Recovery from bout of risk aversion will send peso (but not euro) back up, yen back down

Genevieve Signoret & Patrick Signoret

Currencies

- The ongoing bout of risk aversion had driven down the peso to $1.00=MXN13.20 by the close of Monday 4 August (13.24 by Wednesday 7). We expect the peso to recover to $1.00=MXN13.00 by the end of 2014.

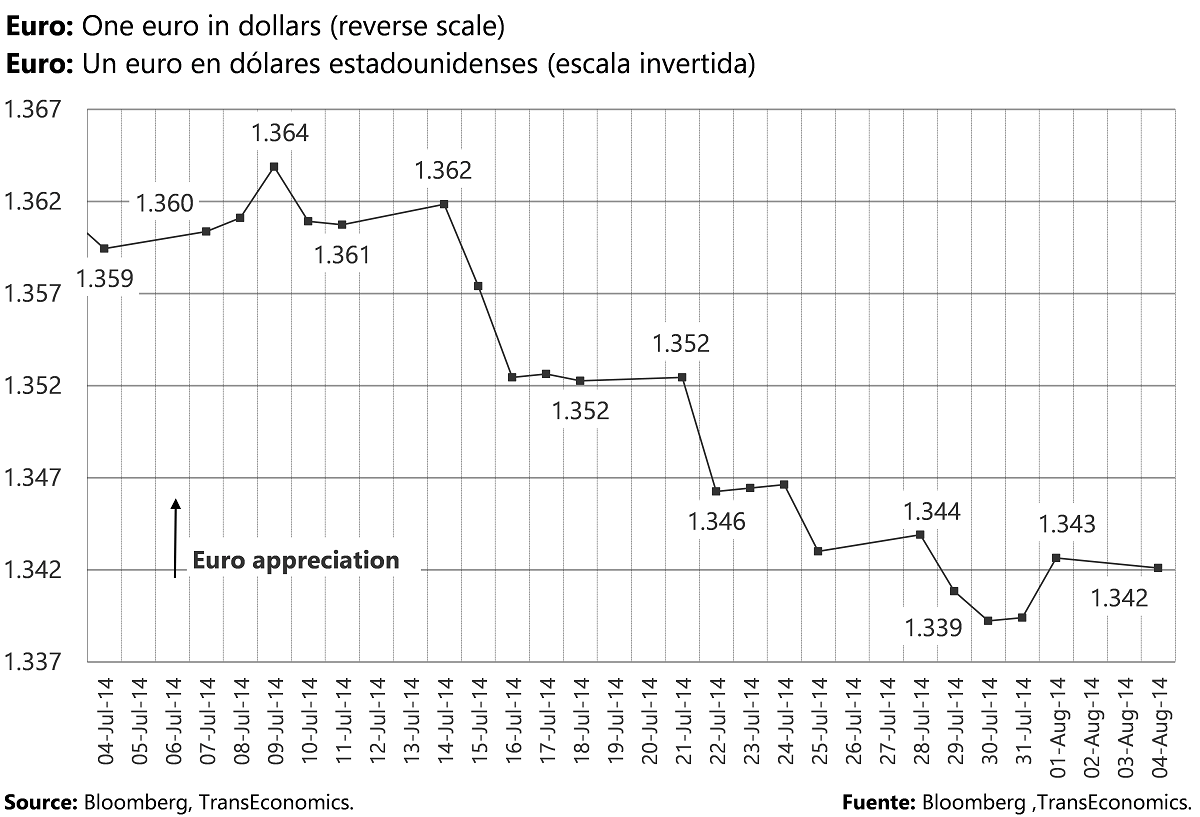

- Today’s EUR/USD weakness fulfills our long-held outlook. We see €1.00=$1.34 for December 2014 and $1.29 for December 2015. Diverging expectations for Fed-ECB policy is the driver, in our view. Italy’s relapse into recession and the euro area’s inflation deterioration to 0.4% confirm our view that the Fed and the European Central Bank (ECB) are headed in opposite directions.

- By the close of last Wednesday 6 August, the yen had strengthened to $1.00=¥102.10. No surprise here: risk aversion usually drives the yen up—one reason why we always have some yen exposure.

The ongoing bout of risk aversion had driven down the peso to $1.00=MXN13.20 by the close of Mon 4 Aug (13.24 by Wed 7). We expect the peso to recover to $1.00 = 13.00 pesos by the end of 2014.

Today’s EUR/USD weakness fulfills our long-held outlook. We see €1.00=$1.34 for Dec 2014 and $1.29 for Dec 2015. Diverging expectations for Fed-ECB policy is the driver, in our view. Italy’s relapse into recession and the euro area’s inflation deterioration to 0.4% confirm our view that the Fed and the ECB are headed in opposite directions.

This USD/YEN graph stops on Mon 4 Aug. Two days later the yen had strengthened further, to $1.00=¥102.10. No surprise here: risk aversion usually drives the yen up (hence we always have some yen exposure).