We hold to our USD/MXN forecast

Genevieve Signoret

13 October 2014

Currencies

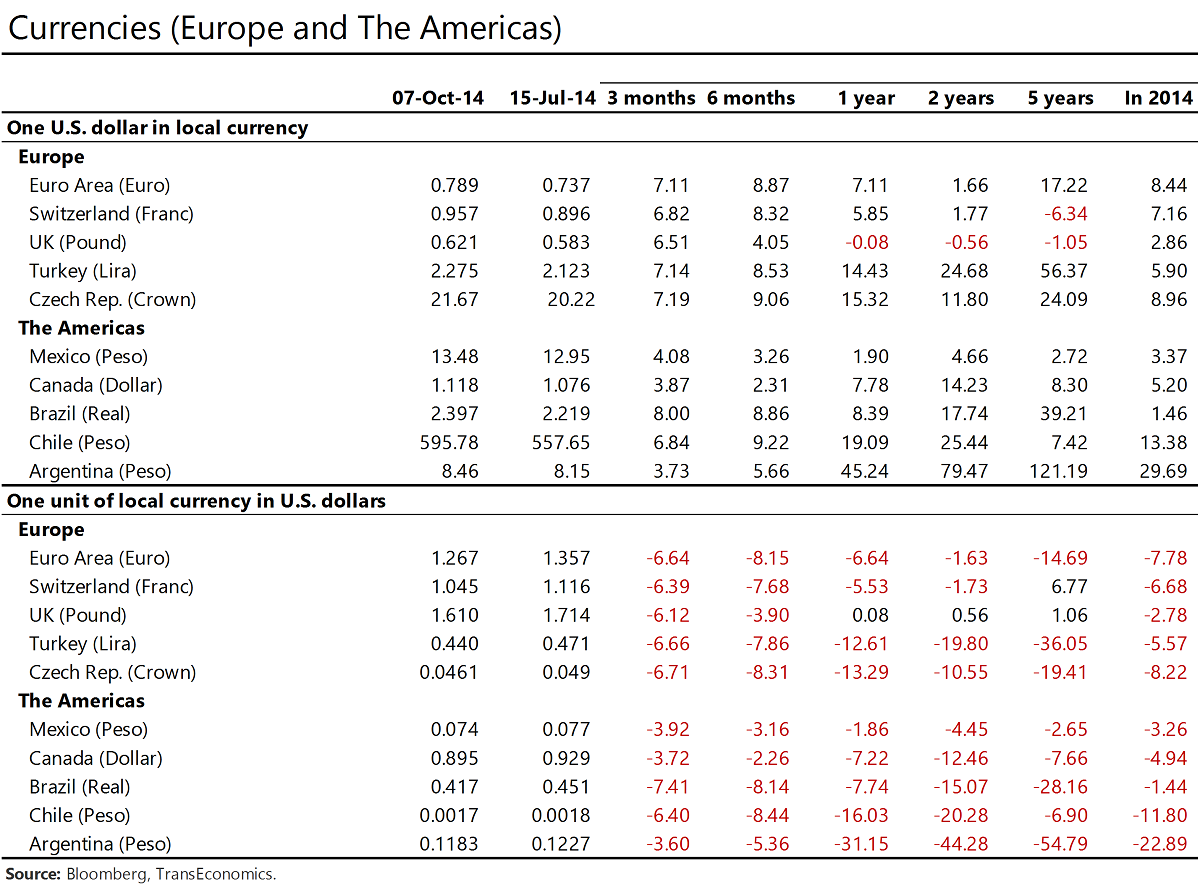

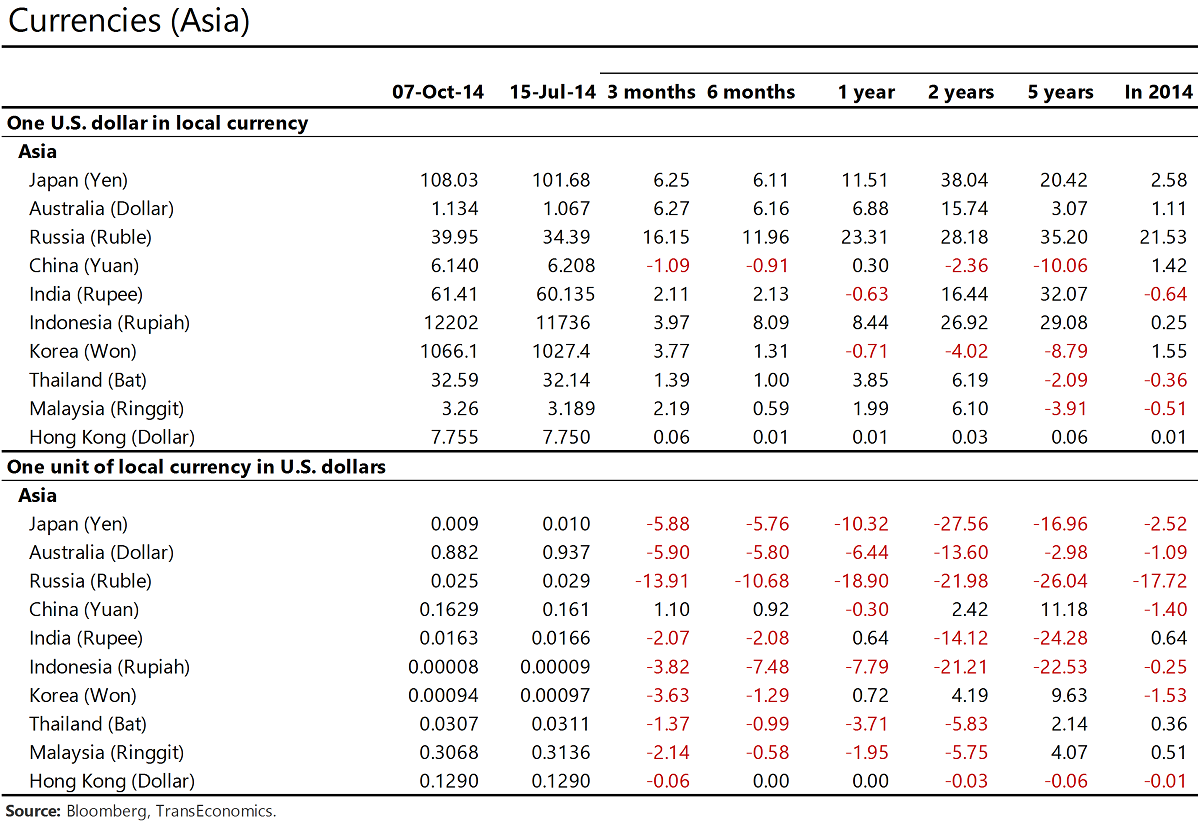

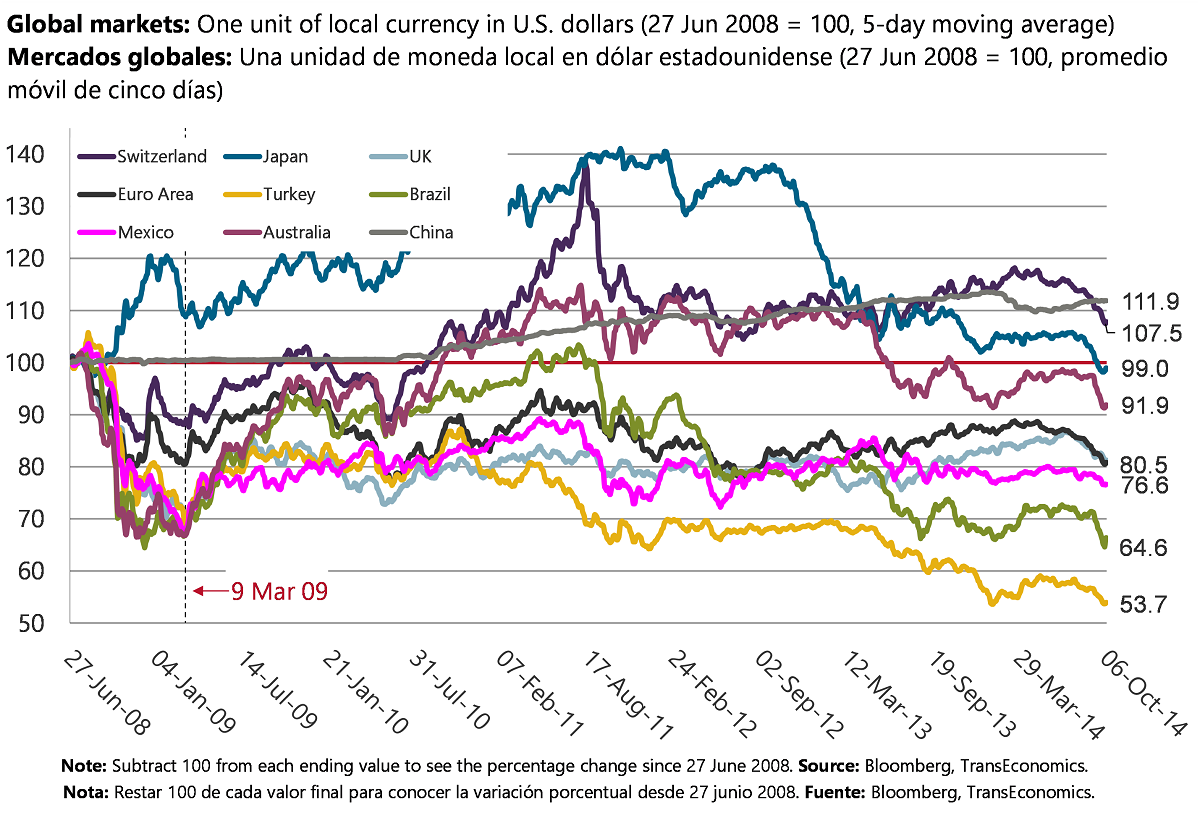

- The dollar continues to strengthen, fed by risk aversion (dollars are flowing into safe-haven U.S. Treasuries) and divergent outlooks for monetary policy (in the next year, the European Central Bank (ECB) and the Bank of Japan (BoJ) are expected to loosen further while the Federal Reserve is expected to tighten).

- We expect the ongoing bout of risk aversion to end over the next 3–6 weeks, pushing the peso back up to end the year at $1.00=MXN13.10.

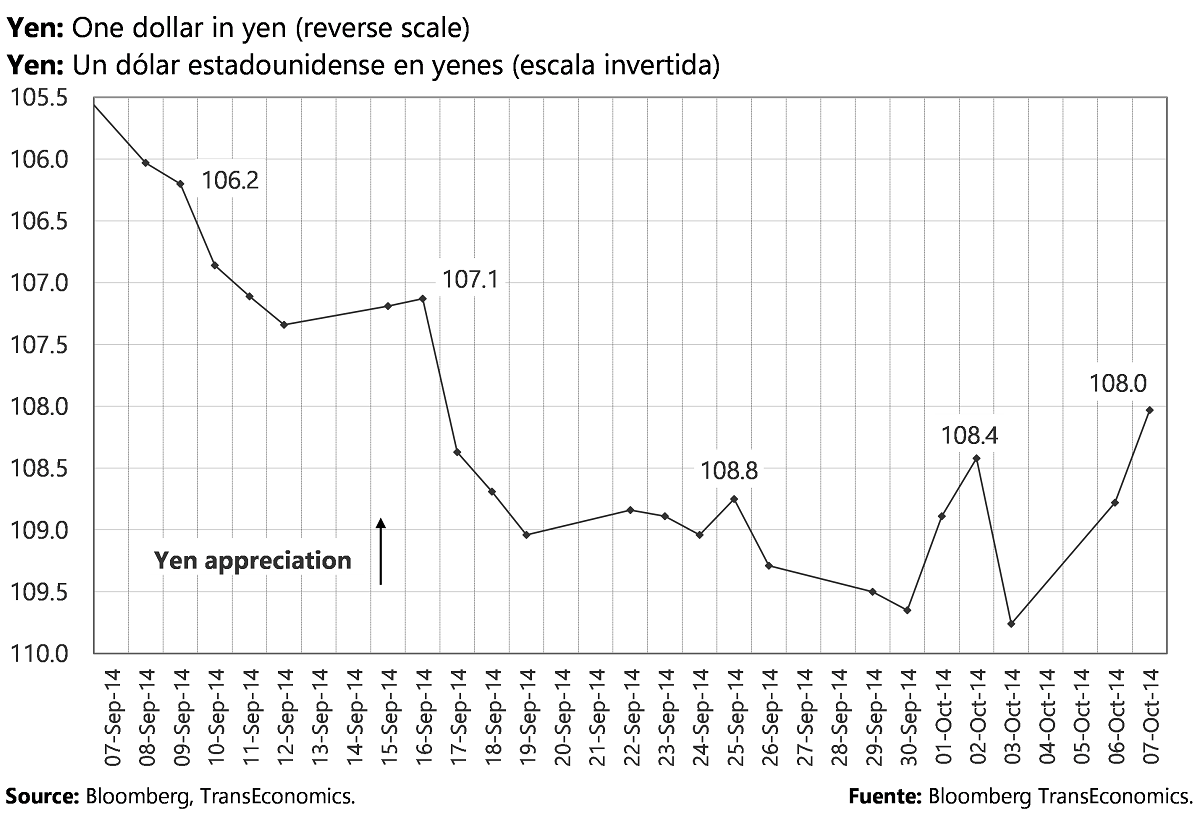

- Risk aversion in the past few days has offset outlooks for monetary policy to boost the yen against the dollar to a Wednesday 8 closing price of $1.00=¥108. The yen is generally viewed by investors as a haven even safer than the dollar. Once risk appetites recover, we see the yen resuming its downward trend. We forecast $1.00=¥109 for December 2014 and ¥114 for a year later.

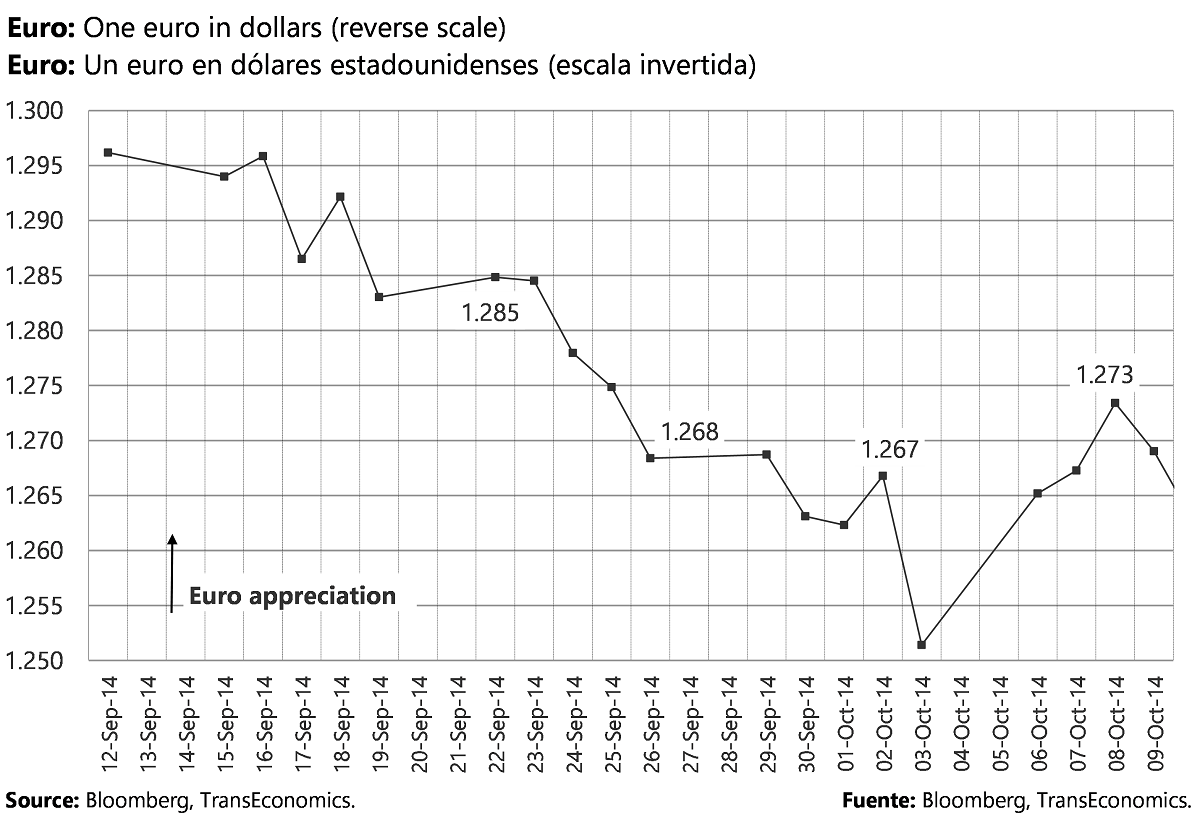

- Expectations that the ECB will turn on strong stimulus now has driven the euro way down against the dollar to €1.00=$1.27 as of last Wednesday 8. We project €1.00=$1.29 for the end of this year and $1.26 for end 2015.

The dollar has strengthened against eight of these nine currencies (the Chinese yuan is the exception)

Risk aversion has hurt the peso against the dollar. We expect this trend to revert in the next six weeks, thus project a year-end exchange rate of $1.00=MXN13.10.

Expectations that the ECB will turn on strong stimulus now has driven the euro way down against the dollar

Risk aversion in the past few days has offset outlooks for monetary policy to boost the yen against the dollar. The yen is generally seen as a haven even safer than the dollar.

Comentarios: Deje su comentario.