In revised forex outlook, we still see volatility

Genevieve Signoret

Currencies

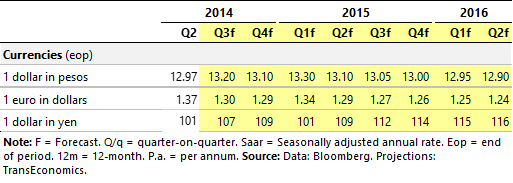

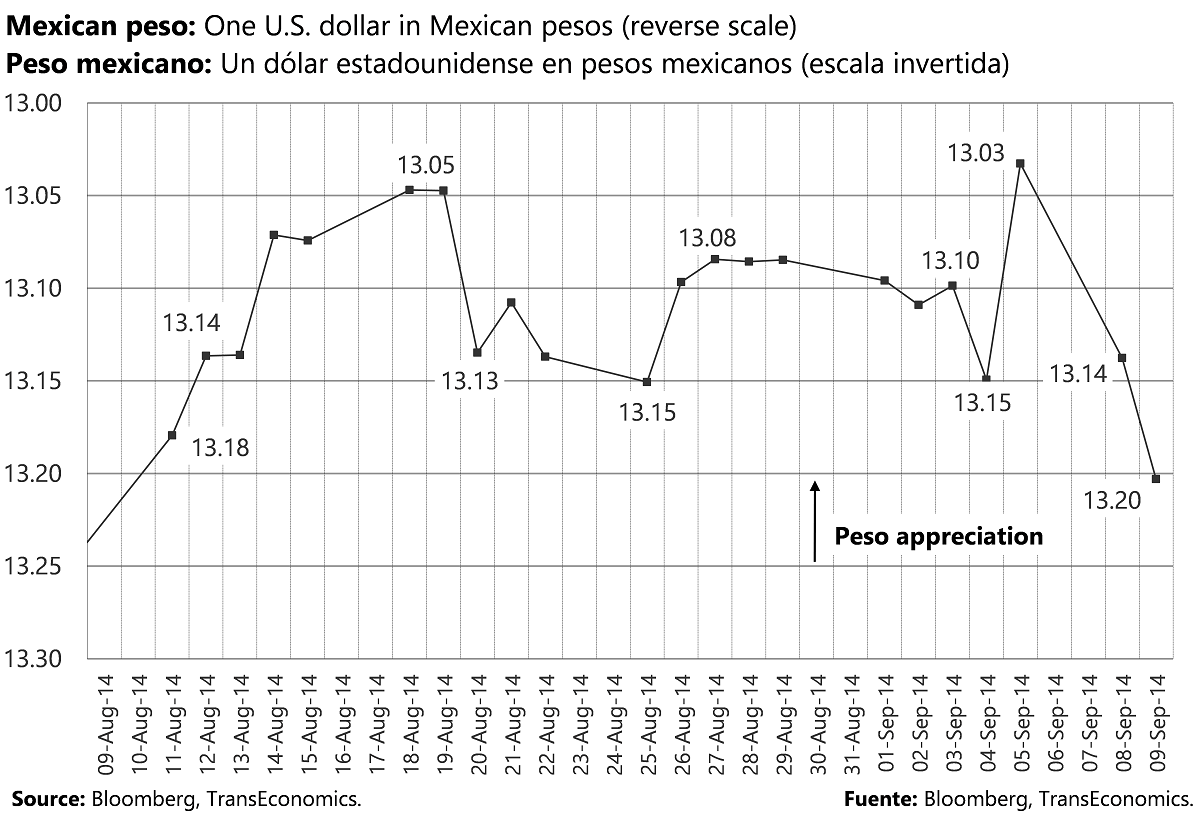

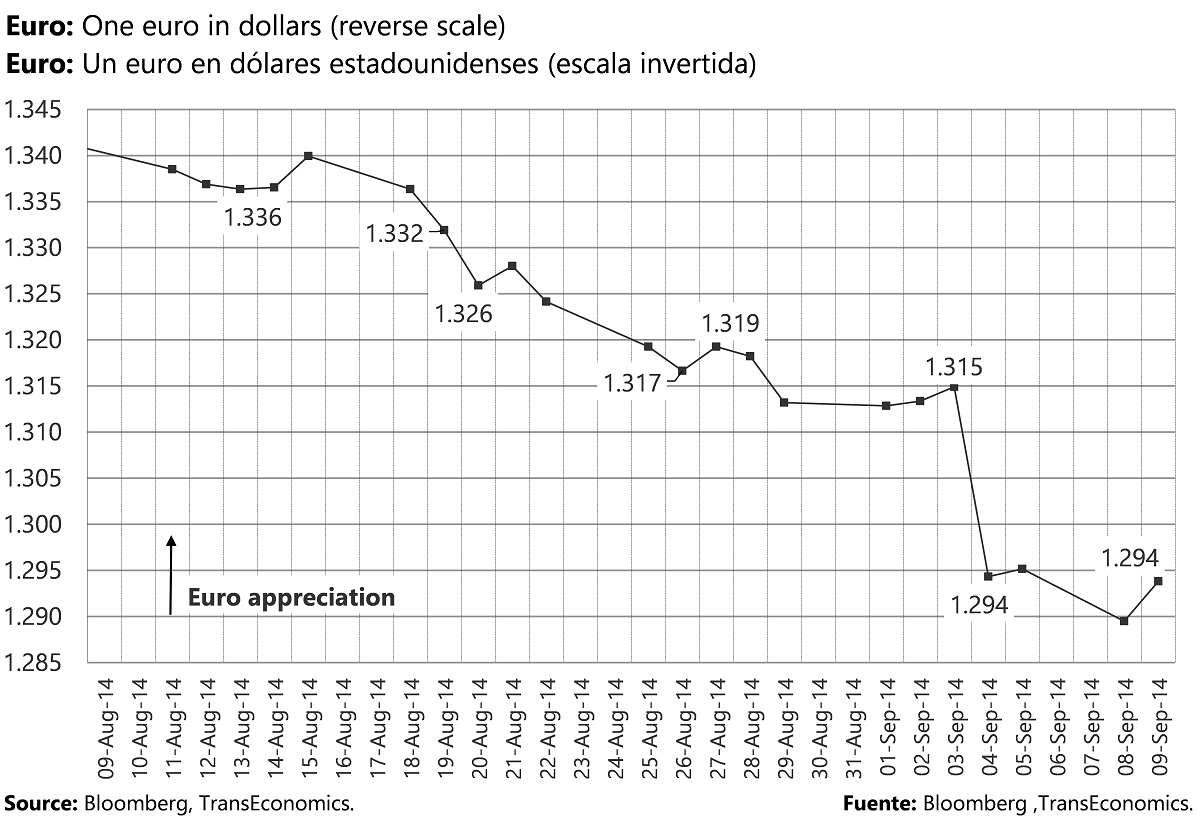

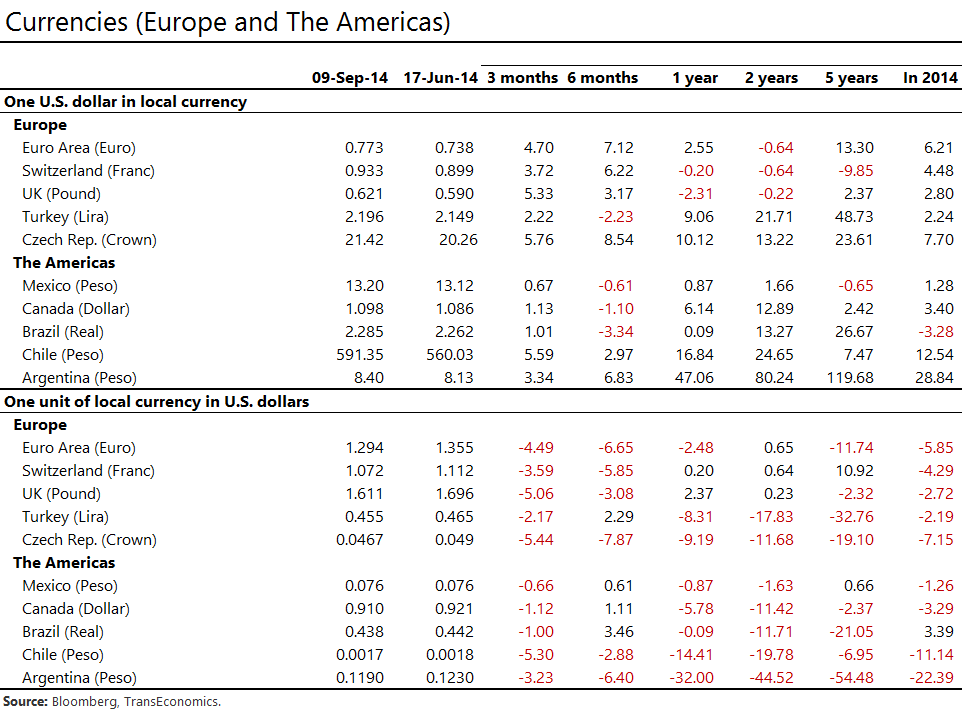

We have revised our central-scenario forecast for exchange rates. We now project the peso, euro, and yen to end this month weaker than under our previous forecast.

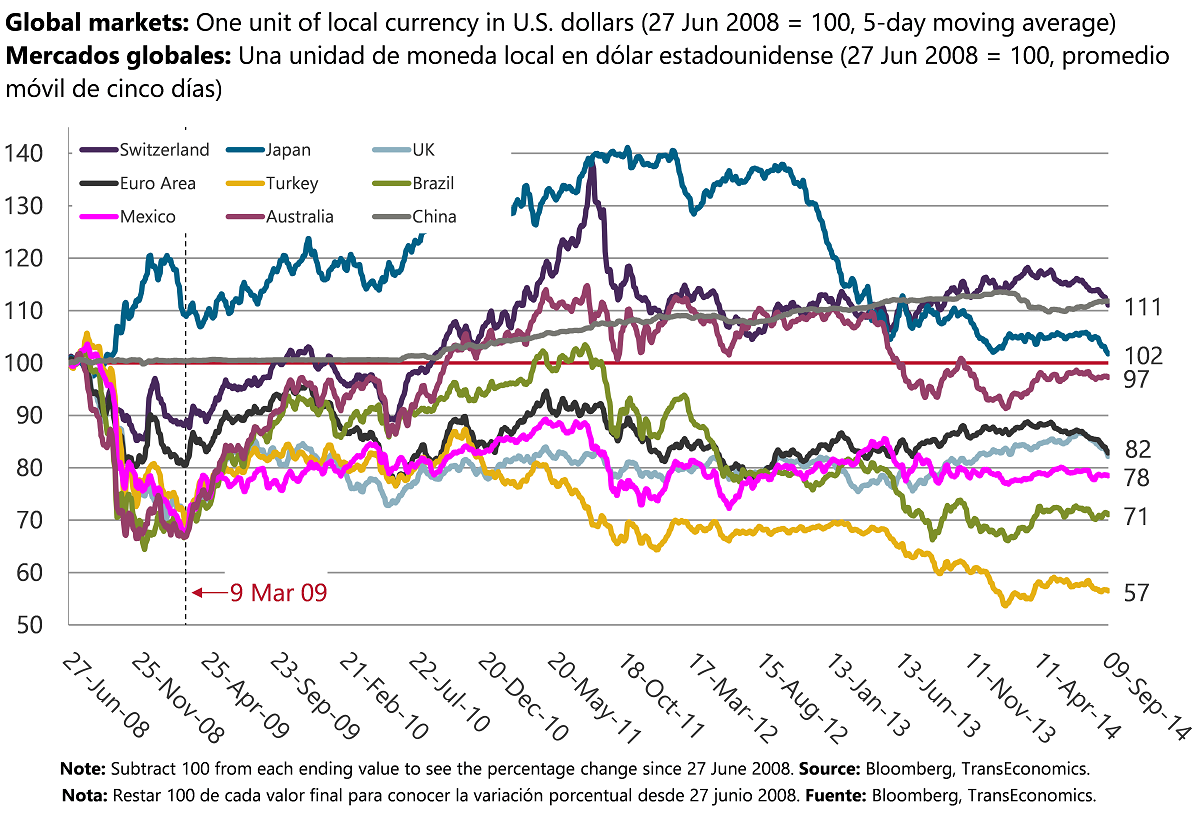

We continue to anticipate a bout of sharp volatility marked by unpleasant positive correlations across asset classes excluding safe-haven cash. It is triggered by sudden market awareness that the Fed means business—it really will raise interest rates—coupled with the belief, held erroneously and temporarily, that the FOMC will not only normalize its policy stance but also adopt a tight stance.

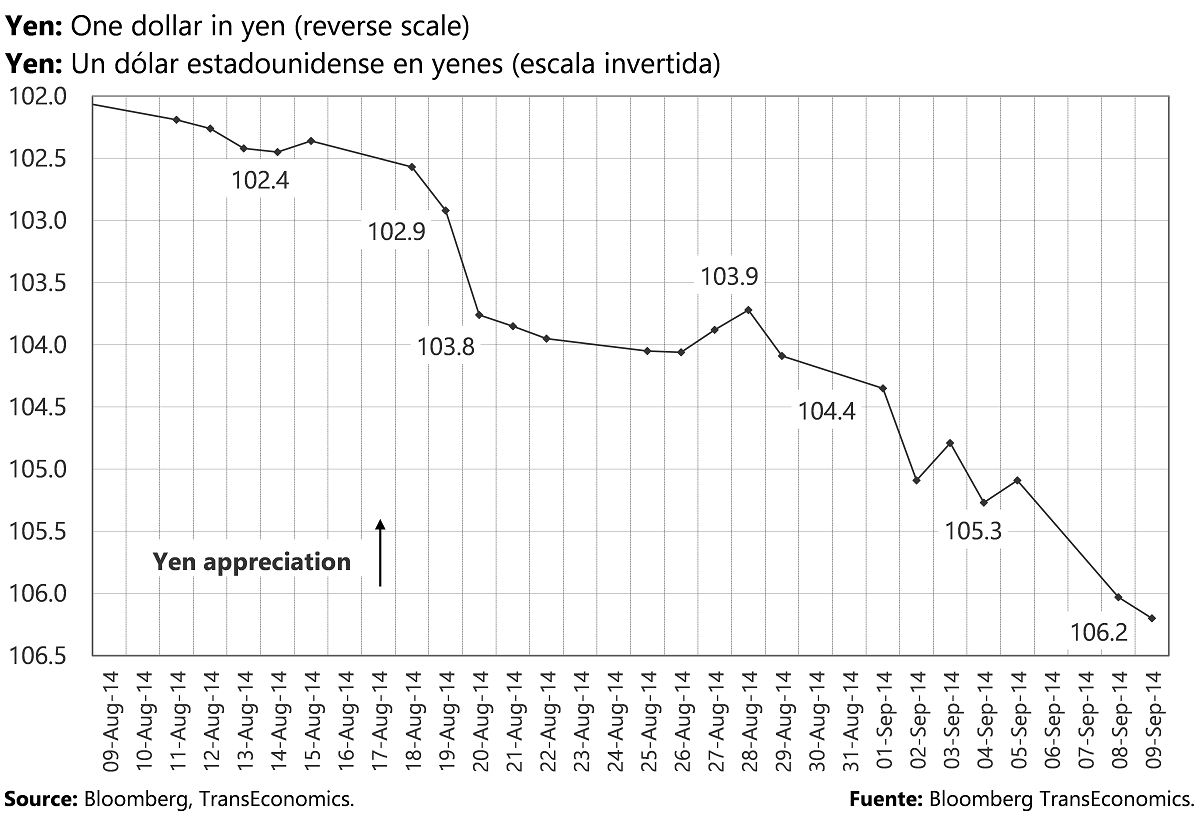

During this episode, the dollar spikes against the peso and other emerging market currencies but drops against the euro some and the yen considerably, as investors globally reverse dollar and, especially, yen, carry trade positions, and European investors take refuge in Germany bunds.

We don’t know when such an episode is due. In our previous forecast, we had visualized it occurring in Q3 2014. We now place it rather arbitrarily in the first quarter of 2015. In fact, it can hit at any time.

Revised forecast

Quarterly Q3 2014 – Q2 2016 forex projections under central scenario