Mexico, EM, and Pacific equity are top performers

Genevieve Signoret & Patrick Signoret

Our Performance

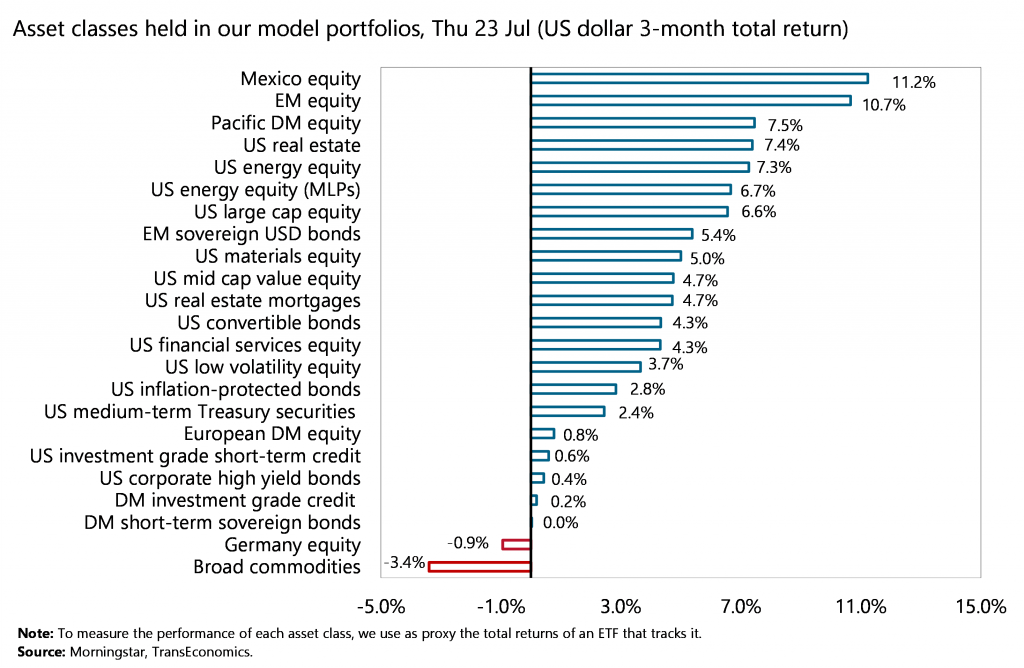

In the past three months, the asset classes in our model portfolios[1] that delivered the highest U.S. dollar returns were Mexico equity (+11.2%), emerging market equity (+10.7%), and Pacific developed market equity (+7.5%).

Producing the lowest returns were broad commodities (-3.4%), German equity (-0.9%), and developed market short-term sovereign bonds (+0.2%).

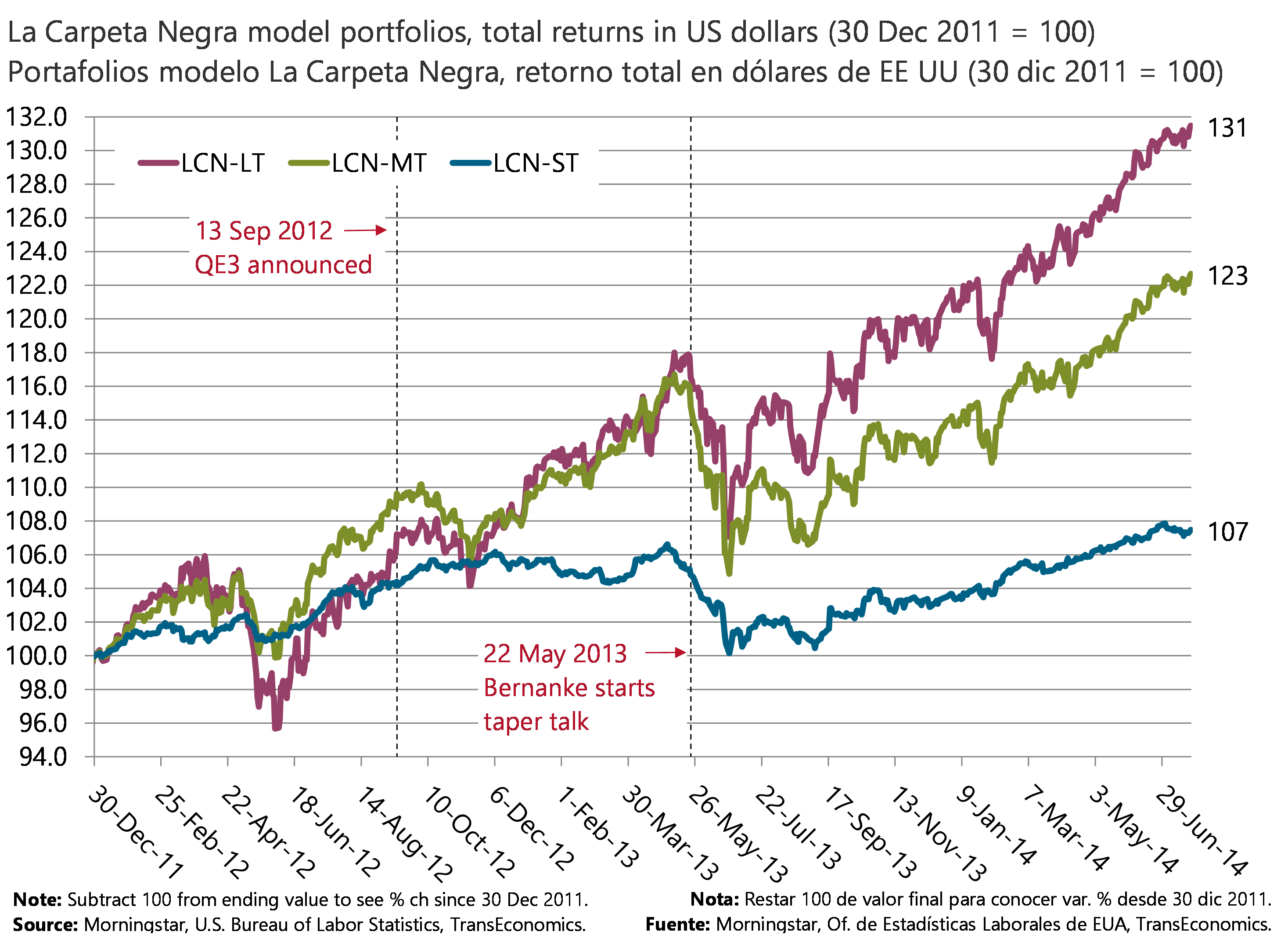

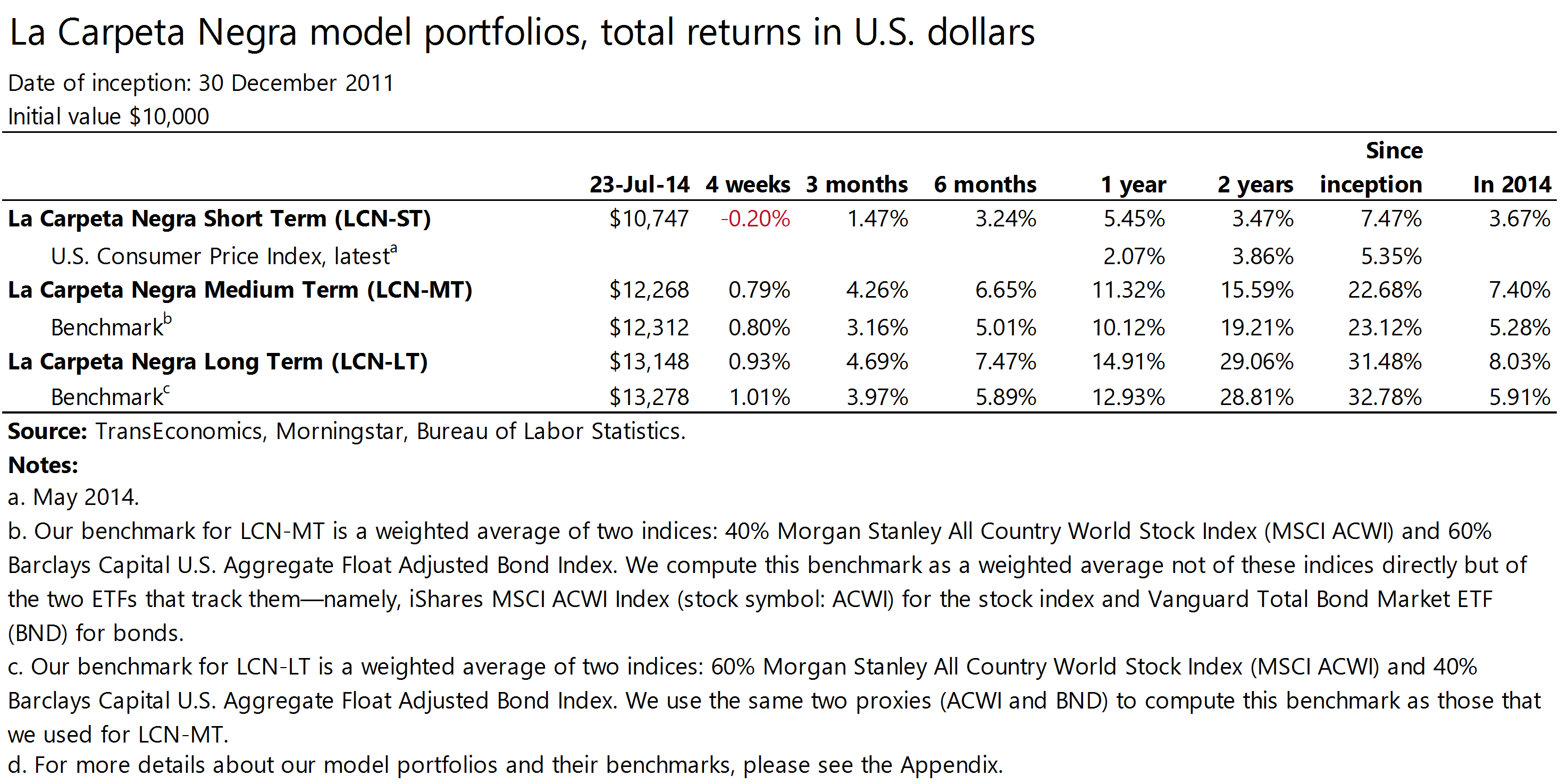

So far this year, our medium- and long-term model portfolios have outperformed their benchmarks. Meanwhile, over 12 months, our short-term portfolio has outpaced inflation.

[1] Read descriptions of these portfolios here. Clients receive details on their composition in addition to individualized strategies and portfolio management services. To request more information, please write to patrimonial@transeconomics.com.