Major changes in our fixed income strategies

Genevieve Signoret

01 February 2015

Fixed Income

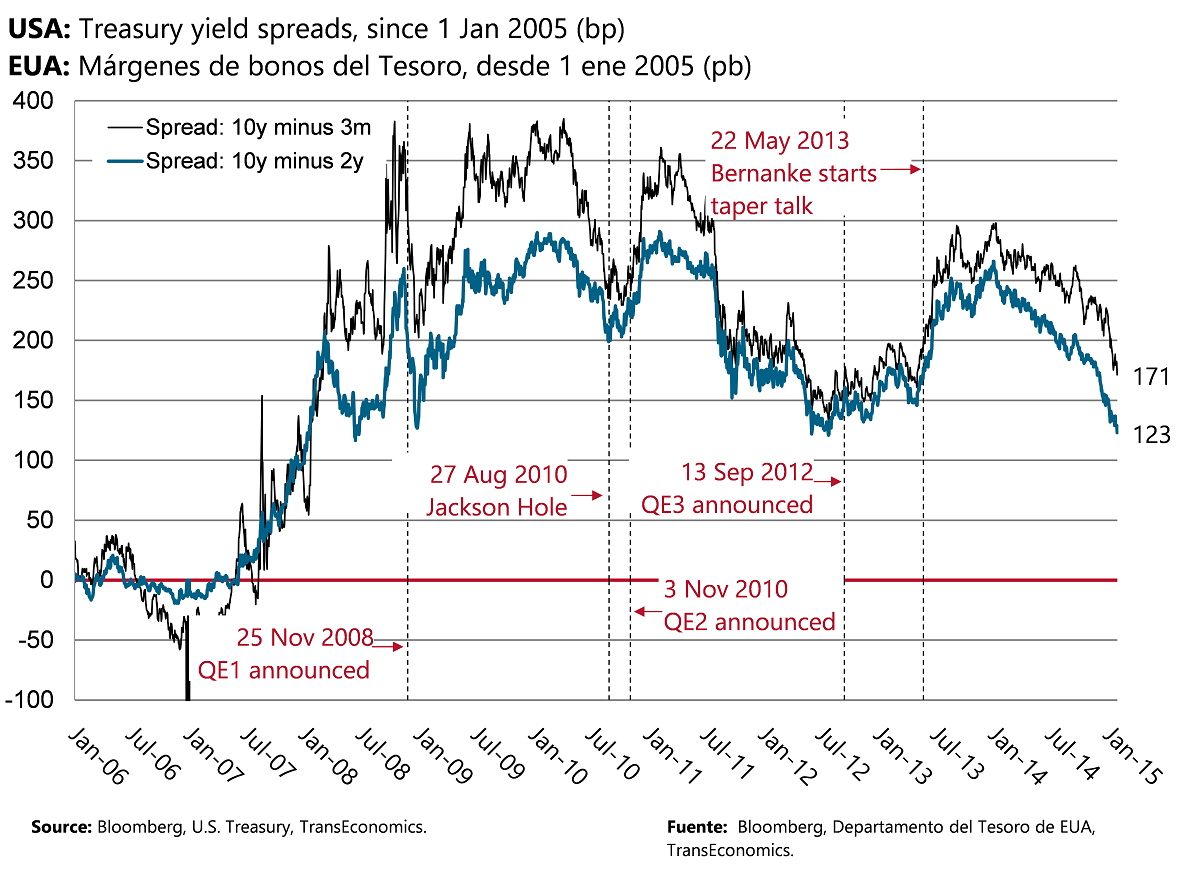

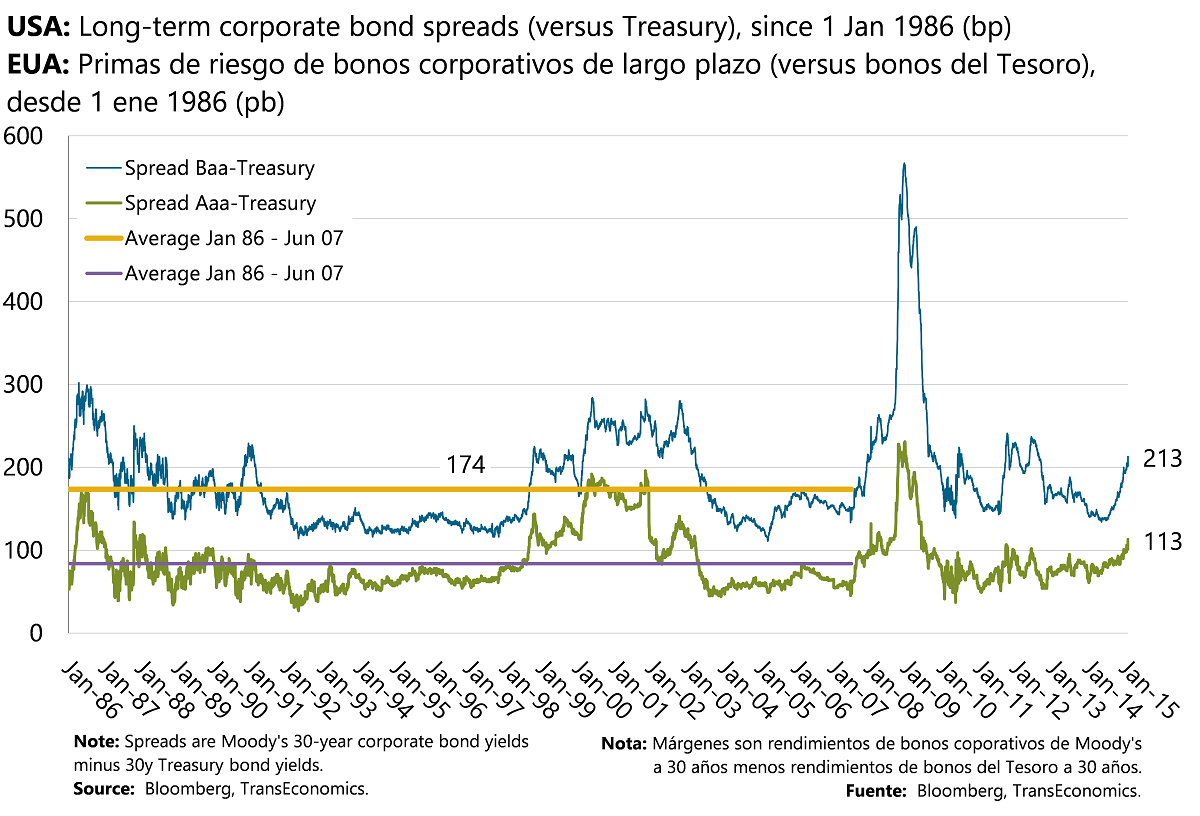

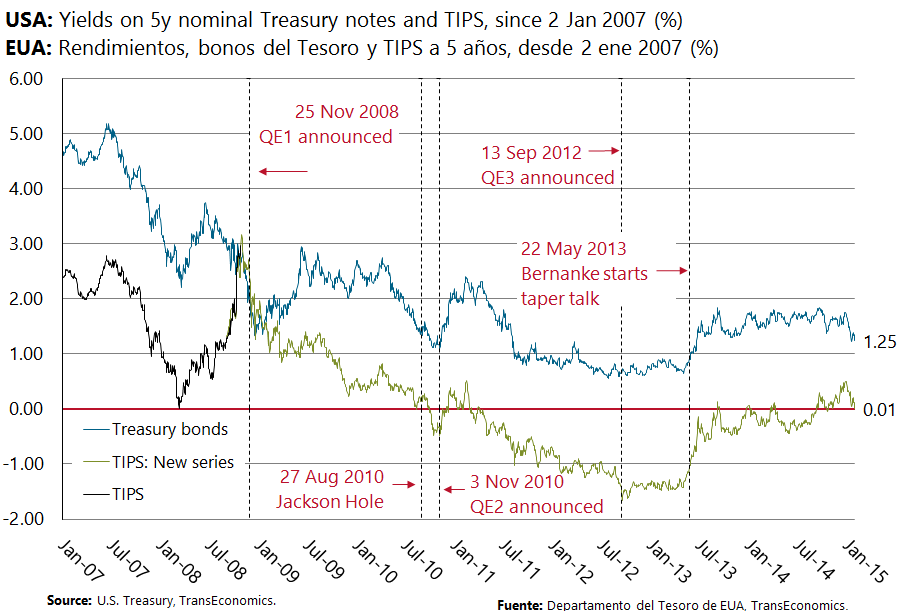

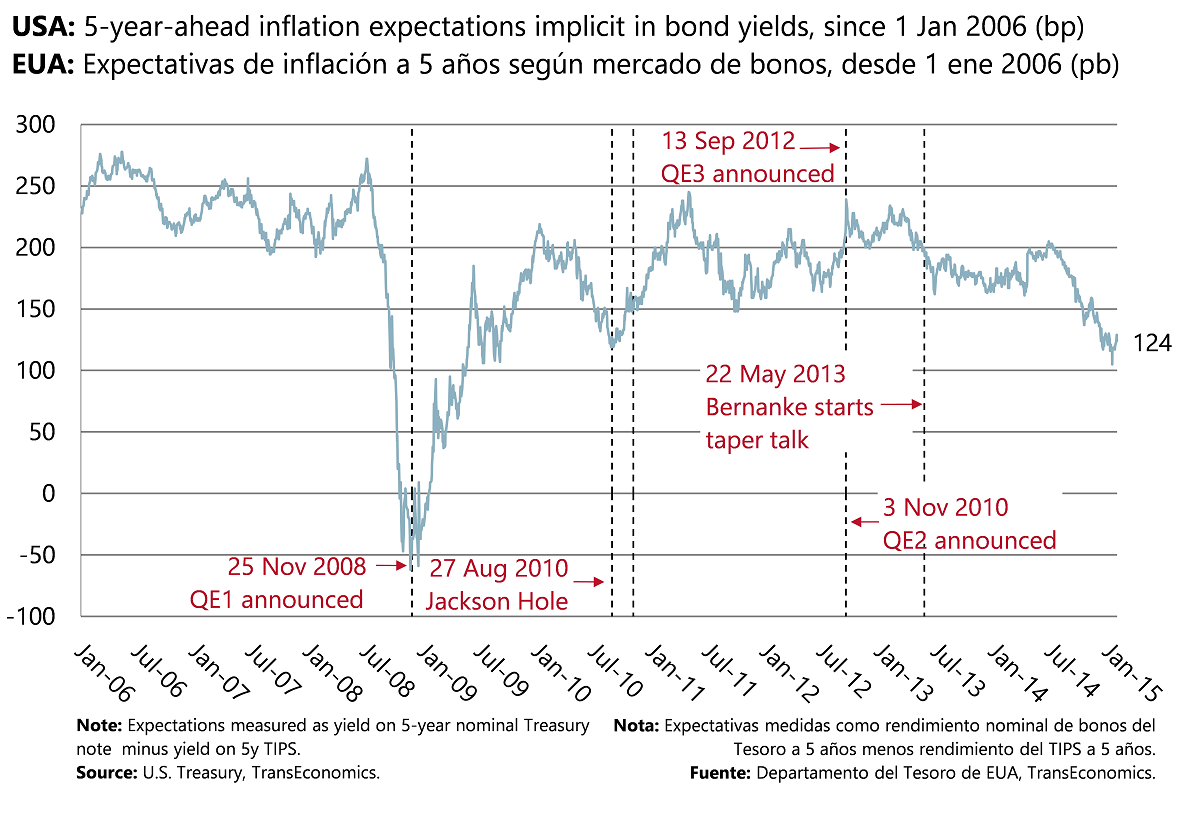

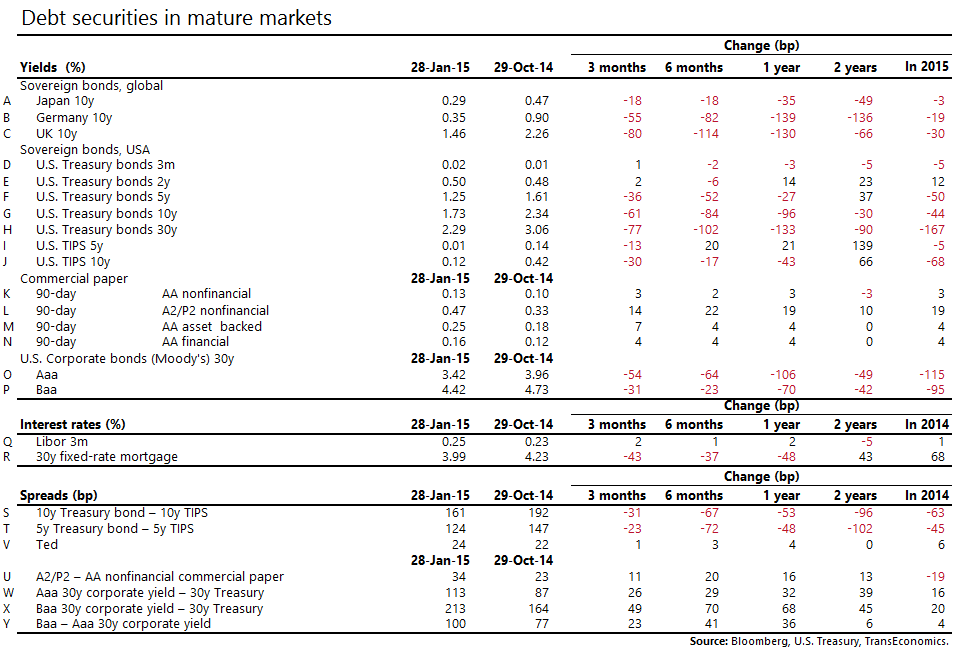

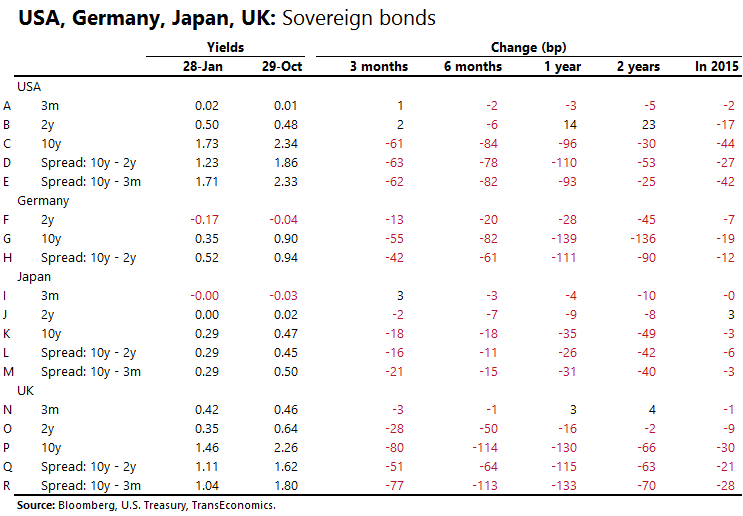

- We continue to expect the first Fed rate hike in the third quarter of 2015 and see a risk that it will come sooner. Given our view on rates, we think the U.S. yield curve is unsustainably flat and will adjust abruptly (painfully) quite soon. We see its flatness as a flight to quality as investors grapple to understand what falling energy prices, a leftist government in Greece, and an unrepentant and aggressive Russia all mean for the world and their portfolios. We base this interpretation on the recent (healthy, realistic) downward adjustment in junk bond prices.

- In our short-term model and client portfolios, while continuing to holding small allocations to U.S. equity, dollar-denominated emerging market bonds and non-U.S. investment grade bonds, we’re moving farther into quality by closing all positions in U.S. corporate bonds, adding short-term municipal bonds, and adding a large (30%) cash position. Additionally, within the U.S. fixed income portion of the portfolio, we’re adopting a barbell approach: shrinking and extending duration at the same time. This means holding a pile of cash (0–12-month U.S. Treasury bills) and, once again, 7–10-year Treasury bonds.

- In our medium-term (2–5-year) model and client portfolios, we’re lengthening duration a bit and increasing quality by shifting back into 7–10-year Treasuries by reducing our exposure to 5–10-year U.S. investment grade bonds and eliminating junk bonds. We’re holding on to two hybrid asset classes: convertibles and Master Limited Partnerships.

- For more detail on our strategy changes, please see this week’s Letter from the President: “Revised portfolio strategies”.

Comentarios: Deje su comentario.