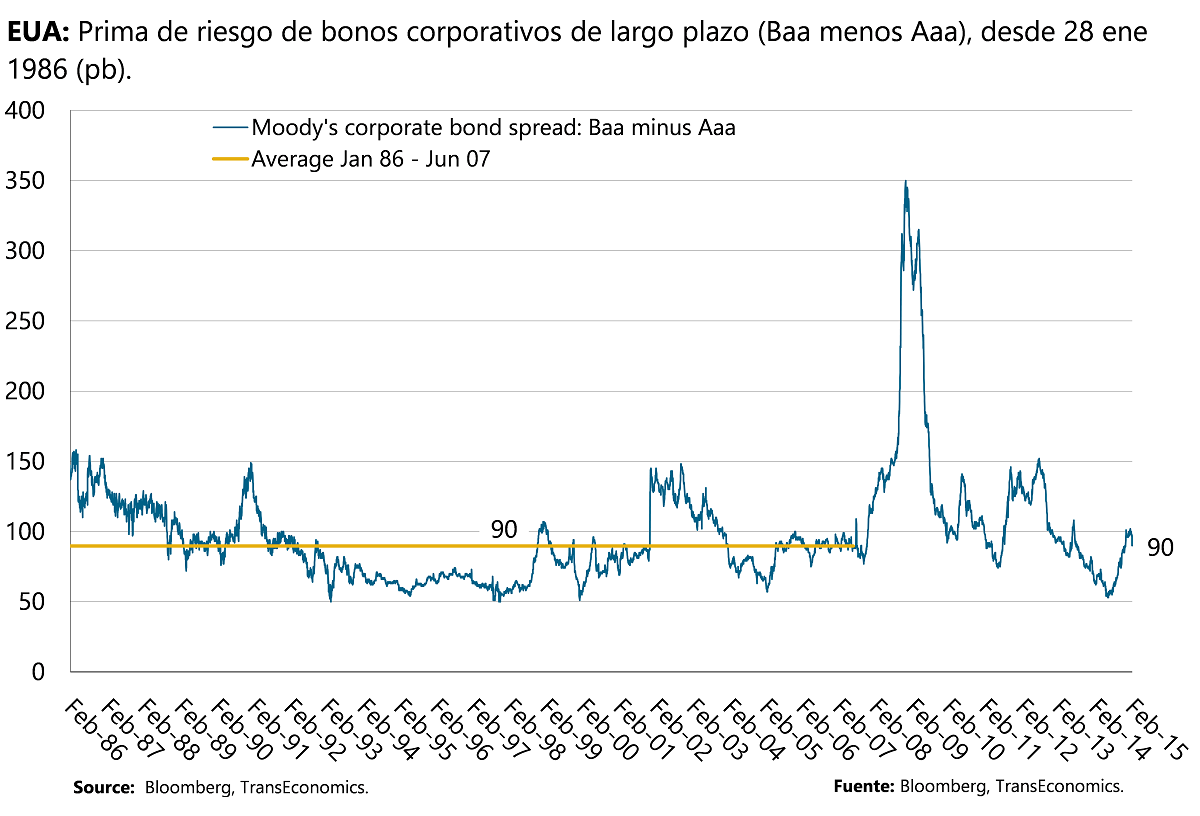

One possibility is that bond markets see risk in corporate bonds so are seeking quality. It might seem so given how wide have grown junk bond yield spreads over yields on comparable Treasuries: to 196bp, versus 174 on average for 1996-2006. But if credit quality were the issue, one would expect junk bond spreads over comparable investment grade corporate bonds to also be spiking. They are not. They’re at their 1996–2006 average of 90bp.

So what else could explain the flatness? A drop in long-term inflation expectations? Survey of consumers and forecasters refute this.

Preference for the U.S. dollar over comparable long-term sovereign bonds denominated in non-U.S. currencies? This is our current working hypothesis.

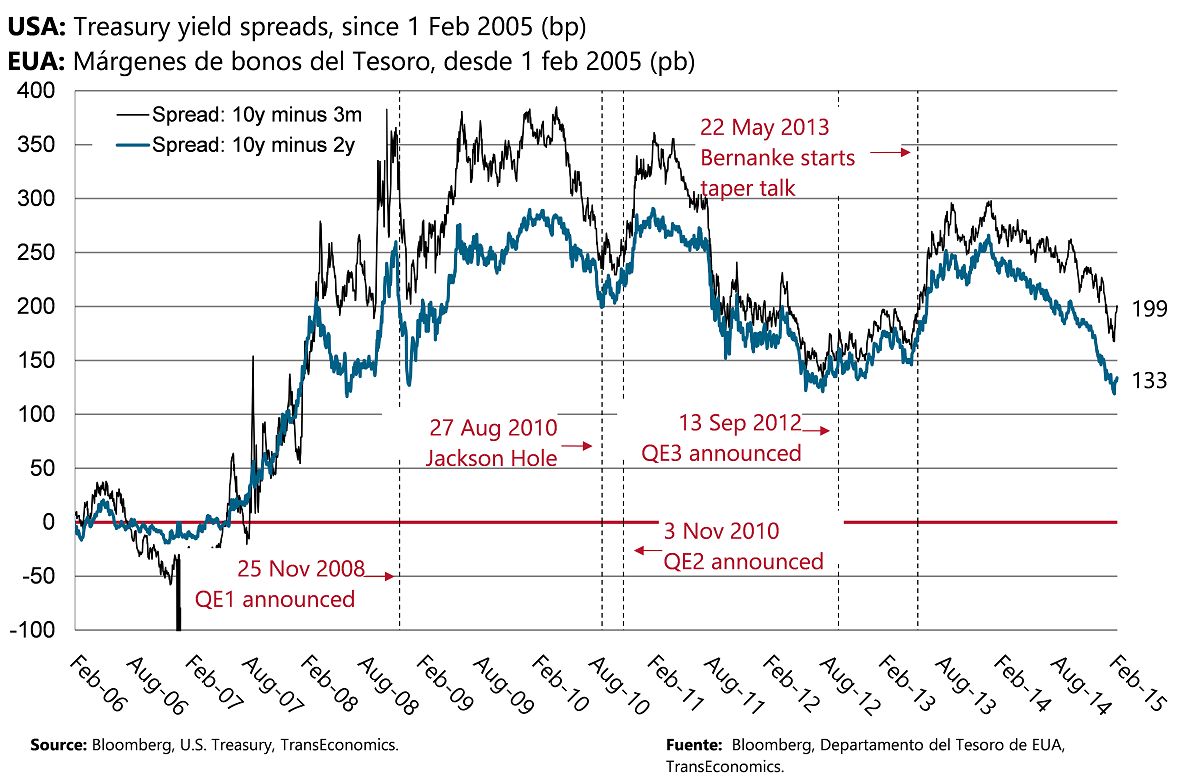

A related question is what the Fed might do about it. The last time the U.S. Treasury yield curve got as flat as it is today was in September 2012. The Fed promptly announced QE3. We don’t expect new stimulus this time but do continue to believe that the Fed will hike rates for the first time not in June as the Fed itself projects but later in the year.

While for maturities shorter than 5 years, UST valuations have slipped in anticipation of near-term Fed rate normalization, for long-term bonds, valuations have sky-rocketed (the yield curve is quite flat)

At 196bp, corporate junk bond spreads over comparable U.S. Treasuries are considerably wider than the pre-crisis average 124bp…

…yet spreads paid by junk bonds over comparable investment grade corporate bonds are average (90bp) for non-crisis periods. Demand for USTs is probably not being driven by a search for credit quality.

Last time the yield curve became as flat as it is today, the Fed announced more stimulus (QE3). We don’t expect that this time but do expect the first rate hike to come later this year than June.