EM, Mexico and Pacific equity again are winners

Genevieve Signoret & Patrick Signoret

15 August 2014

Our Performance

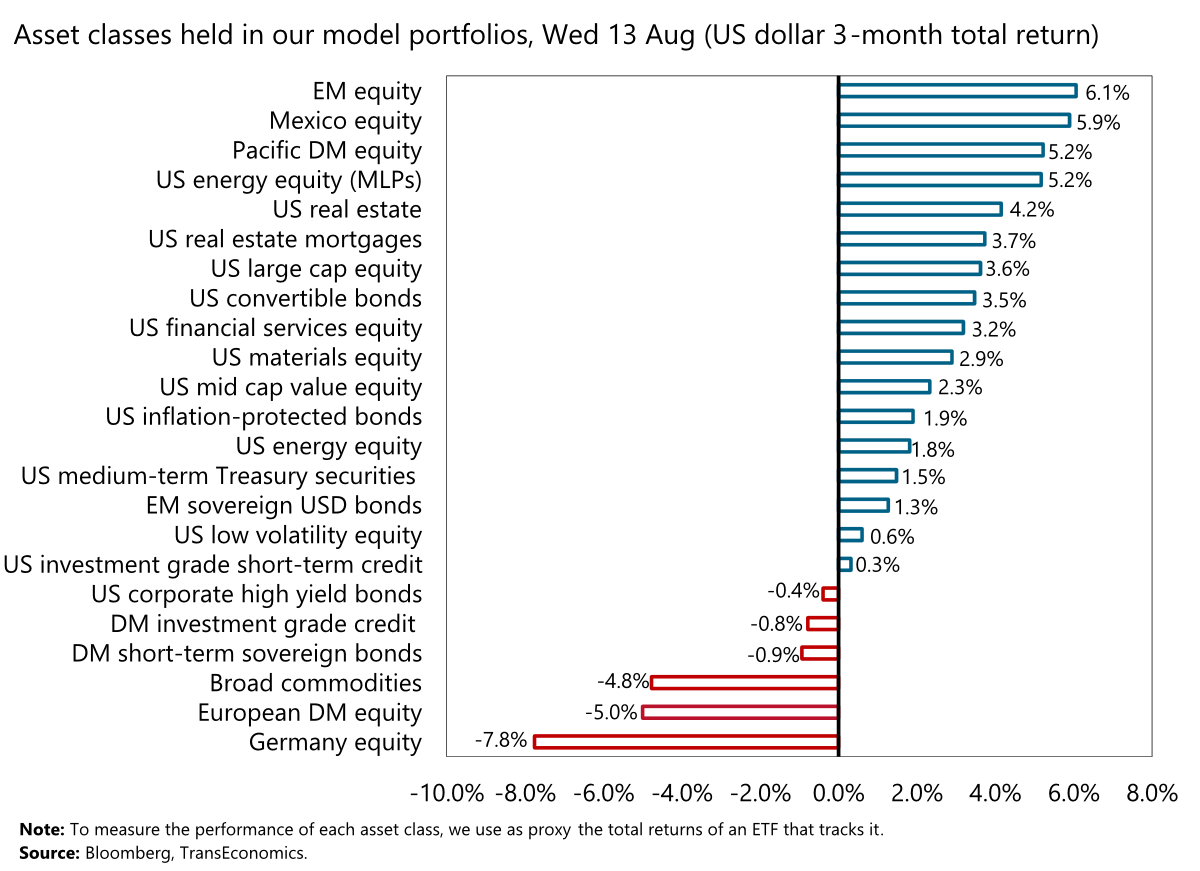

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar returns were emerging market equity (+6.1%), Mexico equity (+5.9%), and Pacific developed market equity (+5.2%).

Producing the lowest returns (in dollar terms) were Germany equity (–7.8%), European developed market equity (–5.0%), and broad commodities (–4.8%).

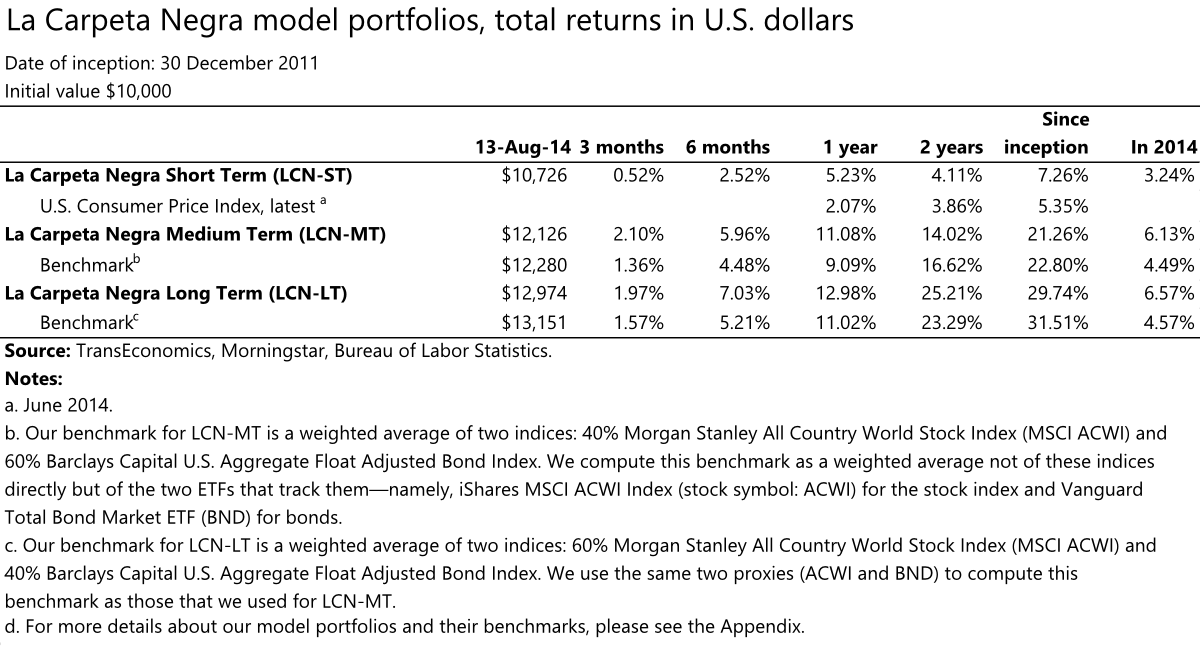

Over the past 12 months, all our model portfolios have outperformed their benchmarks:

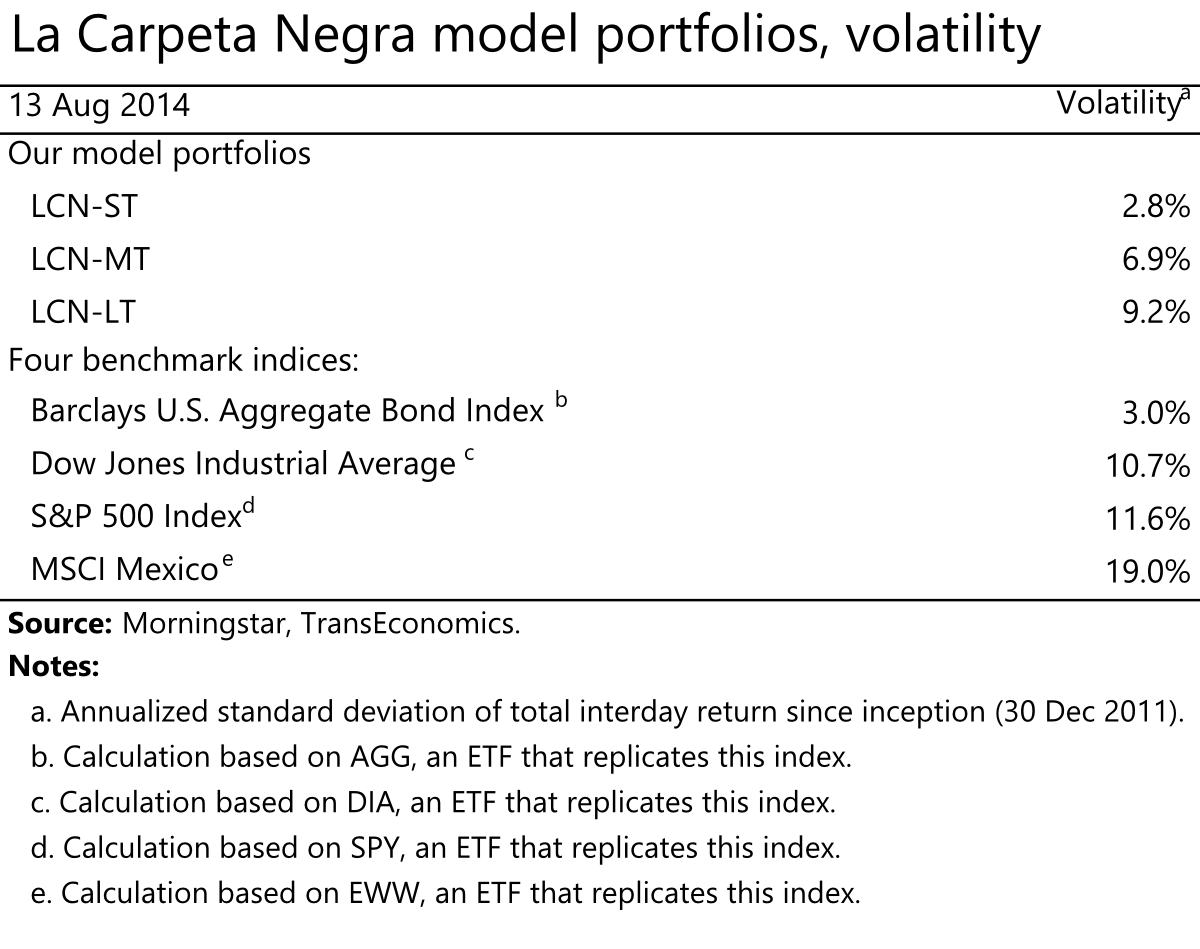

- LCN-ST +5.2% (benchmark: +2.1%)

- LCN-MT +11.1% (benchmark: +9.1%)

- LCN-LT +13.0% (benchmark: +11.0%)

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.

Comentarios: Deje su comentario.