10y UST 2.50% on December 31

Genevieve Signoret

14 November 2014

Fixed Income

- At the close of yesterday, yield on a 10-year UST was 2.35%. For December 31, we revise down our forecast to 2.50% from a previous 2.60.

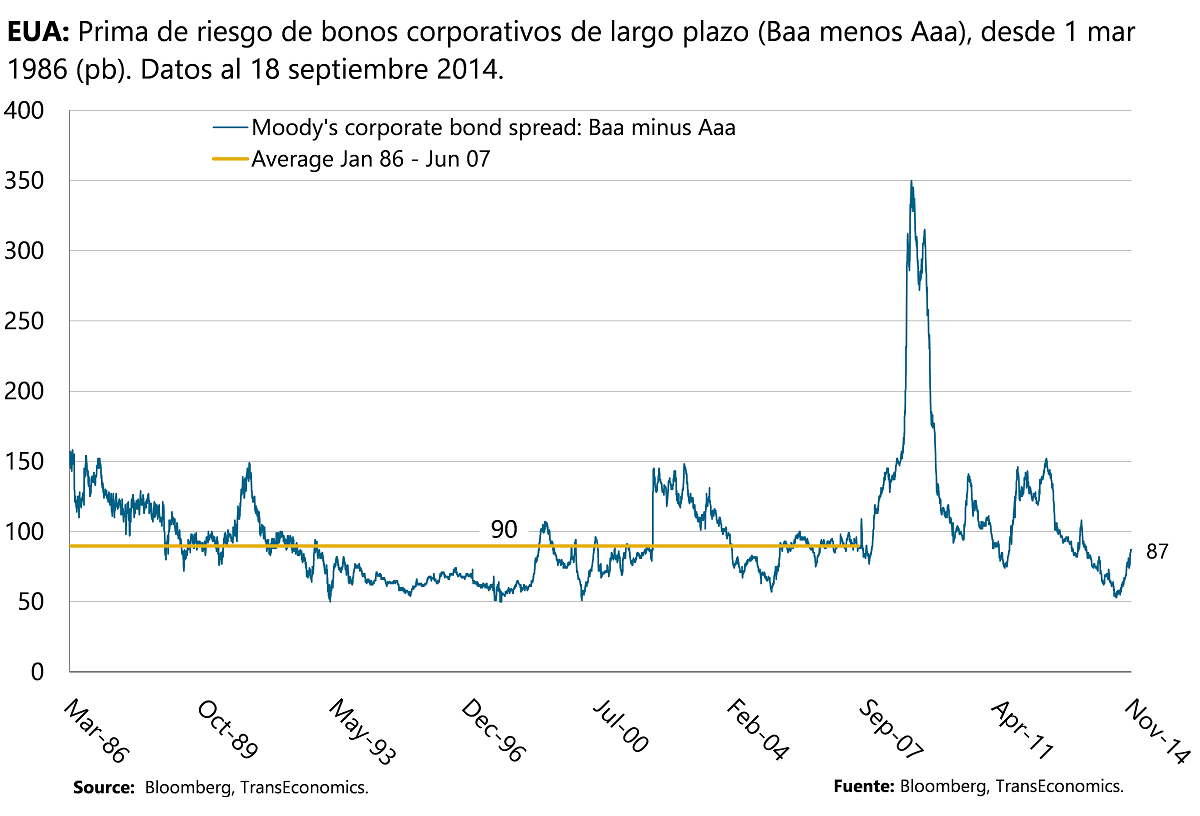

- Risk premia on long-term corporate bonds have moved closer to their long-term average. Although the correction has been painful, today’s wider spreads strike us as more stable than the razor-thin ones we were looking at a few months back.

- Although the U.S. bond-market–implied inflation outlook for five years from now has bounced back up a bit, at 1.58%, it remains low.

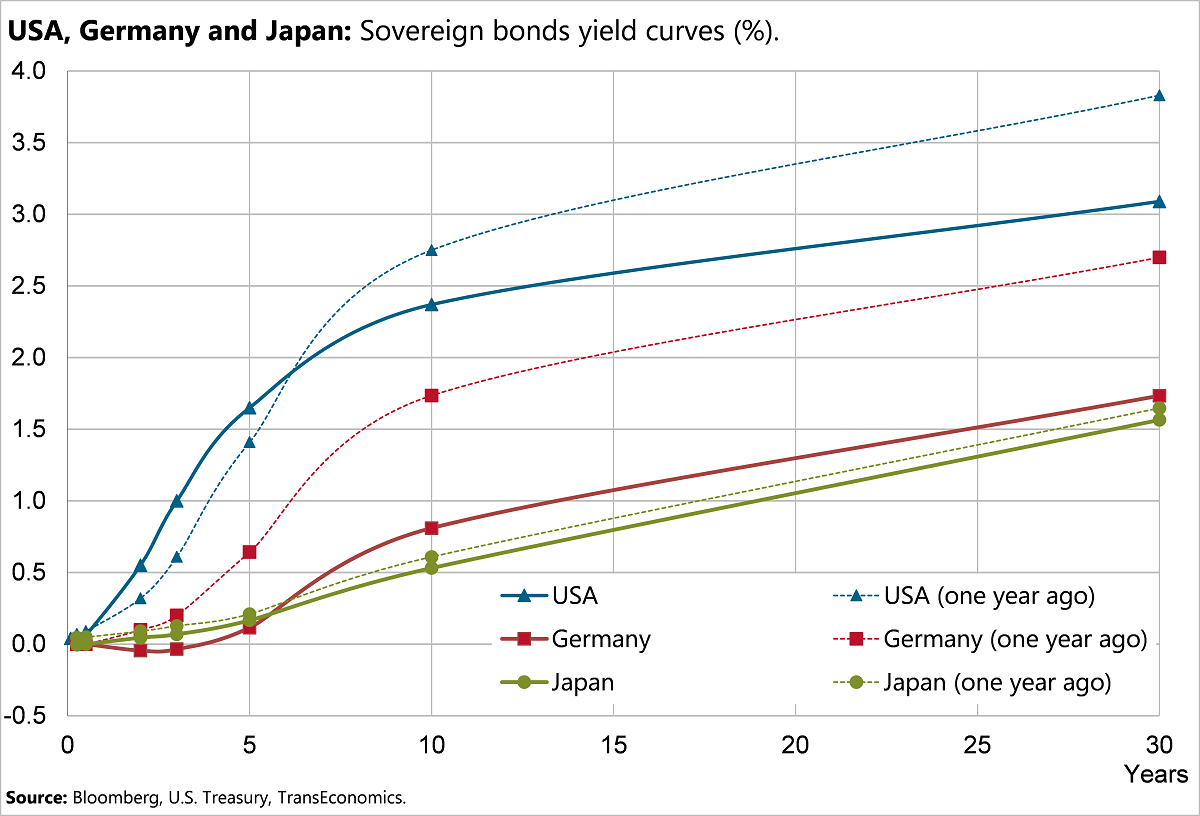

- We hold to our monetary policy outlook: More QE in the euro area and Japan next year, small gradual rate hikes in the UK and the USA. In the case of the USA, no hikes before summer. Banxico holds rates at 3.00% till at least June 2015.

At the close of yesterday, yield on a 10-year UST was 2.35%

Risk premia on long-term corporate bonds have moved closer to their long-term average. Although the correction has been painful, today’s wider spreads strike us as more stable than the razor-thin ones we were looking at a few months back

U.S. bond-market–implied inflation expectations remain low (1.58% for five years ahead)

Comentarios: Deje su comentario.