U.S. low volatility equity, financial services equity, and U.S. real estate lead the pack

Genevieve Signoret

08 November 2014

Our Performance

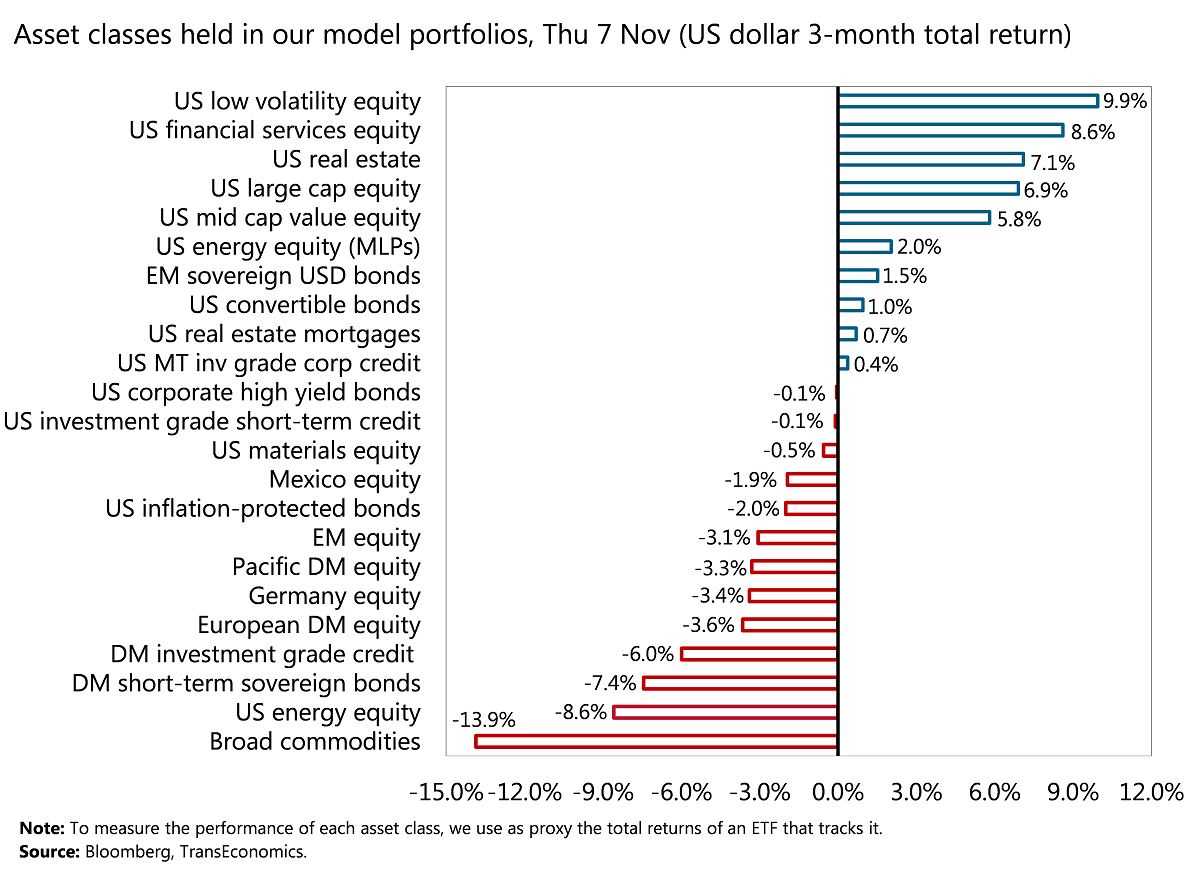

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar returns were US low volatility equity (9.9%), US financial services equity (8.6%), and U.S. real state (7.1%).

Producing the lowest returns (in dollar terms) were broad commodities (–13.9%), U.S. energy equity (–8.6%), and developed market short-term sovereign bonds (–7.4%).

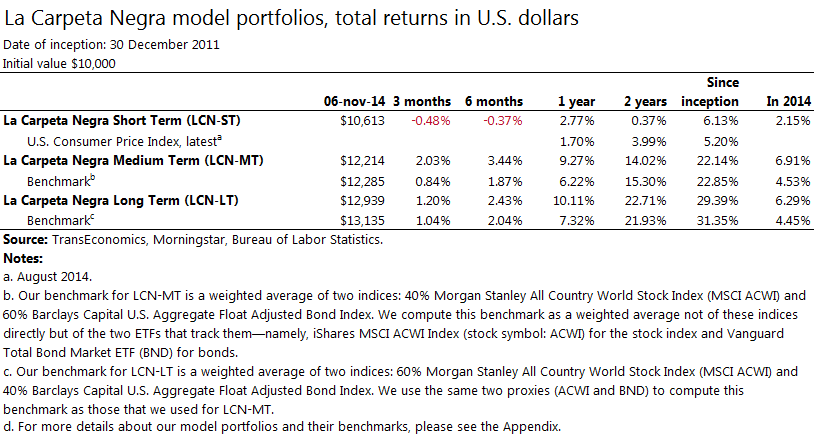

Over the past 12 months, all our model portfolios have outperformed their benchmarks:

- LCN-ST +2.8% (benchmark: +1.7%)

- LCN-MT +9.3% (benchmark: +6.2%)

- LCN-LT +10.1% (benchmark: +7.3%)

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.

Comentarios: Deje su comentario.