A twisted U.S. yield curve

Genevieve Signoret & Patrick Signoret

Fixed Income

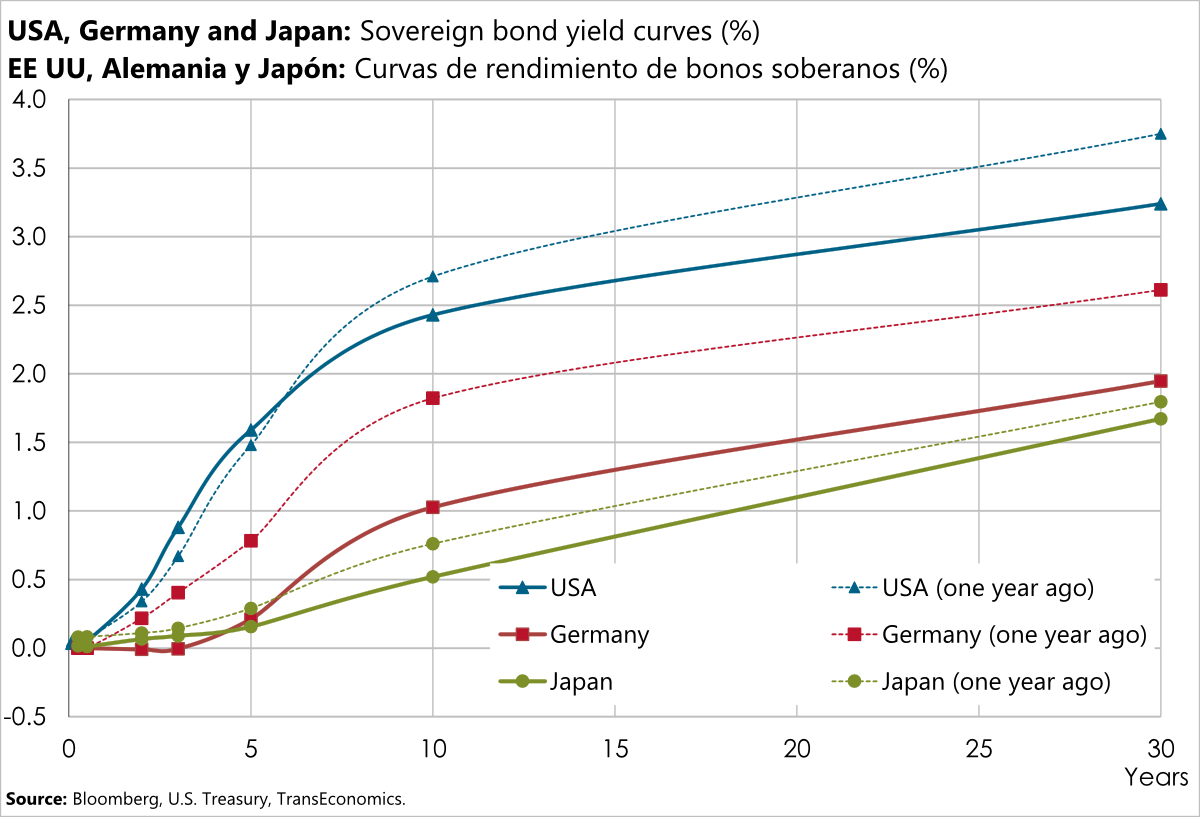

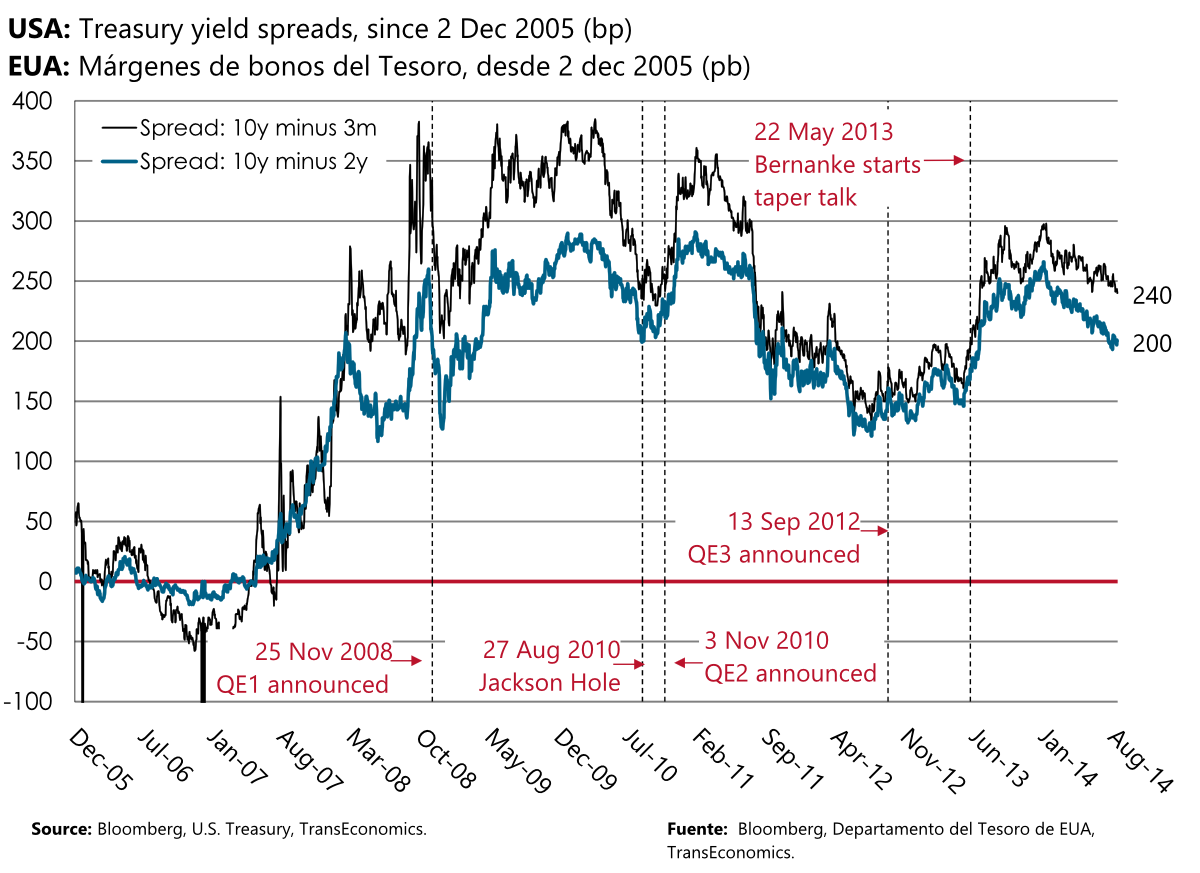

- Expected rate hikes have shifted up the short end of the U.S. yield curve, while risk aversion (flight to quality) has shifted down the long end.

- We do not think that the flattening in the U.S. yield curve is going to last. We see it as a transitory response to a wave of risk aversion (we think long-term investment-grade bond prices will soon drop sharply).

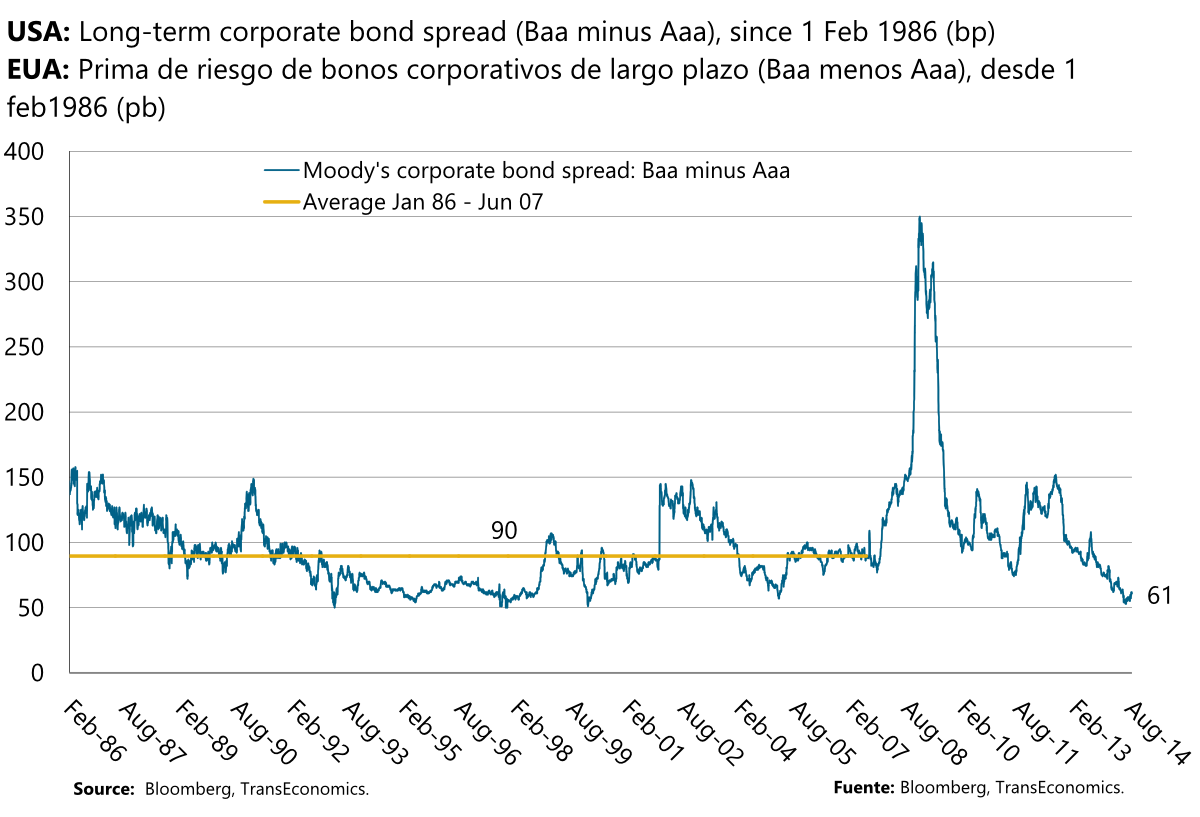

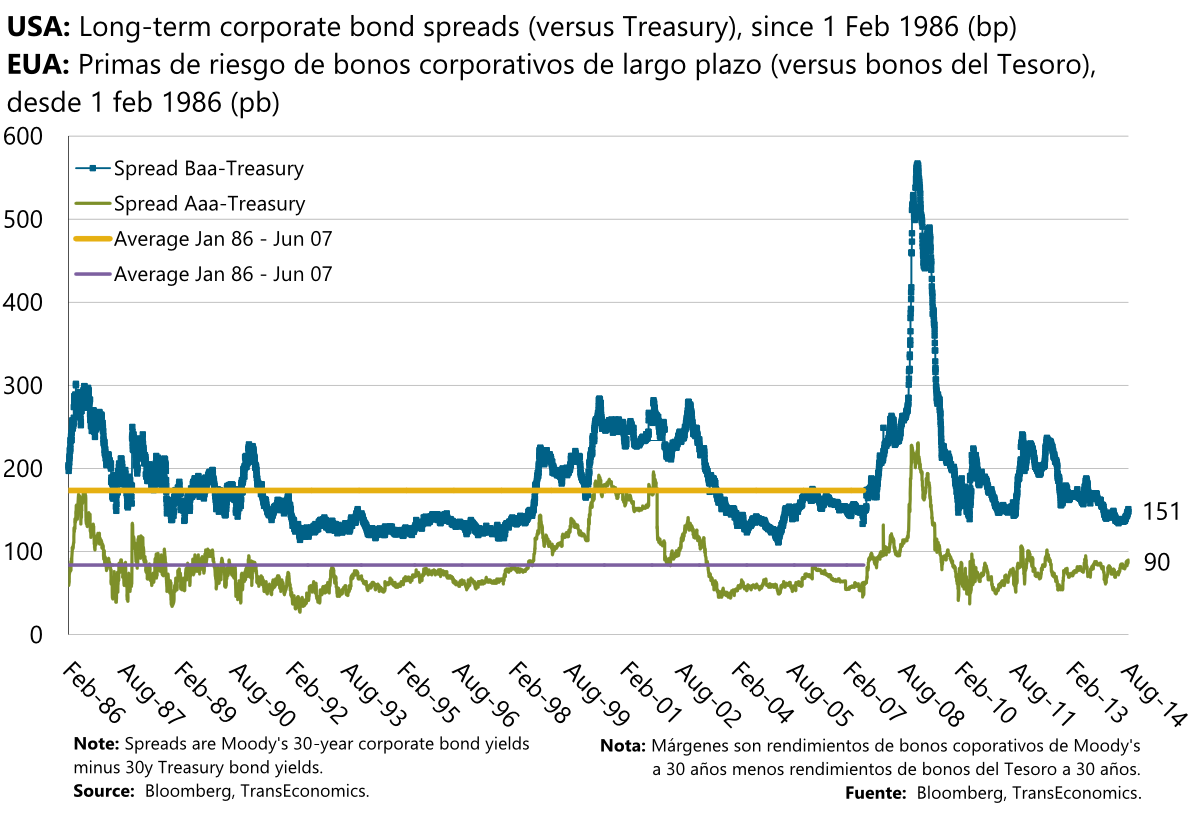

- We have long been harping here that developed market corporate credit spreads were unsustainably thin. In recent days, they have widened slightly. Will this turn into a new trend or is it transitory?

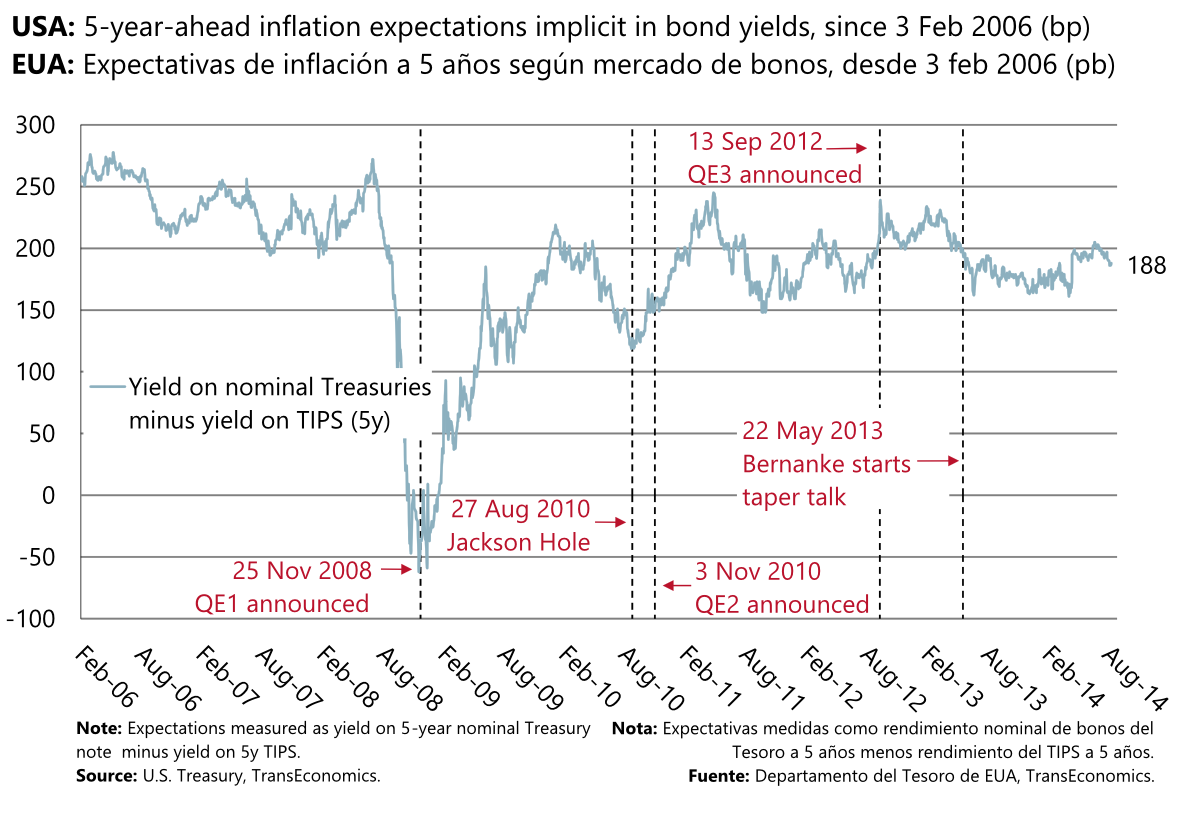

- Throughout the ongoing volatility episode, bond market perceptions of long-term inflation risks have been tame. Clearly, what’s driving today’s volatility is not fear of inflation.

Expected rate hikes have shifted up the short end of the U.S. yield curve, while risk aversion (flight to quality) has pushed the long end flatter

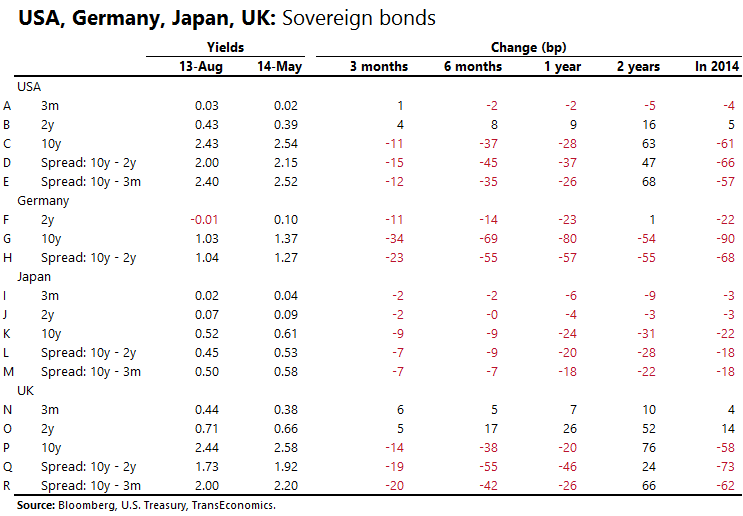

In lines D–H and S–T, we illustrate in data-table form the same thing: anticipation of Fed rate hikes are showing up in the short end of the curve; risk aversion is visible in the long end

We do not think that the flattening in the U.S. yield curve is going to last. We see it as a transitory response to a wave of risk aversion (we think long-term investment-grade bond prices will soon drop sharply)

We have long been harping here that credit spreads were unsustainably thin. Now they have widened slightly. Will this turn into a new trend or is it transitory?

The chart above showed junk bond spreads over investment grade corporates. This one shows spreads over comparable Treasuries. In contrast to investment grade spreads over Treasuries, junk bond spreads are far below their (pre-crisis) historic average—hence their unsustainability.

Throughout the ongoing volatility episode, bond market perceptions of long-term inflation risks have been tame. Clearly, what’s driving today’s volatility is not fear of inflation.