U.S. real estate remains the best performing asset class

Genevieve Signoret

Our Performance

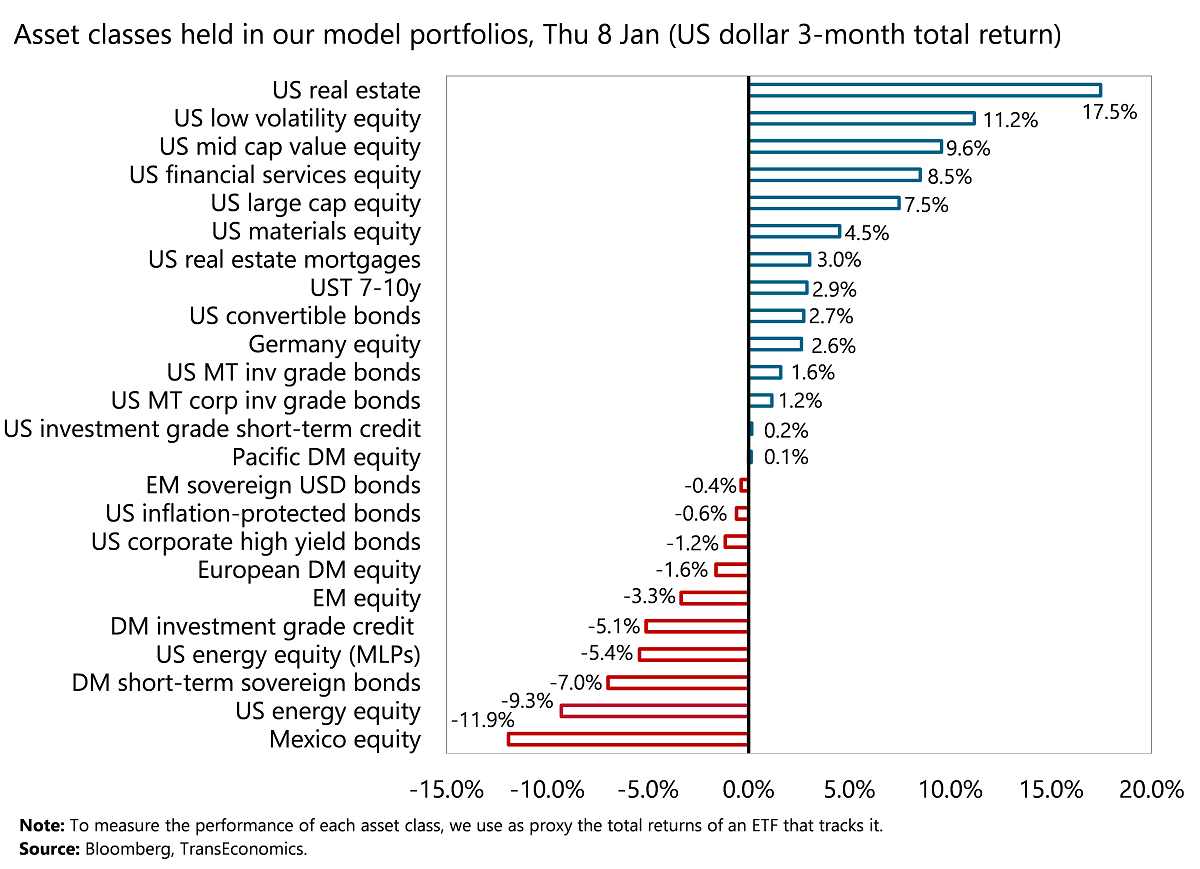

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar returns were U.S. real estate (17.5%), U.S. low volatility equity (11.2%), and U.S. mid cap value equity (9.6%).

Producing the lowest returns (in dollar terms) were Mexico equity (–11.9%), U.S. energy equity (–9.3%), and developed market short-term sovereign bonds (–7.0%).

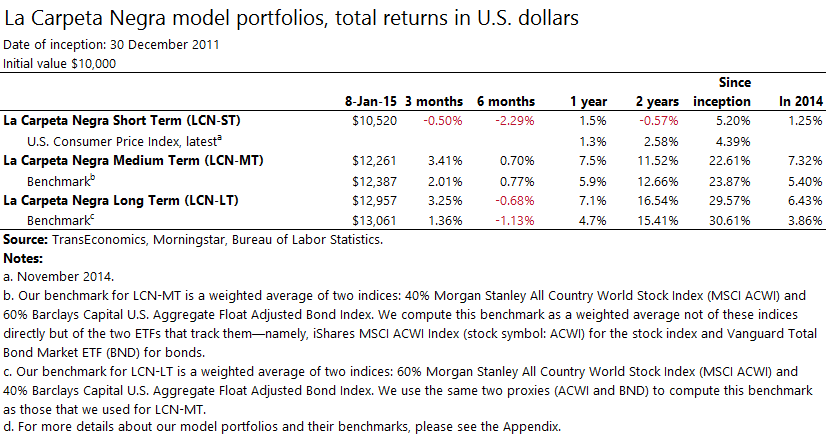

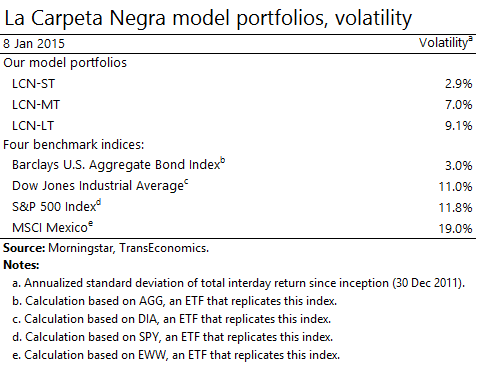

Over the past 12 months, all our model portfolios have outperformed its benchmarks:

- LCN-ST +1.5% (benchmark +1.3%)

- LCN-MT +7.5% (benchmark +5.9%)

- LCN-LT +7.1% (benchmark +4.7%)

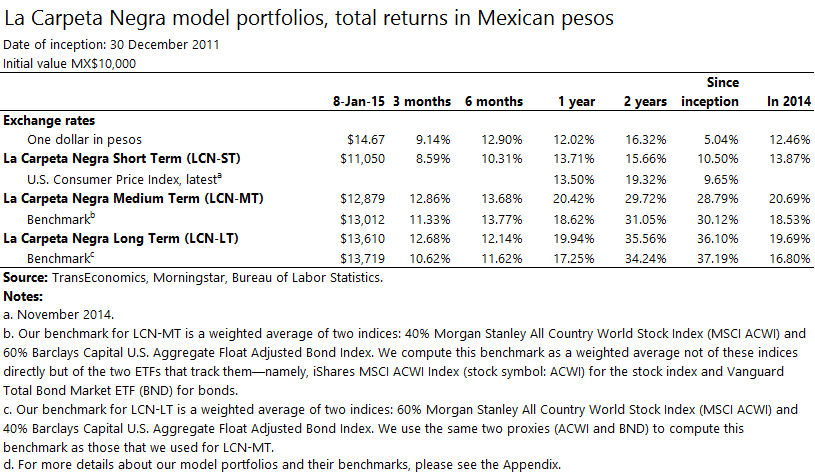

In peso terms, our 12-month performance was as follows:

- LCN-ST +13.7% (benchmark +13.5%)

- LCN-MT +20.4% (benchmark +18.6%)

- LCN-LT +19.9% (benchmark +17.3%)

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.